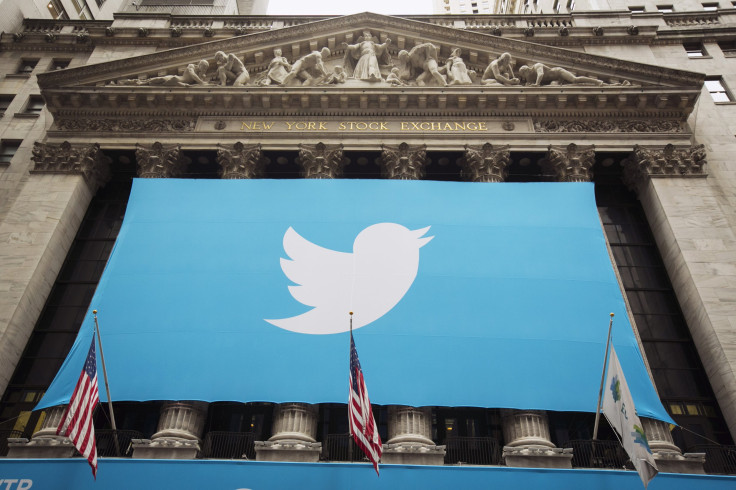

Twitter IPO: Never Before Have So Many Wanted To Pay So Much For Stock To So Few

To paraphrase Sir Winston Churchill's declaration on a much more somber and noble event: Never before have so many wanted to pay so much for stock to so few.

As the market preps for Twitter shares to begin trading later Thursday, Web denizens are preoccupied -- nay, obsessed, like a dog chasing its own tail -- with blasting every detail about the social media phenom out to the interwebs, only to have them quickly bounce back to their own feeds.

We've already learned that Twitter CEO Jack Dorsey's father is awake and tweeting:

GoodMorning

- Tim Dorsey (@Tim535353) November 7, 2013

From the annals of the this-must-be-why-they-make-the-big-bucks stating of the obvious, New York Stock Exchange CEO Duncan Niederauer told CNBC: "It feels to me, listening to the guys on the floor, it trades up a little bit on the opening. That would be my guess." Way to climb out on a limb there, Duncan.

Niederauer said he expects the shares to begin trading about 10:30 or so, after orders and available shares are matched up.

According to that same CNBC report, the Twitter CEO came across as the voice of reason as he admonished prospective investors not to fret about Twitter's inability to turn a profit before offering shares to the public that will make him and others more than well-off. CEO Dick Costolo told CNBC that investors should not be concerned about the company's current lack of profits, because it's part of a plan to invest for the long term.

Here are a few more choice Tweets from #twitteripo...

So the bid ask spread is $40 - $44. The opening trade will cross somewhere in between. $twtr

— John McDuling (@jmcduling) November 7, 2013

Moving higher. Spread now $42 - $46

— John McDuling (@jmcduling) November 7, 2013

16 tweets that made Twitter: http://t.co/igIM7c7qAU #TwitterIPO

— Jonathan Anker (@JonFromHLN) November 7, 2013

Got here just in time!! #twitteripo @nathanblesse @jennylykken @EClaireMiller pic.twitter.com/T2FaA7eYtI

- Melissa Daimler (@mdaimler) November 7, 2013

#TwitterIPO: Should you buy it? Find out in this Q&A w/ @WSJ and Professor Anant Sundaram http://t.co/dogeGCd8oS

— Tuck School (@TuckSchool) November 7, 2013

My TweetDeck columns for #TwitterIPO and #Ring are making me dizzy

— Nicolas Harnois (@nicolasharnois) November 7, 2013

What the #TwitterIPO is worth to some of the bell-ringers: - Ev Williams $1.5 billion - Jack Dorsey $610 million - Dick Costolo $200 million

— Daily Mail US (@DailyMailUS) November 7, 2013

.@Twitter owes success to its users, so gives #NYSEBell to @SirPatrickStew, @VivienneHarr & @Bostonpolice #TwitterIPO pic.twitter.com/fAprlGV8Vs

— (NYX) NYSE Euronext (@NYSEEuronext) November 7, 2013

Come back later for more coverage of the Twitter Circus on IBTimes as the day progresses, and follow us, yes, you guessed it, on TWITTER, at @IBTMoney.

© Copyright IBTimes 2024. All rights reserved.