Price Of US Treasurys Plummets And Yields Shoot Higher After Federal Open Market Committee Issues Rosier-Than-Expected Economic Forecast

The yield on the benchmark 10-year U.S. government bonds, also known as Treasurys, shot up more than 6 percent Wednesday after the Federal Reserve issued an economic outlook that was more optimistic than many had expected.

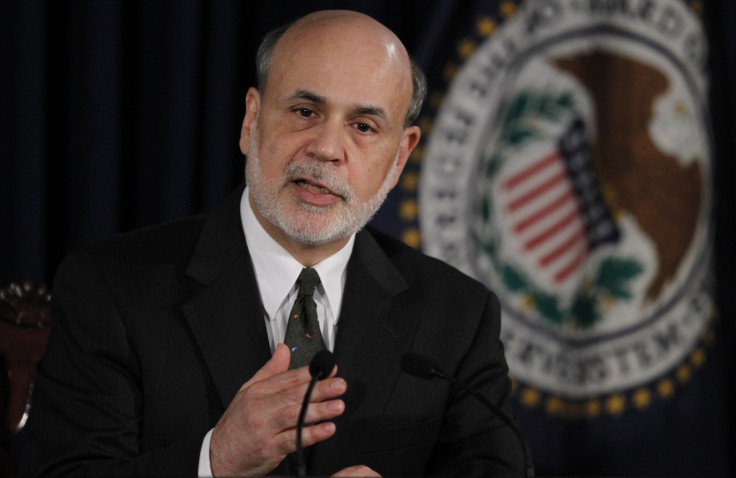

The central bank's key rate-setting committee, known as the Federal Open Market Committee, or FOMC, concluded a two-day meeting on Wednesday and issued a statement saying it will continue its quantitative easing program at $85 billion per month to stimulate the U.S. economy and provide liquidity to markets while also keeping short-term interest rates the same.

While still noting that joblessness was "elevated," the FOMC said, "Labor market conditions have shown further improvement in recent months. The committee also said that it sees "the downside risks to the outlook for the economy and the labor market as having diminished since the fall."

Crucially, the FOMC said it expects unemployment to decline more quickly than it had expected and also to fall to a lower level than it has previously forecast.

By the end of 2014, for example, the FOMC sees unemployment hitting between 6.5 percent and 6.8 percent, an improvement from March when they saw it hitting between 6.7 percent and 7 percent by then. At the end of last year, the forecast was 6.8 percent to 7.3 percent.

"The new language hints that the outlook has improved sufficiently to begin thinking about reducing the monthly purchases, even if the improvement hasn't been substantial enough to warrant a complete halt," Paul Ashworth, chief U.S. economist for London's Capital Economics, said.

Markets reacted strongly to the suddenly heightened prospects for diminished bond purchases by the Fed and the resulting increase in interest rates. Treasury yields shot up, at one point surging 6.14 percent.

The dollar rose 0.84 percent against the euro and 0.3 percent against they yen.

Stocks, meanwhile posted losses of between 1 percent and 0.5 percent.

© Copyright IBTimes 2024. All rights reserved.