Student Loan Servicing Failures: Obama Administration Explores Regulations To Protect Borrowers

Lorie White works for a nonprofit in New York state that helps families in poverty. Last winter, however, she had her own financial troubles. With $76,000 in debt from obtaining a bachelor's degree and a master's in art therapy, she says an income-based repayment plan had been helping her manage a monthly budget. But last winter, she saw that nearly $800 was debited from her account instead of the usual $30.

She says she didn't know she needed to prove to her loan servicer that she still qualified for an affordable, income-based payment. And while she was eventually able to clear up the issue, she was stuck with about $200 in overdraft fees from her bank account.

White, 47, and her husband don't have anything put away for retirement, and they “still get by month to month," she says. "We don’t have emergency savings.”

White is not alone. A Department of Education analysis of borrowers in the government's Direct Loan Program "indicated that 57 percent of borrowers did not have a timely recertification of income processed" -- one of the many problems borrowers say they encounter with student loan servicing highlighted in a new report from the Consumer Financial Protection Bureau (CFPB).

Now the Obama administration is considering creating new rules for the student loan servicing industry, a sector it says is plagued by a widespread failure to help borrowers stay in good financial standing.

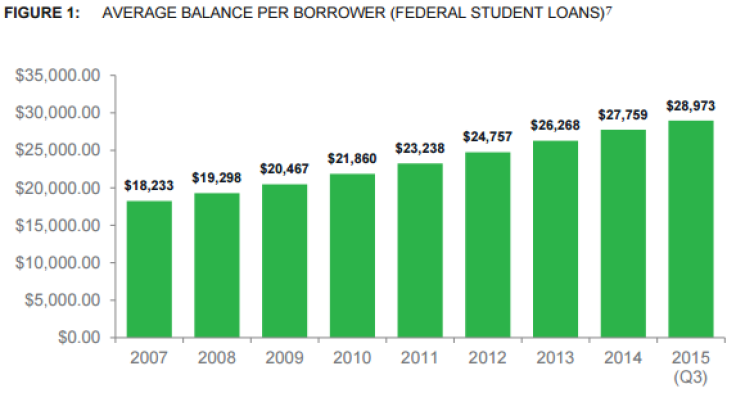

At $1.2 trillion, outstanding student loan balances make up the second-largest source of U.S. consumer debt, after mortgages. The volume of those loans has more than doubled since 2006, and approximately 8 million borrowers are in default. Among 41 million borrowers nationwide, the CFPB estimates that one in four borrowers is either in default or delinquent on payments.

As student loan servicers earn the ire of borrowers, consumer advocates and lawmakers, loan servicing reform has emerged as a White House priority in an attempt to address borrower default. The CFPB Tuesday released an analysis of 30,000 public comments on student loan servicing problems, which comes in advance of student loan servicing recommendations due to the White House this week from CFPB, Education Department and Treasury Department officials.

The companies that contract with the federal government to service the bulk of U.S. student debt are an important lifeline for borrowers. In theory, they are a prime source of information about the options available to borrowers -- options that can include deferring those payments, for example, or selecting a plan that pegs monthly payments to a borrower's income, and could be more affordable. Yet these contractors, along with the Education Department, which oversees them, have attracted a steady stream of criticism for the companies' performance.

“Federal agencies have entered into numerous recent enforcement actions from payment allocation problems and billing errors, to mistreatment of service members, to illegal collections practices,” Treasury Department Deputy Secretary Sarah Bloom Raskin said in a speech Monday. “Repairing this system before it does further harm to borrowers is a must.”

This month, a report by the Government Accountability Office found that the Education Department fails to consistently notify borrowers about income-based payment options, and as a result, many borrowers could be missing a chance to avoid default. The report also noted the results of a recent Treasury Department study estimating that 70 percent of borrowers in default met requirements to participate in income-based plans.

"There's a growing body of evidence that borrowers could avoid default by enrolling in income-based repayment plans, but because of bad servicing, they're not getting the opportunity to enroll," Maura Dundon, senior policy counsel at the Center for Responsible Lending, says. "These are private companies who are making money off student loans but who aren't making borrower's lives better; they're making them worse."

President Barack Obama requested $855.2 million for student loan servicing in this year's budget, including $842.8 million for operations and maintenance of student loan servicers on contract.

In May, the CFPB launched an inquiry into student loan servicing and solicited comments from the public. Respondents described to the agency servicing problems that included difficulties accessing the income-based repayment options and troubles with trying to resolve errors on their accounts, as well as increased interest and late fees.

Kristin Whitaker recalls a period last year when her servicer said she had to pay more than $30,000 in a span of three months. It was a mistake, but it took months of emailing to resolve the error.

A single mother who lives in McKinney, Texas, Whitaker had spent years trying to get back on her feet, and was finally at a point where she found her payments to be manageable. But when she discovered the mistake, "I was really upset and really frustrated, and I didn’t know what was going to happen," she says. "It was a daily stress for me.”

She believes anyone looking at her credit report at that time would not have extended her a loan based on the mistaken information that appeared about her student loan payments. “To me, the loan servicers for student loans are not there for customer service," Whitaker says. "They’re there as collectors.”

As a legal aid attorney in Milwaukee, Karen Bauer says that for many of her clients dealing with student debt, "the misinformation they receive at the hands of their loan servicer, at the very least it worsens the problems they’re having, and in some cases, I think, causes the problem they came to me with.”

Sometimes, she says, clients who have tried calling their servicer are told to seek answers elsewhere. “I have had many clients told: 'Just Google it.' And this is the answer to a bunch of different questions,” Bauer says. "The expectation that the caller is supposed to know what they want, and why, and what the consequences are of that action, is ridiculous. We shouldn’t expect that the average borrower knows all the options available to them or what the consequences of using that option will be.”

In a separate statement released Tuesday, officials with the CFPB, Treasury Department and Education Department said borrowers are entitled to consistent and accurate loan servicing, and that student loan servicers should be held accountable.

“Today’s report underscores the need for marketwide student loan servicing reforms to halt harmful practices and boost assistance for distressed borrowers,” CFPB director Richard Cordray stated.

© Copyright IBTimes 2024. All rights reserved.