Square IPO A 'Bellwether' For Market’s Mood On Startups

UPDATE: 7:58 p.m. EST

Shares of Square priced at $9 Wednesday night, well below the target range of $11 to $13.

Original Story:

Another unicorn is leaving its Silicon Valley stable for the pastures of Wall Street. Payments company Square is set to announce its initial public offering price late Wednesday, a highly anticipated coming-out that's expected to value the company at more than $4 billion. The IPO is likely to send ripples through the startup market.

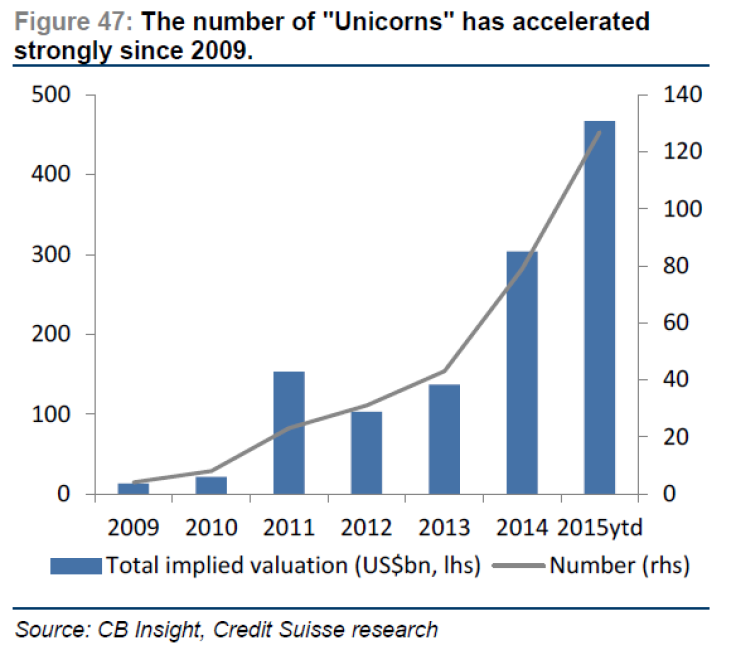

With more than 140 private companies valued at $1 billion or more -- also known as unicorns -- investors in the startup world have grown increasingly edgy. Leading venture capitalists like Bill Gurley and Mark Cuban have openly discussed a resurgent tech bubble as an unprecedented profusion of startups have delayed IPOs to rack up multibillion-dollar private valuations.

Amid the growing trepidation, Square’s IPO could prove an inflection point in a unicorn market valued at a combined $507 billion, according to CB Insights.

“This is going to be a bellwether,” Kathleen Smith, principal of Renaissance Capital, which manages IPO-focused exchange-traded funds, said. “Public markets are very valuation sensitive, but the private market is not. There is a disconnect.”

Some of the highest-profile tech companies that went public in the past year have stumbled out of the gate. After settling on an IPO price above its expected range, data storage company Box saw its shares fall more than 40 percent this year. Peer-to-peer loan provider Lending Club is trading 17 percent below its December 2014 IPO price of $15.

Meanwhile pre-IPO companies are feeling the squeeze, as valuations soar and companies put off going public. Mutual funds that have moved into the private startup space have issued a series of markdowns in recent months. In one of the toughest corrections, photo- and video-sharing app Snapchat got hit with a 25 percent markdown from mutual fund investor Fidelity.

Square co-founder and CEO Jack Dorsey, who also launched Twitter and currently serves as a chief executive there, has attempted to assure investors that Square has a big future.

But market appetite is fickle. According to Smith, companies that have gone public in the fourth quarter have traded at an average of 25 percent below the midpoint of their price range. “The market asked for a discount and they got a discount,” Smith said.

Square's IPO comes during a relative drought in public offerings. In the first 10 months of 2015, just 14 percent of IPOs were tech companies, the lowest share for the technology sector in two decades. And a survey released this week by advisory firm Fenwick & West showed some signs of slowdown in the startup pipeline. The median price increase for venture capital financings in the third quarter was 51 percent, compared to 74 percent in the second quarter.

The steroid era of startups is over.

— Keith Rabois (@rabois) November 6, 2015"You can’t delay an IPO forever," said Matthew Wong, a research analyst at CB Insights. "[Early] investors will eventually seek a return."

Square investors got a taste of the chill felt by startups going public earlier this month when the company announced a price range between $11 and $13 a share. The price implied a valuation of up to $4.2 billion, a discount of 30 percent from previous private valuations. According to Reuters, one-third of American tech companies that went public in 2015 also did so at a bargain.

At the news of the valuation markdown, Square’s former chief operating officer Keith Rabois tweeted, “The steroid era of startups is over.”

But Square’s valuation could still be a steep price for a company that has yet to post a net profit. Square lost $154 million in 2014 and $132 million in the first nine months of this year.

And the company’s market of payment processing entails a number of unknowns. “Besides not making money, it’s also serving small businesses,” said Smith. “There’s a lot of moving parts with Square.”

But Square's revenue has skyrocketed since its 2009 founding, growing from $203 million in 2012 to $850 million in 2014, according to securities filings. The compact card reader that established Square among small business owners has become just one facet in a technology company that has branched into lending and data services.

Wong noted that Square's IPO could bring other financial tech companies to the public markets. With 18 financial tech startups valued at $1 billion or more, Wong said, "it will be interesting to see whether it accelerates some of these very valuable companies on the payment side start to think about public offerings."

But the wider private capital markets will still be watching the stock’s performance in the weeks and months to come, when venture investors are finally able to unlock their shares and see a profit.

“The market doesn’t work if IPO investors don’t make money,” said Smith.

© Copyright IBTimes 2024. All rights reserved.