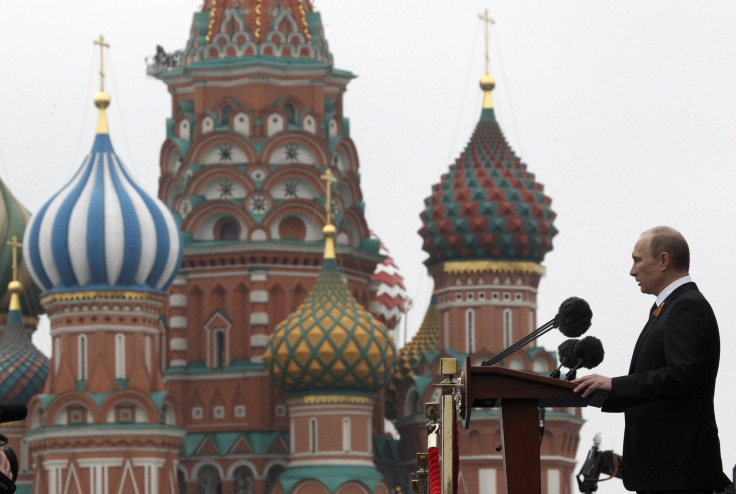

Putin Regime Could Fall If Oil Price Drops To $60: Fund Manager Browder

A plunge in the price of crude oil to $60 per barrel could remove Russian President Vladimir Putin from power, claimed a prominent investment fund manager at the World Economic Forum in Davos, Switzerland. The Daily Telegraph reported that in the event of a $60-per-barrel price level, “Putin would be gone within a year," said William Browder of Hermitage Capital Management, a Guernsey-based investment fund and asset management company specializing in Russian markets.

Browder also said the Putin regime is very “brittle” and that oil must be priced at $117 per barrel to enable the Russians to balance their budget. (Brent crude is currently trading at $107 and has hovered between $100 and $114 since last April. It has not been priced around $60 since the spring of 2009.)

Browder, who characterizes himself as “enemy number one” of Putin, said a price plunge would force Moscow to dig into its reserve funds, which in turn would trigger an additional capital flight out of the country. Not even Russia’s nearly half-trillion dollars in foreign reserves would provide a cushion. "We saw this in 2008 when everything fell apart in a few months even though Russia had the world's third-biggest reserves,” he told the Telegraph. “It wasn't supposed to happen, but it did."

The Telegraph noted that a possible oil glut arising from the phasing out of sanctions against Iran and renewed production from Libya could conceivably push the price of Brent crude down to $60. In the meantime, however, such a drop is unlikely. On Tuesday, oil prices climbed higher after the International Monetary Fund raised its forecast for global economic growth in 2014 from 3.6 percent to 3.7 percent, the IMF’s first upward revision in almost two years. In addition, the International Energy Agency increased its prediction of growth in oil consumption. The IEA said oil demand will grow by 1.3 million barrels per day (mbd) in 2014, up from a prior forecast increase of 1.2 mbd.

Russia is the world’s top oil producer (and second-largest exporter after Saudi Arabia) and relies heavily on export revenues to maintain its economy. In 2013, Russian companies produced 10.5 mbd, a 1.4 percent increase over the prior year. Russian Energy Minister Alexander Novak told Reuters that oil production will be kept at a minimum of 10.1 million to 10.2 million bpd in the next few years and might increase to 10.8-11.0 million bpd before 2030.

Separately, Browder noted that Putin has other problems besides the price of oil; indeed, he suggests that the type of street protests convulsing Ukraine could spill over into neighboring Russia. "There is no ideological fervor [to] sustain the regime, though Putin is trying to create a new form of ideological conservatism with his attacks on gays. Putin's allies will abandon him as soon as there is trouble," Browder added.

Browder has had a stormy relationship with Putin, to put it mildly. A Russian court under Putin’s control had sentenced Browder in absentia to nine years in prison for his part in advocating for the Magnitsky sanctions, a U.S. measure passed in 2012 that applies visa bans and financial sanctions on Russian officials who were implicated in the death of Sergei Magnitsky, a whistle-blowing Russian attorney, in 2009. Moscow has rejected the law as interference in its domestic affairs.

© Copyright IBTimes 2024. All rights reserved.