Wall Street Analysts Upgrade Shares Of Credit Card Issuers Despite Less Borrowing by US Consumers

The deleveraging of credit-card balances by U.S. consumers has not dampened analysts' optimism about the share prices of credit-card companies.

Layoff Rumors Swirl Around Deutsche Bank

Deutsche Bank is reportedly set to fire more than 500 employees in Germany, various financial media outlets reported Friday, but the Frankfurt-based bank is denying the reports.

Party In Big Bank Stocks Over: UBS

A rally that has added 30 percent to large U.S. bank stocks is over, and it's time for investors to cash in, a UBS report warns.

Bank of America Layoffs A Reminder It's September On Wall Street

The news that Bank of America was speeding up the layoffs of 16,000 workers aroused fear on Wall Street.

After Hitting 6-Month High, Gold Rally Takes A Pause

Gold prices traded flat Wednesday and against news suggesting a rally was in the offing, after reaching six-month highs earlier in the day.

Obama Spikes in Political Futures Markets As QE3 Ignites Furious Rally

All kinds of markets have been up following the announcement last Thursday of further monetary stimulus from the U.S. central bank. But the one thing that has gone up the most, according to futures markets where people put money on such things, are the chances Barack Obama will win the U.S. presidential election in November.

Markets Keep Rallying, Companies Brace for Tough Q3

The stock markets are having a monster rally. But next earnings season might challenge that.

People Take To The Streets As Protests Rage Across The Globe

Photos from demonstrations around the world Friday through Monday, including Occupy Wall Street in New York, marches against austerity in Europe, anti-Japan demonstrations in China, and street action in the Muslim world.

Awful 'Empire State' Manufacturing Data from the New York Fed Leaves Markets Unmoved

Financial markets yawned Monday in the face of an anemic U.S. manufacturing report from the Federal Reserve Bank of New York that showed industrial production in the Northeast falling to a nearly two-year low.

QE3 Reviving Fears Of Global Currency Wars

Thursday's announcement by the U.S. Federal Reserve that it would be engaging in a third round of open-ended bond-buying, known as QE3, to energize the economy saw a resoundingly positive reception in the foreign financial markets, where indexes rose Friday. But market-watchers were expecting the global equity party would lead to an inevitable hangover soon, in the form of intervention by central banks around the world, to stop massive inflows of dollars into non-U.S. economies -- in short, a...

Apple iPhone 5 LTE Data Plan Won't Work On China's Largest Network

The Apple Inc. (Nasdaq: AAPL) iPhone 5 won't work on the LTE infrastructure of China's largest mobile network, Nomura analysts reported Friday, the latest setback for a launch that is not making the expected waves in that Asian country.

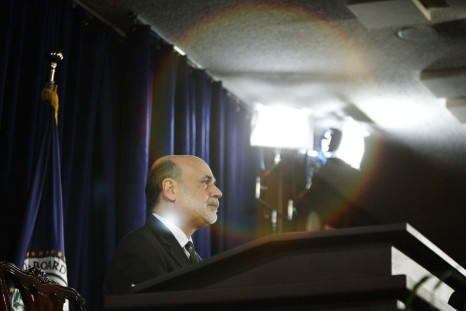

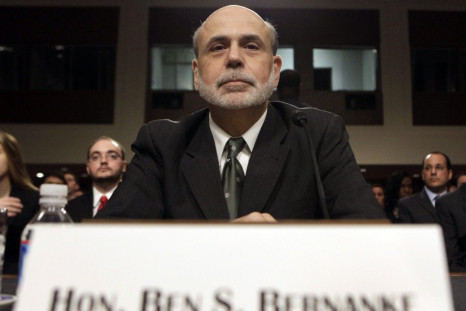

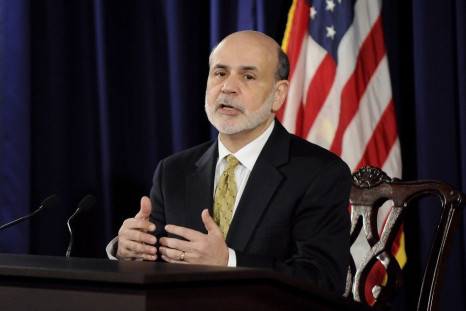

Fed Recap: Chairman Bernanke Defends QE3, Pre-Empts Political Criticism

Fed Chairman Ben Bernanke offered a spirited defense Thursday of the bank's decision to launch QE3, as the central bank's third round of quantitative easing is known, amid speculation that the initiative may have been politically motivated as the presidential election nears.

Bernanke Press Conference On QE3 - Live Blog

The Fed's decision to increase securities purchases by $40 billion per month - QE3 - exceeded analysts' expectations, and in his press conference Bernanke outlined the central bank's reasons for the move.

Fed Announces QE3, Bigger Than Expected

The Federal Reserve will begin buying more than $80 billion of securities per month in the third attempt at stimulating the U.S. economy by boosting the central bank's balance sheet.

Live Stream of Bernanke Press Conference: Where to Watch

Here are two places to get a live stream of the news conference that Ben Bernanke, the chairman of the Federal Reserve, will hold today following the conclusion of a two-day meeting by the central bank's rate-setting committee.

Wall Street Setting Itself Up For Collateral Meltdown Daisy Chain All Over Again: Bloomberg News

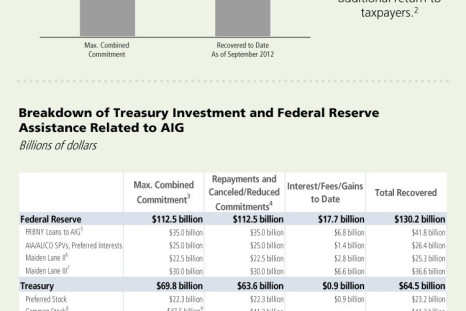

Less than 24 hours after the U.S. government reported it was mostly done with its money-losing bailout of AIG, a Bloomberg News article out Tuesday explained how Wall Street banks are setting themselves up for the next systemic crisis by playing at financial alchemy in the derivatives market.

Washington Bends Logic Into Mobius Strip To Show Profit On AIG Bailout

The U.S. government went into a full-throated propaganda offensive Tuesday in an effort to show that the highly controversial 2008 bailouts of American International Group, Inc. (NYSE: AIG) were profitable.

Fed Meeting Preview: QE3 Has Arrived

Markets have been talking about QE3 for two years. Now, after a sovereign credit downgrade, the near collapse of the European financial system, and facing an anemic recovery that has only marginally helped heal the carnage in the labor and housing markets, the vast majority of financial pundits believe QE3 this week is "pretty much a given."

Volt A 'Technology Masterpiece,' Not A Loss-Leader: Bob Lutz, Former GM Exec

A former high-level General Motors Company (NYSE: GM) executive -- widely considered to be the godfather of the company's foray into electric-vehicle production --struck back Tuesday at the assertion the carmaker might be losing nearly $50,000 on each one of the signature Volt plug-in vehicles the firm has sold so far.

Most Important Supreme Court Decision Of 2012: Six Things To Know

The most important court decision of 2012 will take place Wednesday in Germany, when the red-robed justices of the German Constitutional Court hand down a decision for which it is no hyperbole to say it could change the course of history. The Court is expected to rule over whether Germany is barred from contributing to the European Stability Mechanism, Europe's all-purpose bailout fund of which the German state is the major planned benefactor.

Gold Rally: How Long Can It Go?

Two large investment banks issue fresh forecasts for the price of gold

Germany, Most Robust European Economy, Headed For Recession - Economists

Germany is currently seeing better-than-predicted GDP growth, low unemployment, and steady prices. Surprisingly, economists say a recession is around the corner.

Draghi's ECB Announcement - Spain A Stealth Loser, Italy A Silent Winner

While pundits and analysts dissected a myriad angles regarding the ECB's proposal, one lesser-considered issue has been how, following the announcement of the plan Thursday, it increasingly seemed Spain was being given the short end of the stick, while Italy was being favored, by the announcement.

Police Riots in Athens Punctuate Week of Violent Strikes

On-duty Greek riot police clashed with a small contingent of colleagues on strike Thursday in an event that put an emotional climax to a week of protest in Greece.

Gold Tops $1,700 on Draghi Comments, Holds Despite Good Jobs Data

Gold futures blew past the $1700-per-ounce mark early Thursday morning ahead of a widely-anticipated appearance by European Central Bank president Mario Draghi where the central bank head was expected to announce further monetary accommodation in the eurozone.

Which 2012 Campaign Issues Really Matter To Wall Street Investors?

While the presidential candidates' plans to tackle unemployment, the national debt, health care reform, immigration, gay marriage and gun control might be the topics that have Main Street voters buzzing ahead of this year's election, a new report by the global equity research team at Standard & Poor's shows Wall Street investors have very different policy debates in mind.

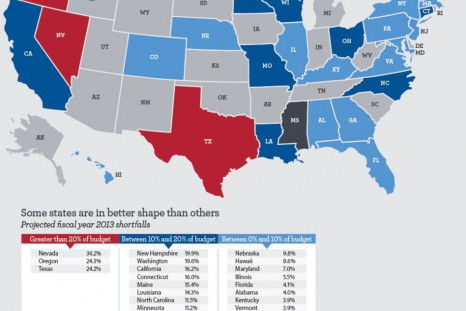

Purple States Most Likely To Be In The Red: Wells Fargo Report

While opinion polls in places like New Hampshire, Ohio, Nevada and Wiscounsin continue to find no clear trend as to whether the residents will support a Democrat or a Republican for President, a new report by asset manager Wells Fargo Advisor Wednesday found those very states unambiguous in their spending preferences in running large budget shortfalls

Thursday Meeting Preview: ECB's Draghi To Push Paradox Of Monetization On Reluctant Germans

Late Monday, word leaked out that Draghi is now saying the ECB should pursue a policy of monetizing sovereign debt of periphery countries -- that is, printing reams of new euro to buy bonds issued by those governments -- even though such a policy path exceeds the central bank's mandate and has been adamantly opposed by the German political establishment.

Is Santander's Mexican IPO The Death Of 'Goose' That Lays Golden Eggs?

Banco Santander's announcement that it would be spinning off nearly one quarter of its Mexican unit in an initial public offering later this month was greeted by the markets as a seemingly win-win-win proposition. But the move by the large Spanish bank only highlights the increased dependence Iberian banks have had on their overseas branches over the past few years and how, in an effort to now package off those units and sell them, they could be killing the hen that's been laying the golde...

Bernanke's Speech at Jackson Hole: 6 Key Take-Aways

It seemed everyone was claiming their crystal ball has been right in anticipation of a much-hyped speech by the world's most powerful central banker, who managed to turn the attention of traders around the world to his podium in bucolic Jackson Hole, Wyo. Friday. They were all right and, as usually happens in such cases, they were also all wrong.

![2012 Election: Mitt Romney Favored Over Barack Obama To Advance The Technology Industry [FULL TEXT]](https://d.ibtimes.com/en/full/756971/2012-election-mitt-romney-favored-over-barack-obama-advance-technology-industry-full-text.jpg?w=466&h=311&f=76d20f3899e367692fcd5ec77d89ff31)