PRECIOUS MONTHLY- Silver, metal of the month; palladium most shining year-to-date

Fresh news of China cooling, another no-impact G-20, deepening concerns of Europe's periphery debt and an unexpected Korean crisis helped shape investment decisions in global markets through November. The net impact was positive for dollar with its trade weighted index calculated for six major currencies rising 5.5 percent from its end-October level, compared with its year-to-date jump of 4.43 percent. Amid tensions, investors as usual sought safety with the greenback, which was also supported by a weak euro.

At the same time, worries about a lack of momentum in US economic recovery and the Fed's policy of printing more dollars prompted some investors to selectively invest in commodities like metals and oil.

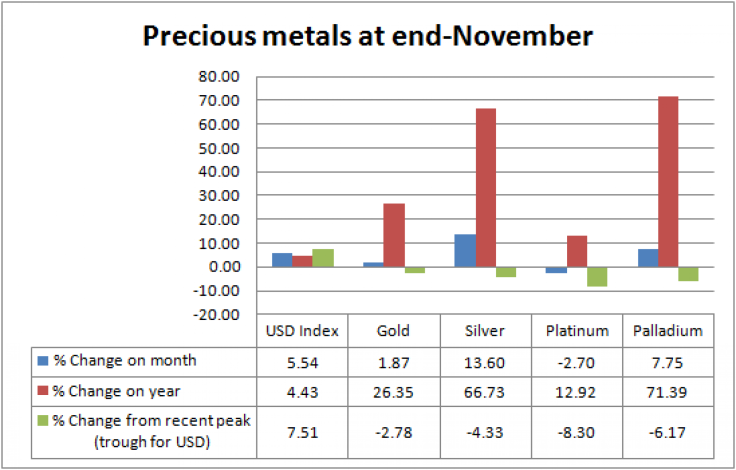

The precious metals, however, were mixed in November, with silver outshining the rest with a 13.6 percent jump, followed by palladium which rose 7.75 percent. Gold managed to end the month with marginal gains of 1.87 percent while platinum fell 2.7 percent from its end-October level. See chart for a comparison.

The week of Korean crisis saw gold outshining its colleagues in the precious group, but on the month, silver and palladium remained strong, mainly helped by demand for cheaper alternatives in jewelry and industrial applications.

The US dollar index rose to 81.44 by Tuesday, its highest since September 20, before settling the month at 81.31.

Spot gold ended the month at $1,384.45 per ounce, from end-October level of $1,359.05. Immediate delivery silver rose to $28.06 as on November 30, up $3.36 per ounce in the month. Spot palladium stood second in performance in November, with a 7.75 percent rise from October closing. It closed the month at $695 an ounce from $645 on October 29.

Silver and palladium - most shining

With gold near its record high price, many switched to silver for their jewelry and related needs, helping the demand for the white metal. Traders said such a trend was visible in markets like India, which consumes the largest chunk of gold and silver. Palladium, which is used as a cheaper alternative for platinum in some industrial applications, was mainly supported by uncertainties about its supply.

Plus, silver coinage program in many countries saw a remarkable boost this year, showing across-the-globe investor interest in the white metal, mostly from small-ticket buyers.

Industrial applications contribute almost 43 percent of silver demand and there was a slew of news in the month about confident silver companies like Silver Wheaton planning to produce more, foreseeing better demand going forward.

International Monetary Fund (IMF) has forecast the world to grow 4.3 percent in 2010, after falling 0.6 percent in the previous year.

Platinum and gold - yellow metal more in demand

Platinum, which is costlier than gold, more or less tracked the yellow metal through the year but it was down by $46 per ounce in November to end the month at $1,656.49. The metal for immediate delivery was up only 12.9 percent up from its end-2009 level, finishing last among the precious group of four.

Gold, however, fared better when performance after November 9 peaks of the precious metals were taken into account, showing the yellow metal's relative strength as a stable choice of investment avenue. Investors still find gold as the best available tool to hedge inflation, especially given bearish long-term outlook for major currencies like dollar and euro.

The yellow metal at its end-November level was 2.78 percent weaker than its peak hit early this month compared with 4.3 percent for silver, 6.2 percent for palladium and 8.3 percent for platinum.

December for clarity from Europe and China

Traders will look for more clarity as to the how much China will raise its key rates or allow its currency to appreciate to combat inflation and criticism that it has kept yuan weaker to help its exporters.

The second largest economy had raised its key lending rate in October for the first time since September 2007 but higher-than-expected inflation data that followed prompted investors to brace for more action by the People's Bank of China (PBoC). Chinese authorities since then tightened credit to banks, especially for the realty sector but market expectations of a policy rate hike not waned yet.

However, fears of European debt crisis spreading to more countries has been weighing more in financial markets of late, which is likely to continue well into December. The Irish settlement last weekend did not help ease impending worries of Spain, Portugal and Italy, of which Italy could turn out to be a real big threat, given the size of its economy as well as debt.

Italy's debt is expected to reach as much as 120 percent of GDP this year. Also, the country has to raise 389 billion euros next year to cover its new borrowings and roll over existing debt. On November 30, Italy's 10-year yields rose to 4.75 percent, its highest in the year, and the spread to German bunds rose to 214 basis points, a euro life-time high, and up by 68 from end-October. Meanwhile, credit default swaps traded at 275 basis points, up from 172 at the start of November.

© Copyright IBTimes 2024. All rights reserved.