California Democrats Killed A Bill That Would’ve Saved Billions Of Dollars, Says Economist

California’s Democratic lawmakers blocked universal health care legislation — the culmination of a successful lobbying campaign to portray the proposal as unrealistic and unaffordable. But days later, advocates of a universal health care system in which the government is the single payer got three boosts.

First, U.S. Sen. Elizabeth Warren — a prospective 2020 presidential candidate — said Democrats should support legislation to create a single-payer system. Then influential investor Warren Buffett declared his support for such a system. And most recently, a new poll from Quinnipiac University found 60 percent of Americans now say they support “an expansion of Medicare that would make it available to any American who wants it.”

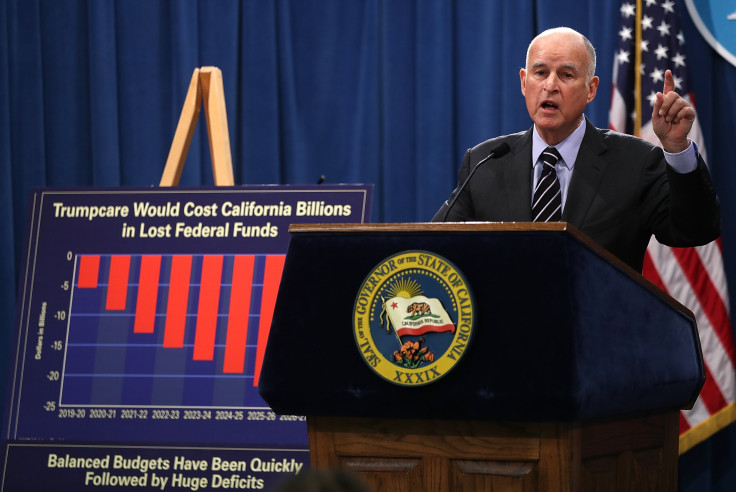

The California situation, though, exemplified the ongoing political challenges for such a proposal — even in a state with a Democratic supermajority, where government already pays 70 percent of the health care bill. Democratic Gov. Jerry Brown had in 1992 declared his support for single-payer, explicitly saying states could create such systems. However, even as he made headlines slamming Donald Trump's health care proposals, he refused to support the single-payer initiative in his own state.

Meanwhile, California's Democraitc Assembly Speaker Anthony Rendon — who made the decision to halt the legislation — declared the bill “woefully incomplete” and then moved to block it, effectively preventing the legislation from being completed. “The bill that we got from the Senate cost literally double the state budget and didn’t have a funding source,” Rendon said. In California, existing measures like Proposition 98 make it difficult for the legislature to raise new resources without putting a funding measure on the statewide ballot.

California illustrates how the key stumbling block for single-payer advocates has been the argument that a government-sponsored health care system would be unaffordable.

Would a state-based single-payer system really be the unaffordable budget-buster that opponents have long claimed? International Business Times’ David Sirota discussed the question with Robert Pollin, a University of Massachusetts economist who had been a top economic aide to Brown during his 1992 presidential campaign.

Pollin was recently commissioned by single-payer supporters to evaluate the financial underpinnings of the California proposal. After publishing a report about his findings, Pollin argues that opponents of the bill have misrepresented the most basic facts about health care economics.

Podcast subscribers can listen to the full interview here. What follows is an excerpt of the discussion with Pollin.

Sirota: Some have argued that individual states cannot afford to create single-payer health care systems. What is your response to that argument?

Pollin: I don't see where it works at all. Certainly not in principle. Right now states are spending huge amounts of money for health care. Most of the money is already coming from public funds. For example, California is spending $370 billion this year; 70 percent of that is coming from public funds already.

Really, all we're talking aboutin moving to single-payer is shifting the 30 percent that is channeled through private health insurance companies into the public system. In addition, when we move to single-payer we will get cost savings that have not been generated when we rely on private insurance companies to deliver health care.

Sirota: The term “single-payer” has often been used as a catch-all. But it doesn’t just mean universal health care. What does that term mean in practice?

Pollin: You can come up with different definitions. In my discussions with Gov. Jerry Brown he says, "Oh, it's just a term that nobody knows what it means. It's rhetoric." Here's what I take to mean single-payer. Number one, that the first principle is universal provision of health care so that everyone in the state is guaranteed decent health care. Everyone in the state or the country or whatever the relevant body is. Second, that to pay for the health care we have the government providing the insurance function 100 percent to deliver the guaranteed health care for everybody in the state. Those are the two fundamental principles.

Sirota: You studied California’s recent legislation to create a single-payer system in that state. What would the proposed program do?

Pollin: The proposal was that every single resident of California would have access to decent health care regardless of whether they had a job, who their employer was, who their parents are. Every single resident of California would have access to decent health care. That's the basic principle. Then in order to accomplish that, basically we shift funds out of the private insurance companies and we cover that through public spending generated by new taxes. That's basically it.

Sirota: How much is California currently spending on health care, and what kind of savings do you think it could achieve if it created a single-payer system?

Pollin: What I discovered in my research with my coauthors is that California is paying about $370 billion now in health care and that's with about 8 percent of the population still being uninsured and then about another 33 percent of the population being under-insured. Meaning they have insurance but their deductibles and copays are very prohibitively high and they're not getting the care they need…

We find, working from the existing research literature, we think conservatively you can get about 18 percent savings out of the system.

With 18 percent savings through four basic components: lower administrative costs; lower pharmaceutical prices; lower fees for providers, doctors, and hospitals; and somewhat greater efficiency in delivery of care. Add those four things up you get about 18 percent savings, which means that the total system is now going to cost $330 billion… and that everybody gets decent care.

Sirota: Government data has shown that Medicare — which is basically a single-payer system — has lower administrative costs than private insurance. What are these administrative costs, and why do you believe there would be big administrative cost savings in a state-based single-payer system?

Pollin: Basically the administrative savings occur precisely because you get rid of multiple payers, you get rid of private insurance companies competing with one another, you get rid of those companies that are trying to maximize profits as opposed to deliver decent health care. You also get rid of the administrative costs faced by physicians and clinics and hospitals having to deal with the health insurance companies.

The research literature says that the potential savings available there are in the range of 50 percent to 70 percent. I took the low number. I said, "Okay, let's say it's 50 percent." That's really how I got that number.

A major piece of evidence in the literature was saying, "Well, what if we replicated the administrative structure of Medicare?" The argument is, "Okay, you get savings in the range of 50 percent to 70 percent.”

Sirota: On drug prices — other single-payer systems throughout the world use their market power to negotiate lower prices for prescription drugs. Would California as a state be able to do that? What kind of savings would it get from that?

Pollin: We looked at two examples that would be relevant for the state of California and also other states. One is the U.S. Veterans Administration, which negotiates drug prices as a block with all the pharmaceutical companies for all the needs of its members, the veterans. Then secondly we looked at the Canada case. The Canada case again is one in which we have a similar population level and a similar demographic.

If we look at Canada and the Veterans Administration we see cost savings in the range of 30 percent to 50 percent through negotiating drug prices as a block.

Sirota: Then there's the payment rates to health care providers. What would that look like under the single-payer system being proposed in California? And what do you say to those who worry that lower payment rates could prompt doctors to flee the state?

Pollin: What we proposed is that the payment rates for physicians and hospitals be exactly at the Medicare rate. After all, we're talking about Medicare for all so Medicare rates for all. Those rates are about 20 percent less than what private insurance pays. At the same time they're about 15 percent more than what is paid in Medicaid, which in California is called Medi-Cal, [which] provides about 30 percent of all health care in California.

I met with representatives of the California Medical Association in preparing the research paper. I thought they were going to be much more aggressively opposed to what I was talking about and in fact they weren't. What they said was, "Well, this is going to be good news for a lot of physicians who are expecting Medicaid rates. They're going to get a raise for their Medicaid rates." It's true that some physicians are getting much more.

In those cases they are going to get the compensation but their administrative costs are going to go way down, which we've already factored in. If we say that administrative costs are going to go down by about 10 percent, that goes right back into the pockets of the providers.

Overall, on balance, most physicians, most hospitals, most clinics are going to come out about the same as they are now through different means. Through the raise in Medicaid rates, through the reduction in administrative costs, while yes they are going to see a cut relative to what they get from private insurance.

Sirota: Factoring in all of these savings, there is still an amount of new revenue that would need to be generated in order to fully fund this proposal that emerged in California. Roughly how much would need to be generated? And what are some realistic ways to raise the new revenues?

Pollin: If we say that the whole system for 2017, the whole system would cost $330 billion to cover everybody decently, we have to get that money. Right now 70 percent of the health care system in California is covered by public funds already. That 70 percent is going to stay in place. That's going to remain intact. That's $225 billion out of what we need $330 billion. That means we need to raise roughly another $105 billion total.

What I proposed in the study was two simple mechanisms. One was a gross receipts tax, a tax on all receipts from all businesses at 2.3 percent. Then I built in an exemption for the first $2 million of gross receipts for all businesses. With that exemption, essentially 80 percent of the smaller businesses in the state are completely exempt from having to pay the tax. Another 10 percent are only paying at a rate of about 0.8 percent. That only leaves about 10 percent of the larger businesses in the state paying the 2.3 percent gross receipts tax.

That's going to raise the bulk of the money. Out of the $105 billion that we need, that raises about $92 billion. The rest is covered through an expansion of the existing sales tax in the state. Adding 2.3 percent sales tax but again I'm exempting necessities. I'm exempting food, housing, and utilities. When we do that it's a very progressive tax and we raise the rest of the money. That's how we get to $105 billion.

Sirota: When the single-payer bill was blocked from moving forward, there was a lot of talk about how it is unaffordable — and the big numbers about cost were thrown around. Do you think these debates end up misrepresenting the total costs of single-payer?

Pollin: That certainly seems to be what's happened. When I presented my study last month in Sacramento somebody said to me, "What techniques are you using to get these numbers?" I said, "Arithmetic and subtraction." It's really not all that complicated. It's pretty straightforward as a matter of fact. I don't see what the big deal is.

What the big deal is, that this massive misrepresentation when the $400 billion number first came out from the State Appropriations Committee report it was written up as though we were going to go from zero, spending zero, to spending $400 billion. Of course, that's preposterous. It isn't even in the study. The study did not make a point of saying, "You know what? We're at $370 billion now and then we're going to go to $400 billion." That's an increase but let's say it's not a gigantic increase.

Then that $400 billion number gets repeated over and over again and, yes, I saw the editorial in the Wall Street Journal, I saw the editorial in the Washington Post, LA Times, and so forth. They keep repeating the same thing.

Pollin: The single-payer system is going to lower health care costs for virtually every household level and for virtually all businesses. This program is good for business.

I wish the Chamber of Commerce would actually take a look and think about it a minute objectively. What businesses are paying now for health care is quite substantial and what I show is that they will be paying less. They will have more money to take home, households will have more money to keep as income, with the exception of the wealthy households. Most households and virtually all businesses are better off on net. Yes, they're going to pay more in taxes but, yes, they're also going to be released from having to pay health insurance premiums, deductibles, and copays.

Sirota: If that’s true, why do you think many business groups oppose single-payer in general, and opposed this legislation in specific?

Pollin: First of all, it's clear why the health insurance industry is against it. They're going to be put out of business. They are operating massively to fight this. Secondly, the pharmaceutical industry [is] going to get lower prices. They're also fighting like mad to prevent this. Those are two big important powerful industries that have a lot of influence in the media. They can buy a lot of TV commercials and all that.

Beyond that, I think a lot of it is inertia. Well, this is what we have. This is what we're used to. There may be some arguments that big government is going to make things bad [but] the administrative issues are not overwhelming. Yesterday Warren Buffet, the third-richest person in the world, and the most brilliant private investor in history according to some, he came out on behalf of single-payer. Well, so there's one businessperson who sees the reasoning here. He made his reputation by being open-minded and being objective. I think that if other business people were to open their minds to an equivalent degree they would also see the benefits.

Sirota: What do you think a single-payer system would mean for the California economy as a whole?

Pollin: The first single biggest effect, and this is at the moment still a deficiency in my study and I'm trying to correct that, is what happens to the people who work in the health insurance industry? We do have to address that. As a matter of transition how do we transition?

Beyond that the issues for businesses, virtually all businesses are going to net out better off so we're lowering costs for businesses, for most businesses, to a significant degree. I would say medium-sized businesses are going to see cost reductions in the range of 3 percent to 9 percent depending on the health plans that they're already offering.

Big businesses, most big businesses, will see modest cost reductions. Not big ones. Then small businesses most of them are going to be unaffected because they're not covering their workers now. They'll be exempt from the gross receipts tax. The small businesses that are covering their workers will see a windfall 22 percent cost reduction.

This is going to induce — to the extent we believe businesses are there are out to make money and encourages them to invest more — to hire more workers, to expand their operations is the prospect of making more money. We are saving them money... Households will have more money in their pockets. That will increase overall spending by household…Overall, it's going to be a stimulus to the economy.

© Copyright IBTimes 2024. All rights reserved.