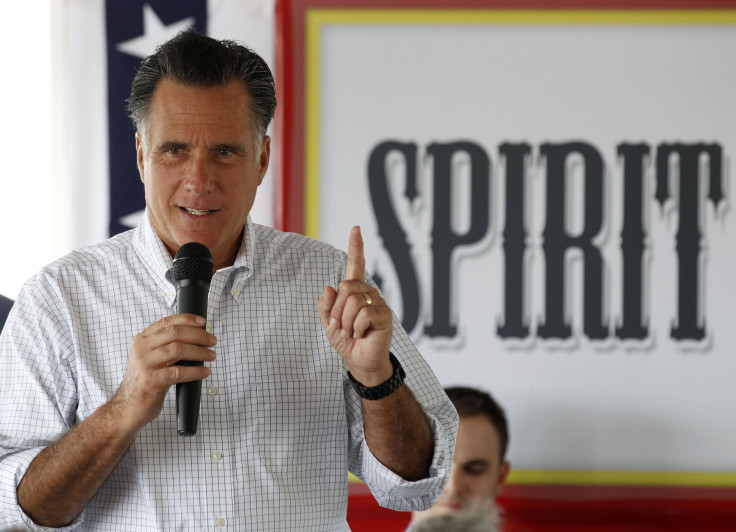

Romney Can’t Fulfill Promises Without Taxing The Middle Class: Experts

If GOP presidential nominee Mitt Romney wants to truly fulfill his promise of tax cuts without raising taxes on the middle class, then something has got to give, tax experts say.

While on the campaign trail in March, Romney outlined a tax cut proposal for reducing federal income tax rates by 20 percent, essentially lowering revenue by about $5 trillion over the next 10 years. The lost revenue would be made up through a broadening of the tax base, according to Romney, and by getting rid of many deductions and certain exemptions for Americans in the upper-income bracket.

As the Nov. 6 general election date draws closer, the now more moderate candidate has since said he doesn't have a $5 trillion tax cut or any tax cut of that magnitude in his plan.

But regardless of what Romney's proposed cuts were, the numbers are still not adding up, especially without a complete plan to base a judgment on.

“This was true even when we bent over backwards to make the plan as favorable to Romney as possible,” wrote tax expert William G. Gale, who is also co-director of the Tax Policy Center. “We considered an unrealistically progressive way of financing the specified tax reductions. We accounted for revenue feedback coming from potential economic growth estimates, as estimated by Romney advisor Greg Mankiw. We even ignored the need to finance about a trillion dollars in Romney's proposed corporate cuts. Our conclusion was not a prediction about what Governor Romney would do as President, it was an arithmetic calculation: all of the promises couldn’t be met simultaneously without resorting to tax increases on households with income below $200,000.”

Gale isn’t the only expert who weighed in on the arithmetic calculation.

Alan D. Viard from the America Enterprise Institute, often considered right-of-center, told the New York Times last month, that more cuts are needed for the Romney plan to work.

“It’s not as if the entire philosophical approach he’s pursuing is doomed,” Viard said. “But he’s going to need to cut rates significantly less than 20 percent if he wants to honor his other goals.”

Obama has said that Romney’s plan would put thousands more on the tax bill for middle-class families.

Though Romney’s camp has said those calculations aren’t true, the experts are still having a hard time making the numbers work any which way.

Gale compares the Romney tax plan to wanting to drive a car from Boston to Los Angeles in 15 hours, without speeding.

“After all, the drive from LA to Boston is about 3,000 miles, so to take only 15 hours would require an average of 200 miles per hour,” he wrote in his opinion piece. “Certainly other road trips are possible -- but the particular one proposed here is not.”

© Copyright IBTimes 2024. All rights reserved.