PepsiCo (PEP) Earnings Preview Q4 2013: Profit Down 7% As North American Drink Sales Stay Weak

Beverage and snack giant PepsiCo Inc. (NYSE:PEP) will likely book a 7 percent profit decline as sluggish demand in the U.S. soft drink market offsets improving North American snack sales.

The Purchase, N.Y.-based company reports fourth-quarter and full-year earnings on Thursday before the market opens. Analysts polled by Thomson Reuters expect profits of $1.58 billion, down from $1.7 billion a year ago. Revenue will edge up 1 percent to $20.16 billion from $19.95 billion.

Earnings per share are expected to slide 2.6 percent to $1.03 from $1.06. Excluding one-time events, earnings per share are expected to shrink by 7.7 percent to $1 from $1.09.

Pepsi sells Lay’s, Doritos, Cheetos, Gatorade and Tropicana orange juice, among other products. It boasts 22 brands with more than $1 billion in annual revenue and a growing portfolio of healthy products, now worth $13 billion in yearly sales.

Sluggish sales likely occurred across most of Pepsi’s geographic units over the fourth quarter, wrote Barclays PLC (LON:BARC) analysts in a research note.

“With the exception of the AMEA [Asia, Middle East and Africa] region, we do not expect a great deal of volume growth for PEP, though we do believe that net price realization could drive underlying top-line growth in the quarter,” they wrote.

Foreign sales, however, could be trimmed by the strength of the dollar.

Sales volumes from drink sales in the Americas fell 3 percent over the quarter, on Barclays estimates.

The unit saw sales volumes slip 4 percent in their third quarter and 3.5 percent in the quarter before that. U.S. demand for the company's Quaker Brands hot cereal items also fell during the October-through-December period, according to Trefis.

Bright spots for Pepsi include its Frito-Lay North America business, which has achieved a 4.5 percent growth in revenue over the first nine months of 2013. Many analysts see Pepsi’s snack business, which is the largest in the U.S., as a key strength, though it struggles to compete on beverages with rival Coca-Cola Company (NYSE:KO).

Goldman Sachs, which expects profit margins for the fourth quarter to have weakened, said the Frito-Lay North American business is gaining market share and has balanced prices and sales volume well.

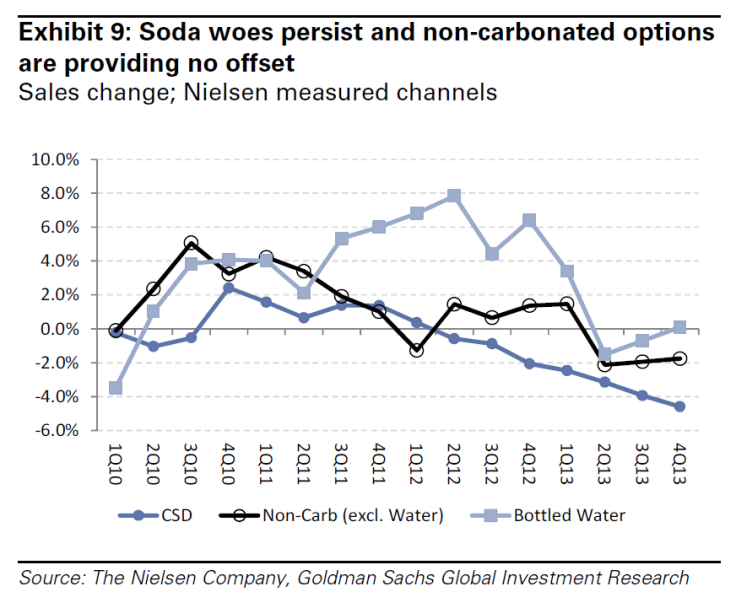

In the U.S., consumers have drunk fewer soft drinks for years, in what analysts worry is a long-term bearish trend for beverage sellers.

“We see no reason at this point to become more optimistic about the [U.S.] recovery in soft drink demand,” wrote Goldman Sachs Group Inc. (NYSE:GS) analysts in a recent research note, noting a trend that has dampened Pepsi and its rivals' sales. “We are about in line [with analyst consensus] for 4Q on KO/PEP/DPS [Coke, Pepsi, Dr. Pepper Snapple Group Inc. (NYSE:DPS)] but below consensus [for earnings] for all three names in 2014.”

On Jan. 1, 2014, Mexico enacted a soda tax, which is expected to weigh on soda sales in a market where Pepsi touts itself as the largest or second-largest food and beverage supplier. Mexico is the second-largest consumer of carbonated soft drinks in the world, after the U.S., per capita.

Despite pushback from a soda tax, Pepsi plans to invest an additional $5 billion in Mexico, Pepsi executives said at the recent Davos economic forum in Switzerland. In 2012, Mexico represented 35 percent of the company’s net revenue, which came to more than $65 billion. PepsiCo has already invested $3 billion in Mexico over the past five years. The country is PepsiCo's third-biggest market behind the U.S. and Russia, according to a research note from equity researcher Trefis.

Pepsi is also a key corporate sponsor of the Super Bowl, and spent a blitz of money on heavy marketing in the just-finished quarter. A Pepsi spokeswoman declined to disclose to IBTimes how much extra revenue the company's Super Bowl activities drive.

Pepsi likely spent millions on the Feb. 2 Super Bowl overall and hosted a three-day Super Bowl celebration in New York’s Bryant Park, coined #PEPCITY. A recent Moody’s Investor Service report found that similar marketing by Coke at the Russian Winter Olympics and the later World Cup in Brazil will likely deliver only “quite modest” dollar impacts, though the intangible effect of billions of media impressions is significant.

Pepsi also announced fresh investments in India and a new drinks partnership with Buffalo Wild Wings (NASDAQ:BWLD) in the quarter, displacing Coke from its longtime deal with the sports dining chain.

© Copyright IBTimes 2024. All rights reserved.