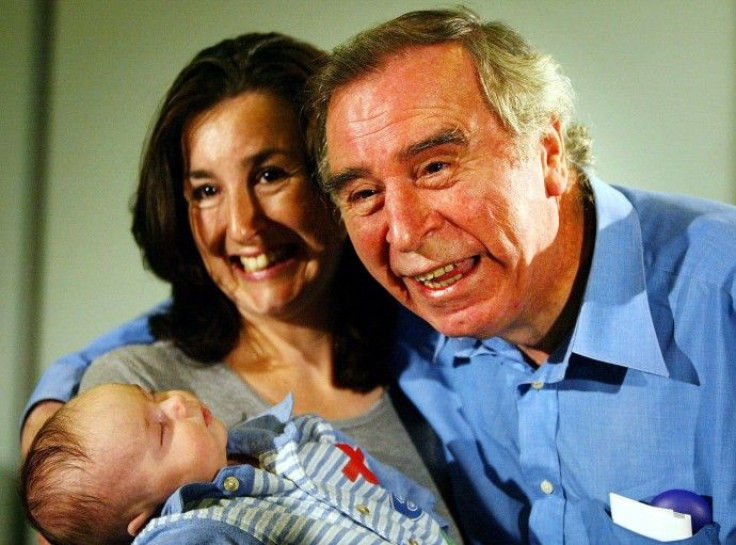

Spare thy love for grandchildren

Grandparents in the UK are providing more than 6,000 pounds ($9,350) of financial support to grandchildren as parents begin to feel the pinch of government cuts, according to a new study by M&S Money.

On average, grandparents gift 6,165 pounds ($9,600) in either money or presents over the first 18 years of each of their grandchild’s life, the study showed.

Children born after January 1, 2011, will no longer get a 250 pounds ($389) Child Trust Fund voucher from the government, and some families will also be hit by the plans to cut higher rate taxpayers' child benefit from April 2012.

Despite these losses, research by M&S Money, a financial services division of London-based retailer Marks & Spencer Group Plc, reveals that grandparents actually contribute more than the outgoing Child Trust Fund voucher spending around 315 pounds ($490) on each grandchild in their first year itself. Subsequently on average, they also spend 257 pounds ($400) on additional items and 68 pounds ($105) on birthday and Christmas presents.

The study showed more than one in five grandparents, or about 22 percent, spends over 50 pounds ($77) on Christmas presents for each grandchild and 11 percent spend more than 50 pounds on each birthday gift.

About 20 percent of the grandparents actually spend more on their grandchildren than they did on their own children despite the recent squeeze on pensioner income, the study showed.

When it comes to financial gifts, 28 percent of grandparents said they give their grandchildren savings for use when they are older. A further one in ten (10 percent) gives their grandchild regular pocket money. Older grandparents are also more likely to give money than an actual gift. Over half (58 percent) of 71-75 year olds said they preferred giving money so their grandchild could buy what he or she wanted compared to only 22 percent of 50-55 year olds.

“With planned benefit cuts likely to affect families across the UK, it is reassuring to see additional support being provided by doting grandparents. Whether this is in the form of gifts or money, grandparents are proving a significant boost to family finances. Although giving an actual present is more popular than giving money, grandparents may want to consider what is likely to be most valuable over the long term,” said Colin Kersley, chief executive of M&S Money.

Unsurprisingly, grandparents with fewer grandchildren are able to be more generous when it comes to both Christmas and birthday gifts. Those with only one grandchild spend 38 pounds ($59) on average on birthday gifts whereas those with 4 or 5 grandchildren spend 29 pounds ($45) per grandchild. At Christmas, those with only one grandchild spend 11 pounds ($17) more per grandchild than those with 5 grandchildren (48 pounds [$74] compared to 37 pounds [$57]).

“Therefore money put into savings when a grandchild is born and then topped up over the course of their childhood would provide a welcome nest egg as they reach adulthood,” the study said.

The Opinion Matters Research was undertaken between November 18 and November 30, 2010 among 1,152 adults aged 50 years and 80 years.

Recent research by M&S Money showed that the average cost of training for one of the top ten most popular careers is a whooping 24,686 pounds ($38,416) for boys and 31,049 pounds ($48,318) for girls.

All training costs are actual fees and cost of accommodation rather than the cost of living while studying. Average University degree costs have been used.

© Copyright IBTimes 2024. All rights reserved.