Oil Prices: The U.S. Economy?s Albatross

Analysis

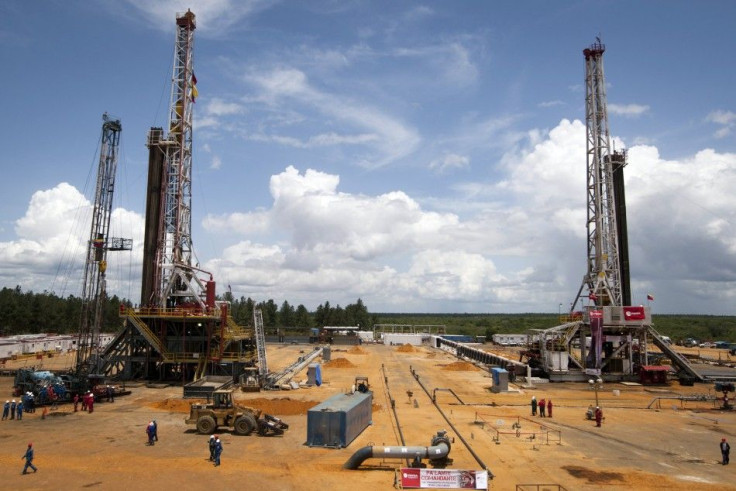

Oil, the world's most vital commodity, continues to create problems for the United States.

Oil, which traded up Monday $1.64 to $87.01 per barrel, is responsible for a considerable portion of the world's wealth since crude was first commercially drilled in 1853 in Poland. It's a commodity that's created family/corporate dynasties and national empires.

But oil -- and in specific oil's price -- has also led to massive economic upheavals, including oil shock-induced recessions in the second half of the 20th century.

The 1973-74 and 1979-80 oil shocks led to recessions in the United States, and the 1990 oil shock played a role in third.

2011/2012: More Trouble For U.S. From Oil?

And it looks like oil is set to wreak havoc on the U.S. and global economies again in 2011 heading into 2012 -- and this after one of the most volatile periods in oil's history -- the leveraging bubble/housing bubble period of 2003-2007.

From 2005 to 20011 oil rose from $40 per barrel to $147 per barrel in the summer 2007, only to crash to $35 per barrel in December 2007/January 2008. That's a price of $145 or $35 for the same product in approximately the same calendar year. Talk about volatility.

Institutional Investors Pile In To Oil

However, this latest surge in oil prices in mid-2011 has not caused by oil producers (as it was in '73-74 and '79-80) or bya military action (Iraq War I in '90), but by institutional investors.

Discouraged by the prospect of low returns on stocks, paltry interest rates, and concern about the Europe sovereign debt crisis' impact on the global economy, many hedge funds, investment funds, and other accredited investors have piled money into oil. The hey day in commodities may be over, but "king oil" still reigns: crude oil remains the preferred alternative asset class for the market's "big guns" -- they like it for its ability to hedge against a weak dollar and for its inflation-insulating properties.

However, there's just one problem with hedge funds and investment funds using oil as hedge en masse: it pushed oil's price far higher than it should be, given oil's supply and demand fundamentals. Keep in my that 150-year average price for oil is about $25 to $30 per barrel in real terms.

In other words, institutional investors, un-enthused by low-return stocks, piled in to oil, driving it up to unacceptable, GDP-reducing levels...slowing U.S. and global GDP growth substantially (except in oil producing states, of course), worsening the economic conditions that led institutional investors to invest in oil in the first place!

The detached reader/observer would review the above and ask: How can the U.S., regional, and global economic recoveries become robust and self-sustaining with an oil price above $80 per barrel?

The answer is: they can't.

© Copyright IBTimes 2024. All rights reserved.