Technicals see USD/BRL up at 1.6926 on dollar's strength; cbank, data awaited

Brazil's real that fell off 7-week highs against a broadly strong US dollar on Tuesday is facing a key inflation report and central bank rate decision on Wednesday, even as the greenback continued to rise elsewhere.

USD/BRL ended at 1.6815 on Tuesday, off an intra-day high of 1.667 and from its previous close of 1.6744. At the day's high, the local currency was its strongest since October 18. The central bank is believed to have bought dollars twice on Tuesday.

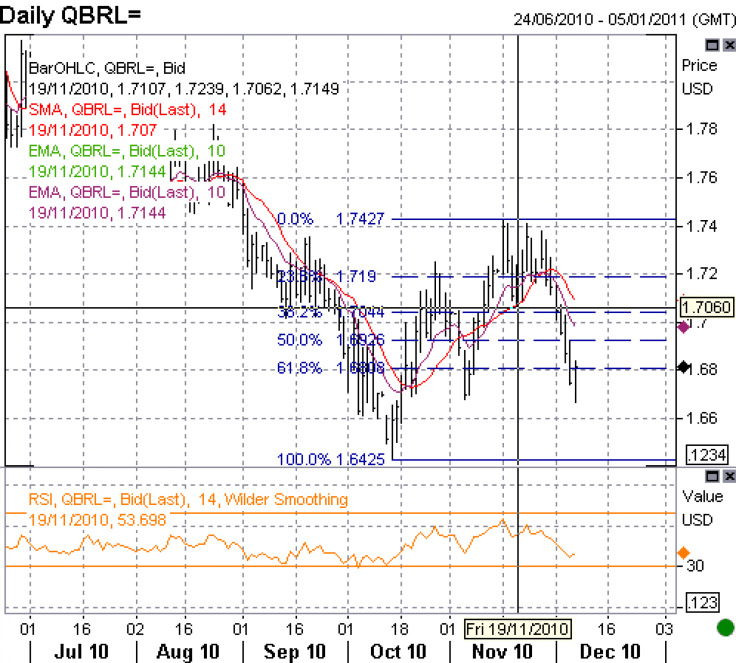

The pair is now testing resistance at 61.8 percent Fibonacci retracement from mid-October low of 1.6428 to mid-November high of 1.7423.

If the real further lose ground in Wednesday's American session, USD/BRL may rise to 1.6926, its nearest resistance as suggested by the 50 percent Fibonacci.

Above that, USD/BRL may rise to 1.7062, a key medium-term support-turned resistance for the pair. Momentum indicator RSI suggests the pair is in over-sold zone.

BCB's president-nominee Alexandre Tominee told Tuesday that he has to ensure a stable purchasing power of the currency. The bank's commitment to keep the currency volatility on check also suggests the market's likelihood to be bullish for the pair at the slightest of real-negative.

The central bank is expected to hold the key rate steady at 10.75 for a third straight review this time but the inflation is expected to rise from its previous level.

The central bank had raised bank's cash reserve requirements last week but many analysts share a view that it was not sufficient to cool rising inflation.

At the same time, the US dollar remained firm against most major counterparts on Wednesday, as people viewed a tax-cut extension as growth-supportive while continued fears of Europe's ability to get out of the debt trap added to the sentiment.

The USD index that tracks the dollar's performance against six major units was at 80.08 as of 10:55 GMT, from its previous close of 79.86, and moving further away from a 10-day low of 79.063 hit last Friday.

© Copyright IBTimes 2024. All rights reserved.