Teen Retailers Struggling To Be Cool On Sinking Profits

Wearing T-shirts with “AERO” or eagle logos emblazoned prominently across the front used to be cool among American teens trying to blend in with their peers. Not anymore.

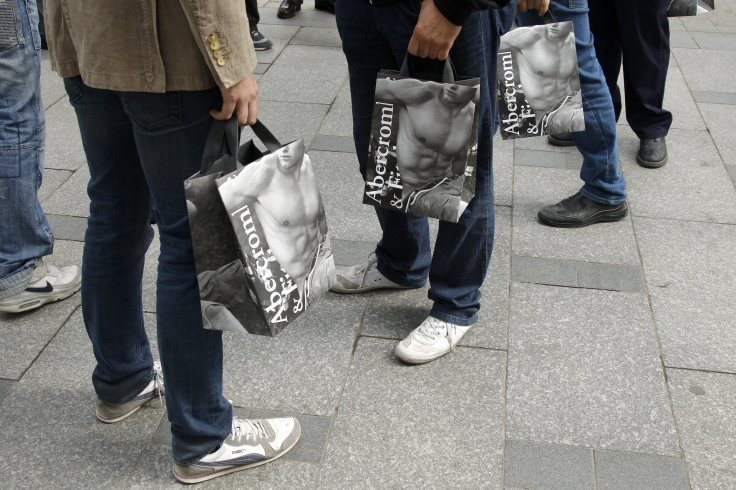

Brands like Aeropostale (NYSE:ARO), American Eagle (NYSE:AEO), Abercrombie (NYSE:ANF) and its offshoot Hollister are known for classic, preppy styles like collared polos and denim mini-skirts. But they’ve been losing shoppers in recent years to trendier retailers like Forever 21 and H&M, stores that move merchandise through much quicker and sell cheaper, funkier looks that individualize the wearer.

Last week, Aero reported a nearly $64 million profit loss in the second quarter compared to the first, nearly twice as much as last year, while American Eagle reported a nearly $20 million loss in profit, a 70 percent decline over the same period a year ago. Abercrombie will announce second-quarter earnings Thursday.

Analysts polled by Reuters predict profit will fall about 40 percent from $11.4 million to $8.1 million over the May-to-July period, compared to the year-earlier period. Earnings per share are expected to come in at 11 cents per share on revenue of $909 million, compared to 14 cents per share on $946 million in the year-earlier period.

Since 2012, Abercrombie’s sales have declined by about 25 percent, according to research from the bank Oppenheimer & Co. Inc. (NYSE:OPY). Its offshoot brand Hollister, featuring lower price points and trendier styles, has seen sales fall 17 percent over the same period.

But analysts are optimistic that Abercrombie is making a comeback, leading the “triple A” brands back into competition.

“They’re probably in the best position because they have the strongest brand, a global brand, a lot of opportunity to explore there, and a two-brand [approach] that lets them differentiate,” said Susan Anderson, retail analyst for FBR Capital Markets.

The company is undergoing an extensive, $175 million cost-cutting program that began last year and kicked into high gear this year. Abercrombie plans to close 60 to 70 underperforming stores this year, after closing about 50 last year, and is upping its presence on Facebook, Twitter and Instagram, where customers hang out.

Boarding up stores and laying off cashiers seems to be working so far, in line with Abercrombie's aggressive strategy to increase online sales. Last quarter, its online sales rose by 27 percent compared to the year-earlier period.

Abercrombie is also selling fewer items featuring its logo, introducing more trends into its fashion, and slashing prices a bit, especially for its Hollister brand, taking it back to its California surfer style roots.

“Their fashion is becoming more mixed, improving. Their logo investment is down dramatically,” said Anna Andreeva, specialty retail analyst for Oppenheimer. “And their sales are declining less.”

Even the stores themselves look and feel different. Many locations have softened the clublike music and taken away shutters and curtains from the storefront that gave an air of mystery and exclusivity.

This back-to-school shopping season will test whether or not Abercrombie and its fellow “A” brands have what it takes to win back their customer bases.

“The brands are real and fixable, but [they] have been mismanaged recently,” Andreeva said.

© Copyright IBTimes 2024. All rights reserved.