Platinum 2014 Outlook: South Africa Mining, China Demand And Europe Emissions Drive Platinum Deficits

South Africa, China and Europe will drive platinum supply-and-demand fundamentals in 2014, even as the premium precious metal struggles against a downdraft from declining gold prices, according to platinum specialist Johnson Matthey PLC (LON:JMAT).

Many precious metals analysts have been bullish on platinum, driven by rising demand and an ongoing supply deficit, but prices this year haven't fared well, sailing down 10 percent partly on weakness in gold. It's unclear whether the tight supply-and-demand situation will beat out other factors in the short term, and lift prices.

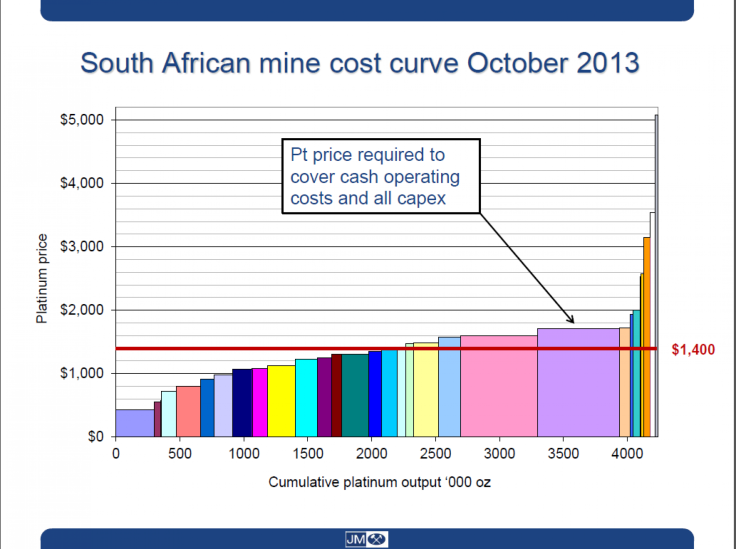

High mining costs in South Africa mean its mines are unlikely to deliver more platinum in the near term, said Johnson Matthey marketing head Jeremy Coombes in a recent industry presentation. Johnson Matthey previously forecast a platinum deficit of 605,000 ounce in 2013, the third straight year of deficits and up more than 40 percent from 2012.

With platinum selling for about $1,400 per ounce, South African mines can cover most of their cash costs. But piling broader capital and exploration costs on top of those unit costs paints a more troubling picture, where many mining companies see mine expansion as unprofitable.

“There’s no doubt that miners are struggling in South Africa,” said Coombes in New York last week. He estimated that, including capital expenditure costs, about half of South African and Zimbabwean mining output doesn’t break even for their parent companies.

South Africa is the world’s largest producer of platinum, far exceeding rivals like Russia and Zimbabwe. It provided two thirds of the world’s platinum mining output in 2013. The world’s top three platinum producers, Impala Platinum Holdings Limited (ADR) (OTCMKTS:IMPUY), Anglo American Platinum Ltd (ADR) (OTCMKTS:AGPPY) and Lonmin Plc (LON:LMI) have major South African operations.

“Companies have tried to conserve cash by not spending as much as maybe they should be on new developments,” said Coombes. “Essentially, South African mining is preserving the short term, possibly at the expense of the long term ability to produce to meet growing demand.”

Precious metals specialists see upside for platinum in coming years, as an automobile recovery in the U.S. and China continues. Much of the world’s platinum is used in catalytic converters in cars, the biggest use for the metal, which is also used in jewelery.

Others have also feared rising production costs for platinum miners, with HSBC Holdings PLC (LON:HSBA) precious metals analyst James Steel pointing to heavy platinum cash costs as a key danger for the industry. He estimated that cash costs could be as high as $1,700 per ounce.

“In the current price climate no South African producer can afford to significantly expand capacity,” wrote Steel in a Nov. 22 report. "Should demand increase significantly, producers might not be able to respond to the increased appetite for the metals.”

Just as South African suppliers suffer from limited growth potential, platinum demand is steadily rising. New emissions rules in Europe, set to take effect September 2014 and into 2015, will significantly raise the amount of platinum required in automobile anti-emission equipment, according to Coombes. Europe’s diesel-fired vehicles tend to use more platinum than its sister metal palladium, which is more common in the emission-control equipment of gasoline engines.

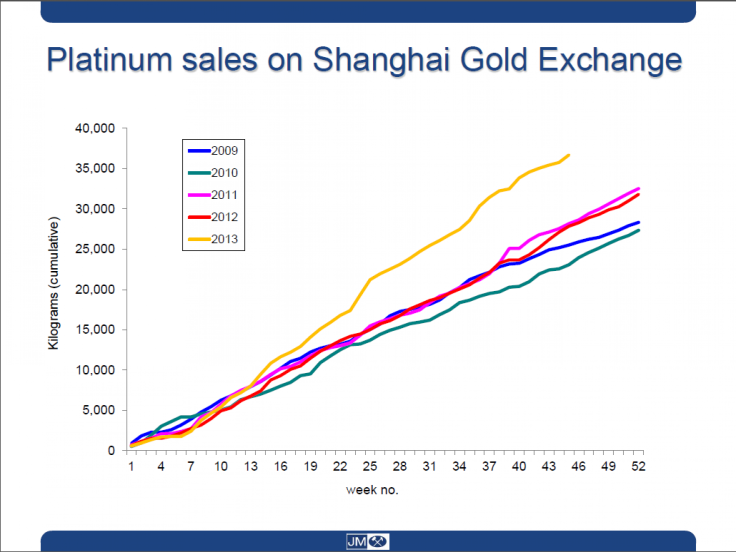

China, too, will play a key role in platinum markets in 2014. The country is increasingly seeking platinum for industrial uses, aside from its already established role as a major consumer of platinum jewelry.

Interest in platinum has jumped in 2013, as measured by sales on the Shanghai Gold Exchange, with this year's sales of about 35,000 kilograms topping those of the last four years.

More platinum should flow into Chinese consumer goods, like computers, tablets and plastics, according to Coombes, as the country shifts slowly from an export-led economy to one driven by domestic consumption. Unusually, Chinese platinum demand this year split evenly between industrial uses and jewelery, though jewelery usually accounts for a majority of Chinese demand, said Coombes. That trend could continue in coming years, he told IBTimes in an interview.

Platinum could well suffer from declining gold prices, however, since it usually trades in tandem with the yellow metal. Gold prices have fallen over 25 percent since the start of 2013. Analysts have hoped that platinum could decouple slowly from gold prices, based on tight supply and demand fundamentals.

Johnson Matthey forecasts an average platinum price of $1,465 per ounce over the next six months. HSBC sees platinum prices at $1,875 per ounce by 2015. Platinum opened at $1,355 per ounce in New York on Monday.

Although some experts see Zimbabwe overtaking South Africa as a platinum hub in coming years, especially as South Africa’s mining sector suffers broadly, others are skeptical.

“Zimbabwe has a huge amount of resources, a lot of which is unknown and undelineated,” CPM Group platinum analyst Erica Rannestad told IBTimes in early November. “The potential is really large. However, the political environment is still very not conducive to investment in the industry,” she continued. Zimbabwe still leans on veteran South African executives for mining expertise, she added.

South Africa has been wracked by platinum strikes this year, losing 44,000 ounces of potential output earlier this fall. Electricity costs could also become a burden, as regulators foresee 10 percent price hikes for industrial users annually for the next five years.

© Copyright IBTimes 2024. All rights reserved.