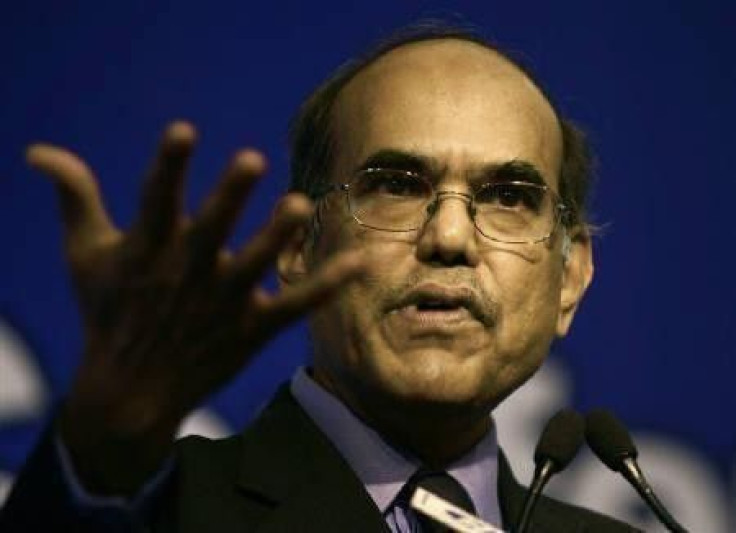

RBI Governor Thinks FDI in Retails May Help Control Inflation

India's growth story is still credible and the move to open up the economy to global supermarket chains will help growth and control inflation, says RBI Governor Duvvuri Subbarao.

It's commendable that government has taken the initiative. Let's hope that it will improve the logistics chain and supply chain management in agriculture, Subbarao said in a speech in Chandigarh.

On Thursday, the government approved 51 percent foreign direct investment in the supermarket sector, paving the entry of firms such as Wal-Mart, Tesco and Carrefour into one of the world's largest untapped markets.

It's important for not only raising overall growth but also important for containing inflation and improving quality of life over 50 percent of population, said Subbarao.

Opening up the retail sector to global players has been a much-awaited reform but has been long hobbled by political differences. The Congress-led government's biggest ally Trinamool Congress is opposed to the move.

The RBI chief said that inflation should be brought down to 5 percent initially and then even lower, consistent with India's integration with global economy. He said that the current inflation situation was a consequence of both supply shocks and demand pressures.

Monetary tightening needs to be supplemented by supply side measures to raise potential economic output, said Subbarao. Raising agricultural production and productivity is, important for containing price pressures, raising rural incomes and making growth more inclusive, he added.

India's inflation, which is largely driven by high food and global commodity prices, plus expansive fiscal policies, is the highest among major economies in Asia. It was wholesale prices that rose more than expected in October as the cost of food and fuel increased.

The high inflation print, above 9 percent for the 11th month, was further evidence of the Reserve Bank of India's (RBI) inability to achieve a breakthrough in its fight against inflation despite 13 rate rise since March 2010.

In its Oct. 25 mid-quarter review of monetary policy, the RBI said that a rate hike may not be warranted if inflationary pressures start to ease by December.

Slowing growth, stubbornly high inflation, rising interest rates, political gridlock, gloom in the West and a sliding rupee have conspired to dampen investor and corporate sentiment in Asia's third-largest economy.

The RBI has lowered the country's growth forecast to 7.6 percent for the current fiscal year ending in March from 8 percent previously. Subbarao says a reduction of federal and state fiscal deficits are important steps for a stable macro environment.

India's fiscal deficit during April to September was 2.92 trillion rupees, or 70.8 percent of the full-year target, government data showed. Most expect it to breach the 4.6 percent of GDP target for the fiscal year.

The government said it would sell debt worth 2.2 trillion rupees, sharply above the budgeted 1.67 trillion rupees in the October to March period.

Subbarao said that India being an emerging economy with a partly open capital account, floating exchange rate and a monetary policy that takes into account global developments has to continue to manage the impossible trinity.

The impossible trinity refers to the economic hypothesis that a country simultaneously cannot have a fixed exchange rate, an open capital account and an independent monetary policy.

RUPEE VOLATILITY TO REMAIN

Subbarao said the volatility in the foreign exchange market would remain until the eurozone crisis is resolved.

Until there is a credible solution to the sovereign debt problem in Europe, we will see movements in the exchange rate, said Subbarao. He added that the central bank was watching the rupee, but could not say whether it would intervene in the forex market directly.

The rupee has skidded nearly 17 percent from a 2011 high reached in late July as risk-averse investors flee emerging markets, increasing the difficulties for a government already struggling with high inflation, slowing economic growth and a widening trade gap.

The rupee touched an all-time low of 52.73 Tuesday and state-run banks were spotted selling dollars in the market in recent sessions, sparking talk of RBI intervention.

On Wednesday, RBI deputy governor Subir Gokarn said that intervention had been aimed at smoothing sharp movements in the rupee.

© Copyright Thomson Reuters 2024. All rights reserved.