Steel Overcapacity: US, 7 Other Countries Call For Production Curbs

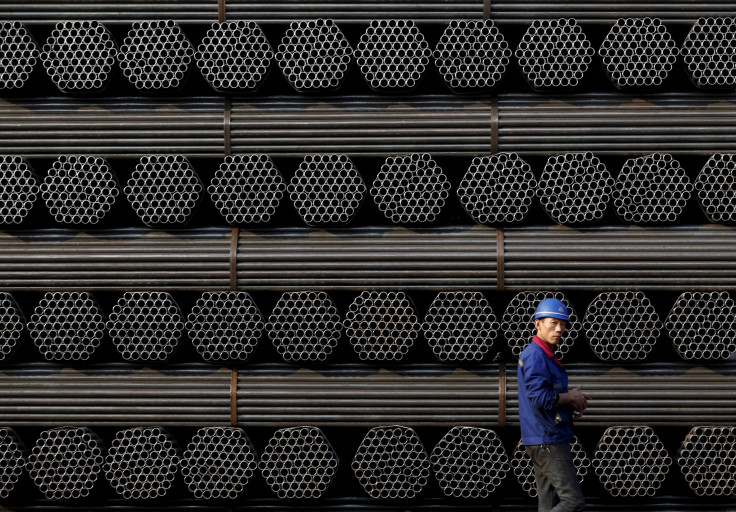

A prolonged global oversupply of steel has caused a crisis for the industry, rendering some previously large manufacturing operations unviable, such as Tata Steel’s decision to shutter its loss-making U.K. business that threatens about 15,000 jobs in the European nation. Much of the oversupply globally is being blamed on China, which is facing accusations of dumping its steel in other markets at prices lower than its manufacturing cost.

After a meeting Monday in Brussels between trade representatives from over 30 countries, eight attendees — Canada, the European Union, Japan, Mexico, South Korea, Switzerland, Turkey and the United States — issued a joint statement Tuesday that said “government support measures have contributed to significant excess capacity, unfair trade, and distortions in steel trade flows.”

The representatives at the meeting also agreed that restructuring of the steel industry was needed, and that it “should be market-driven, with production and trade flows reflecting the market-based competitive positions of steel producers (i.e. absent the effects of government measures that distort markets).”

The meeting did not conclude with a firm course of action to lift the industry out of its doldrums. While the joint statement did not name any country or its government for the overcapacity crippling the industry, U.S. officials blamed China specifically for the failure of the talks, and asked Beijing to cut overproduction or possibly face trade action from other countries.

U.S. Secretary of Commerce Penny Pritzker and U.S. Trade Representative Michael Froman issued a statement that said: “It is our shared goal that other economies, including China, will come to recognize the value of these actions and will join our collective effort to address the causes of the current excess capacity problem. The United States will continue to engage bilaterally and multilaterally with trading partners, including China, to take meaningful action to meet that goal.”

Chinese officials reacted by saying the country was already putting measures in place to curb capacity, for which the government was paying a huge price, and also blamed a slowdown in the global economy for the industry’s woes, Reuters reported.

“It is the slow recovery of the world economy that causes sluggish demand for steel products, which further leads to the overcapacity issue in the steel sector,” Zhang Ji, assistant minister at China’s Ministry of Commerce, told state-run Xinhua News Agency on Tuesday.

China is the world’s largest steel producer and exporter, accounting for about half the global production. It is also the world’s fifth-largest importer of steel. Domestic prices of the commodity recovered last month from a steep slump, prompting steel mills which had shut or suspended operations to resume production. The price recovery in China also had an effect on other regional players, such as Tokyo Steel Manufacturing Co. Ltd., which increased its main product prices earlier this week after a gap of over two years.

Chinese steel has been surrounded by controversy on many instances in the recent past. Last week, thousands of steel workers in Germany reportedly protested against dumping of steel from China. In March, the U.S. imposed a 266 percent tax on Chinese steel imports, citing unfair government subsidies. Last year, the EU reportedly imposed anti-dumping duties on some steel imports from China for six months.

© Copyright IBTimes 2024. All rights reserved.