Twitter: New Hedge Fund Based on Social Network Beats S&P

Derwent Capital has a unique hedge fund based on Twitter, and it beat the S&P index in July.

In its first month, Derwent Capital's hedge fund based on Twitter, the social network famous for tweets, actually outperformed the market, according to a report. The hedge fund uses Twitter to drive its trading strategy, returning 1.85 percent in its first month, according to Financial News.

Derwent Capital apparently finished its first month of trading in the fund at the end of July, beating the S&P, which fell 2.2 percent in July. The hedge fund based on Twitter made 0.76 percent, according to Hedge Fund Research.

The fund uses sentiment data "mined from millions of Twitter messages, or 'tweets', to predict market movements," according to Financial News.

Basing the strategy on research published by the University of Manchester and Indiana University in October, the fund operates on the premise that the number of emotional words used on Twitter can be used to predict daily movement in the stock market.

The news site Financial News reported that Derwent Capital scans a selected 10 percent of available tweets at random and then categorizes those messages into a range of mood states. Apparently, initial research showed that the algorithm predicted movements in liquid stocks at 88 percent accuracy.

Derwent Capital had no comment on the fund's performance, but in an interview with Financial News in March company founder Paul Hawtin said he was "very confident" about the strategy.

"We watch to see how each of the different mood states changes in real time," he said. "The biggest sentiment change is reflected in the market around two to four days later."

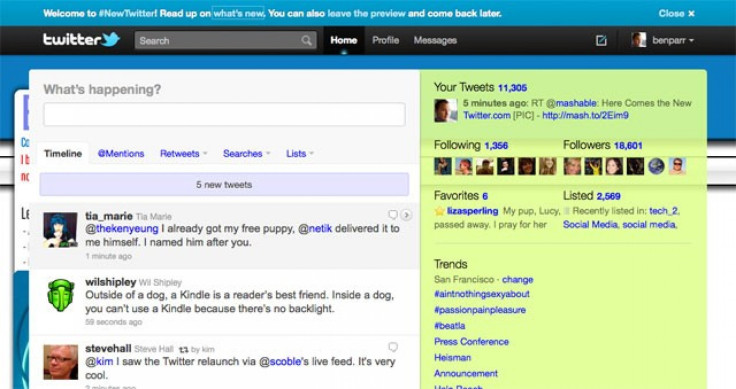

Twitter allows members to tweet messages of up to 140 characters or fewer to other subscribers, or followers. More than 200 million people around the world have used Twitter.

© Copyright IBTimes 2024. All rights reserved.