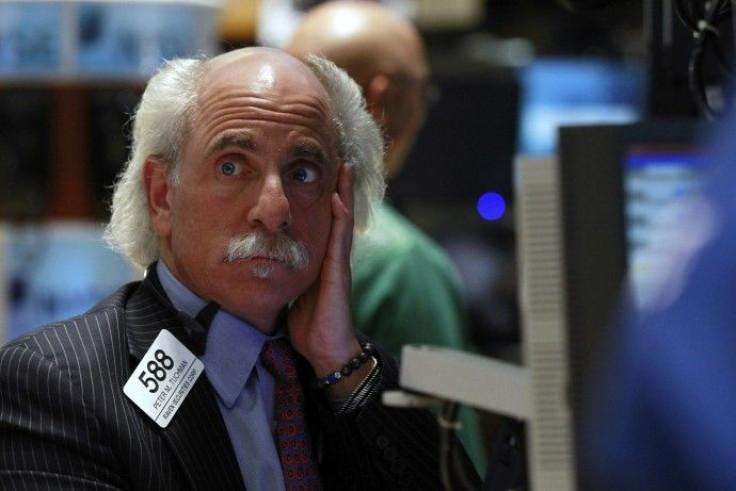

Three reasons to be bearish on the stock market

Recently, investors have been wildly bullish on the U.S. stock market.

The latest Investors Intelligence Survey is at 2.78. The previous reading came in at 2.85, the highest level since late 2007.

The latest American Association of Individual Investors sentiment survey is 51.6 percent bullish. The previous one was 63.3 percent, the highest level since 2004.

On CNBC and Bloomberg TV, commentators are tripping over each other to be more bullish than the next.

Analysts are bullish for a variety of reasons. Some cite the combination of continued monetary stimulus (Federal Reserve's quantitative easing) and fiscal stimulus (Obama's tax compromise with the Republicans). Others point to strong corporate earnings and a slew of better-than-expected recent economic reports that perhaps point to an incipient self-sustaining private sector recovery.

Whatever their reasons, market participants seem almost universally bullish.

However, the herding of investors to extremes is a decent contrarian indicator, meaning it often (but not always) signals a market reversal.

For example, back in March 2009, sentiment was extremely bearish and the stock market went on to rally ferociously. Similarly, sentiment was extremely bullish in late 2007 before the market crashed in 2008.

The current bullishness, therefore, could signal a reversal of the U.S. stock market rally.

Indeed, fundamentally speaking, there are three major reasons to question the universal bullish forecast.

1. Limited U.S. economic growth

The U.S. economic recovery is weak and not self-sustaining. One key missing element is consumer spending, which is constrained by the poor jobs market. A related issue is the still-troubled housing market.

Consumers are still stuck with severely damaged balance sheets because of underwater mortgages. This problem hasn't gone away in 2011 and rising stock market prices are not nearly enough to offset it because, for one reason, only a small percentage of consumers with underwater mortgages have stock market portfolios that rival the size of their mortgages.

In addition, the poor fiscal health of state and municipal governments could become a greater problem in 2011.

Most agree that the U.S. economy is dependent on government stimulus measures; it hasn't proven its ability to stand alone. For example, the whole economy slowed in the middle of 2010 as fiscal stimulus measures faded and the housing market tanked after the expiration of homebuyer tax credits.

While fundamental factors that prevent a self-sustaining recovery persist in 2011, bulls retort that the economy will be supported by fiscal stimulus in the form of Obama's tax compromise and monetary stimulus in the form of the Federal Reserve's quantitative easing.

However, quantitative easing, which is intended to push longer-term interest rates down, could be interpreted as having failed because they are actually rising.

Some argue that rates are rising because of the improved outlook for the economy; however, it's also possible that rising yields actually betray the market's wariness over the government's practice of debt monetization and its perceived inability to reduce the budget deficit. If interest rates are indeed rising for the latter reasons, they actually become a headwind against the real economy.

As for Obama's fiscal stimulus plan, the bulk of it is keeping in place existing policies that are set to expire, so it offers less additional support for the economy than one might think. Moreover, fiscal stimulus adds to budget deficit concerns.

2. The European debt crisis

The European Union's combined economy is actually larger than that of the United States. U.S. financial institutions are also interconnected with their European peers and their balance sheets are exposed to European sovereign debt.

The European debt crisis is therefore a serious matter for U.S. stocks and the underlying causes for this issue hasn't gone away. Moreover, the chances of a favorable resolution aren't good.

In response to the crisis, European leaders have imposed austerity measures on certain countries, which solves the problem of government overspending but does not address other key issues.

Uncompetitive euro zone countries are still stuck using a euro currency that's overvalued. This renders them unable to compete with countries that can provide goods and services more cheaply. In addition, austerity measures will hurt economic growth.

These two tailwinds to the economy will decrease government tax revenues and therefore exacerbate sovereign debt worries.

If the euro zone had a common government bond, these problems would not exist or be much less damaging. Even if Germany, the leading euro zone member, were more cooperative, addressing and solving these problems would be more feasible.

However, the German political climate is very much against bailing out peripheral Europe -- and more so against fiscally joining Germany with those countries -- so a very nasty outcome to this debacle is quite possible.

Greek and Irish sovereign debt woes sparked retreats in global risk assets. A similar problem in Spain or France, if not handled properly, could cause a global financial panic.

3. China's tread mill to hell

China has been dubbed the 'growth engine of the world.' This is especially apparent among certain commodity markets in which China accounts for the bulk of increase in demand and a large portion of the total demand.

Most economists are singing praises of the Chinese economy and point to it as a model of success in the post-financial crisis world.

These economists, however, may have grossly misjudged China, whose economic model is driven by factors like central planning and mercantilism and is therefore unfamiliar to the West.

So while the Chinese economy could be fine, it could also be on a tread mill to hell, using the words of Jim Chanos, a famous short-seller who has set his sights on China.

Chanos claims that real estate construction accounts for 60 percent of GDP. Much of this construction isn't done to meet real demand and thus results in empty offices and residential buildings.

Needless to say, constructing buildings no one will use is not profitable. Chanos also claims that many Chinese companies are in fact unprofitable or have razor-thin margins.

If China is indeed just a huge unprofitable (or barely profitable) machine that's churning at a furious rate, it is unsustainable and bound to crash.

In 2009, the Chinese government rolled out a stimulus package that was (relative to the size of its economy) four times larger than the U.S. stimulus package. Some claim that most of the funds went to builders and exporters, precisely the two industries that are allegedly unprofitable or just barely profitable.

If this is true, it serves as evidence to support Chanos' theory.

China also faces surging food inflation, which may cause civil unrest among millions of poor people. This could prompt the government to aggressively tighten monetary policy and thus significantly slow down economic growth.

Conclusion

The largest economies in the world face serious risks. In particular, genuine consumer demand, the ultimate driver of the private economy, is lacking.

For corporations, revenue growth may be capped because of this. As for costs, they have already been cut dramatically and can't be reduced much further. Also, rising commodity prices could put pressure on margins. Therefore, the earnings and price appreciation of U.S. stocks may be limited.

One tailwind of the stock market that doesn't face too much risk is supportive monetary policy in the U.S.

However, monetary policy alone can only take the stock market so far. Furthermore, emerging market economies are likely to recover faster than the U.S. economy, so a portion of the support from loose monetary policy will benefit foreign financial assets instead of U.S. financial assets.

Moreover, the Federal Reserve can only control short-term interest rates. Longer-term interest rates are determined by the market and there are signs that U.S. government policy may be driving them up for the wrong reasons and to the detriment of the real economy.

Email Hao Li at hao.li@ibtimes.com

© Copyright IBTimes 2024. All rights reserved.