South African Economy Shrinks As Mining Sector Sees Lowest Production Since 1967

South Africa’s economy had its first contraction since 2009 as platinum worker strikes decimated production levels, and economists don’t expect things to pick up soon.

The country’s GDP shrank 0.6 percent, a much larger decrease than the 0.1 percent expected by analysts, and far less than the 3.8 percent growth it experienced in the fourth quarter of 2013.

“The ongoing strike action in the mining sector proved to be more damaging than most had expected,” wrote Shilan Shah, Africa economist at Capital Economics, in a Tuesday note.

“Looking ahead, there are a number of reasons to suggest that a significant pickup in growth over the coming quarter is likely.”

The damage is due in large part to striking platinum miners, who typically produce about 40 percent of the world’s supply, but have been on strike since January asking for better working conditions and higher wages, lowering production to its lowest point in decades.

Mining production fell by 24.7 percent, its worst quarterly performance since 1967.

Given difficult negotiations between strikers and managers, there doesn’t seem to be an end in sight.

“The huge gulf between union demands and the wage offers made by companies suggests that a solution to the strike action remains some way off, which will continue to hold back output,” Shah wrote.

But mining isn’t the only struggling sector. The manufacturing sector contracted by an annualized 4.4 percent since the quarter earlier, while agriculture and retail also slowed down.

“The reality is that growth has slowed across most sectors of the economy,” wrote Shah.

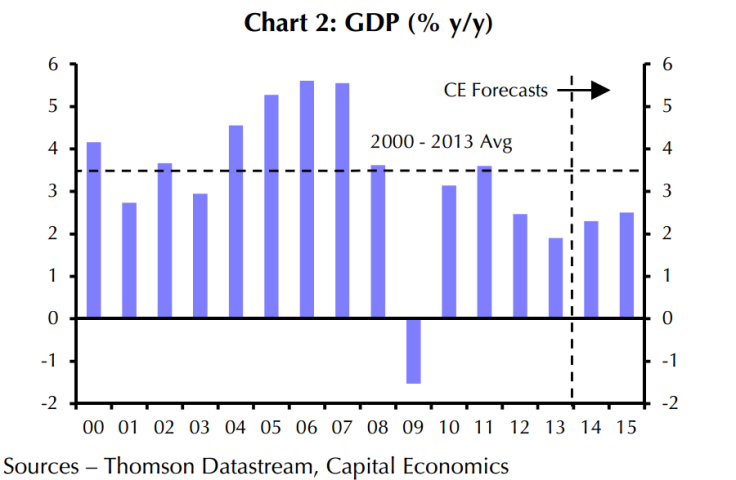

He also expects slow income and credit growth over the next year, which will mean tighter monetary policies. Shah predicts full-year GDP growth of 2.3 percent this year, though adding that the current bad quarter puts estimates on the downside.

“In all, although growth is likely to pick up in Q2, there is little hope for a sharp turnaround in the economy,” he wrote.

© Copyright IBTimes 2024. All rights reserved.