US Cities Economic Report: America's Economic Recovery Outpaced Most Of The Country's Biggest Cities As They Learned Big Lessons For The Future

While the U.S. economy was slowly rebounding in 2011 after a dip in 2010, many of America’s major cities were still in decline and had yet to recover from the great recession, according to a report released on Tuesday by the Pew Charitable Trust.

"America’s Big Cities in Volatile Times" found that 30 of America’s largest cities hit their revenue bottoms a year after national and state governments did. Each city experienced revenue declines at different times and dealt with them in different ways, including dipping into reserve funds, gaining help from state or federal government, cutting spending, and increasing revenue from tax and nontax sources. Only Washington, D.C., was able to recover at the same pace of the U.S. economy.

One explanation for the slow recovery of U.S. cities is that the slow influx of property taxes from the housing boom years kept the other cities afloat while the rest of the country was flailing under the pressure of the recession. However as the report explains, property tax is often slow to respond to economic swings, and eventually the recession began to catch up with cities in 2010, reflecting the deferred impact of the housing crisis. The effort to quell the recession for most cities was difficult as state and federal governments had their own fiscal problems to deal with.

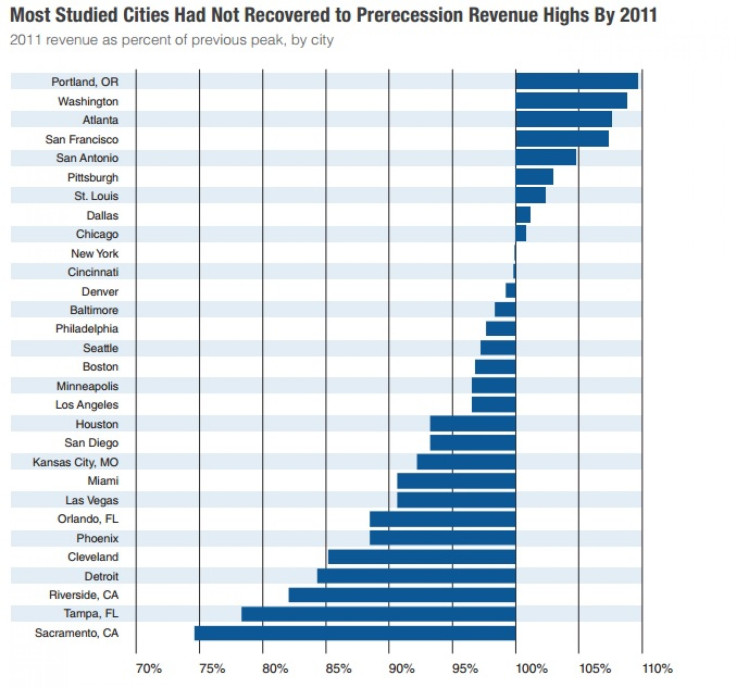

By 2011 two-thirds of the cities has yet to get back to their previous revenue peaks. Those that did recover by 2011 were helped significantly by state and federal aid, not because of growth derived within the city.

Two years after the end of the recession, 21 of the 30 cities had yet to recover their prerecession revenue streams. By 2011, eight of the cities, Boston, Houston, Miami, Minneapolis, Orlando, Phoenix, Sacramento and Tampa, were at their lowest points, showing no signs of recovery, and in some cases, were still in decline.

The report offers no explanation for why Baltimore, Cincinnati, Denver, New York and Philadelphia were near recovery by 2011, and while increases in property tax collections and nontax revenue were consistent factors in revenue growth across each state, it is not necessarily a key factor in their recovery.

Denver, for example, saw an increase in sales tax over 2009 and 2011 that the report claims may have contributed to its speedy recovery. Cincinnati, on the other hand, benefited from a 13 percent increase in intergovernmental aid between 2009 and 2011, resulting in a steady climb back toward peak levels.

The 16 cities that had reached revenue low points or were still in decline in 2011 were the victims of decreased government aid. Thirteen of the cities received aid in 2008 and 2009, but that diminished in 2010 and 2011, and they subsequently saw revenue fall when the city in question could not make up the difference from their own sources.

Nine cities saw revenues surpass prerecession levels. While the report doesn’t say why those cities were able to rebound faster, it hints at effective fiscal policies that saw cuts to public services and job losses, but stops short of saying those were the primary factors. The cities are Atlanta, Chicago, Dallas, Pittsburgh, Portland, San Antonio, San Francisco, St. Louis and Washington, D.C.

Looking ahead, ongoing fiscal constraints at the state and federal levels could further diminish aid to local governments and add to an already shaky fiscal picture. And cities’ unfunded retirement obligations put even more long-term pressure on their finances.

© Copyright IBTimes 2024. All rights reserved.