Takata Shares Surge Amid Report Of KKR Interest In Taking Control Of Troubled Airbag Maker

A day after Japanese airbag maker Takata announced it hired investment bank Lazard for financial restructuring, a report in the Nikkei Asian Review Thursday said U.S. investment fund Kohlberg Kravis Roberts was considering buying a majority stake in the troubled company. The news of KKR’s interest in the company sent Takata shares soaring on the Tokyo Stock Exchange, where they hit the intraday ceiling and closed trade 21.16 percent higher.

KKR wants to take away control of Takata from the founding family that owns about 60 percent of the company’s stock, according to the Nikkei report.

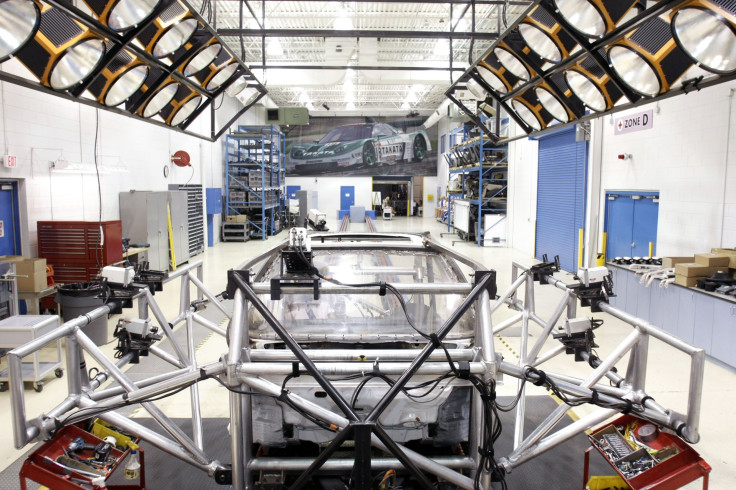

The Japanese company has been at the center of the largest automotive safety recall in history, linked to its airbags installed in millions of cars across the world. The car parts manufacturer is dealing with at least 100 million recalls worldwide, about 85 million of them in the U.S., which are likely to cost the company billions of dollars.

Takata may also face additional costs to settle lawsuits, such as those filed by the state of Hawaii, over its faulty airbags. Lazard has been given the mandate to find fresh investment for the company.

Takata’s troubles are linked to its airbags that can deploy with too much force, exploding and spraying shrapnel inside cars. There have already been 13 deaths due to the faulty airbags, 10 of them in the United States. Its biggest customers, Honda and Toyota, also have been hit by costs linked to the recalls.

The company posted an annual loss of 13.1 billion yen ($120 million) for the financial year ended March 2016. Takata shares have fallen over 66 percent in the last 12 months, and more than 43 percent since the beginning of 2016, even after taking into account Thursday’s surge.

© Copyright IBTimes 2024. All rights reserved.