US Debt Ceiling 2013: The Possibility Of A Sovereign Credit Rating Downgrade

The stock market is getting a little bumpy as the partial shutdown of the U.S. government drags on, but even worse lies ahead if the debt ceiling isn't raised later this month.

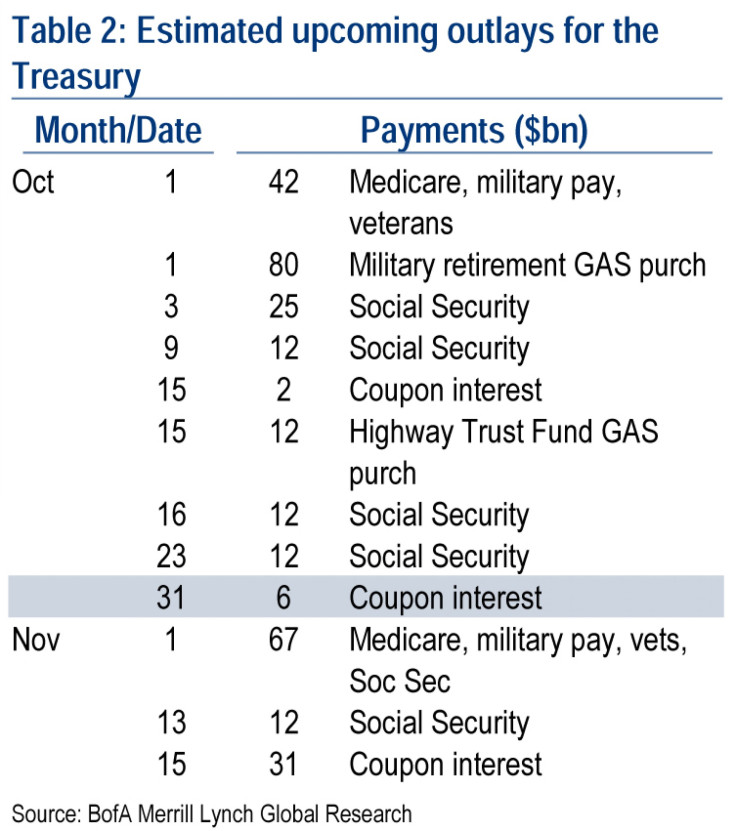

While the shutdown will probably take a small bite out of economic growth, a failure to raise the debt ceiling would not just involve the furloughing of nonessential federal employees. It could also mean that Social Security payments are missed, that government contractors aren't paid and that holders of Treasury notes and bonds won't receive their coupon payments. The Treasury expects to be down to its last $30 billion by Oct. 17.

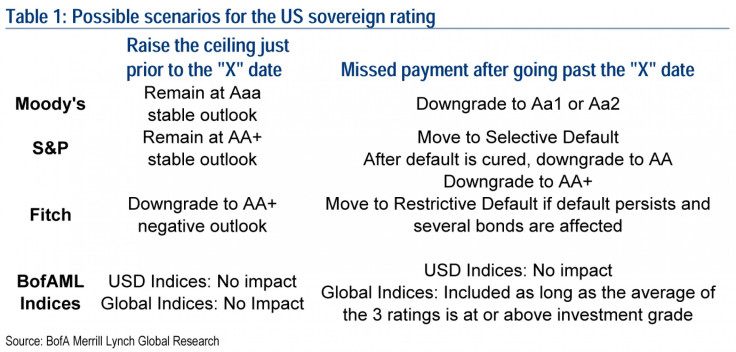

Ralph Axel, interest rates strategist at Bank of America Merrill Lynch, laid out the possible scenarios for the U.S. sovereign rating. The big three rating agencies -- S&P, Moody's and Fitch -- analyze risk and give debt a grade that reflects the borrower's ability to pay the underlying loans and serves as guidance for investors. The safest bets are labeled "AAA."

The most likely outcome is that Congress will increase the debt ceiling before the data is reached. In this scenario, each rating agency may warn of imminent potential rating changes as we near the “X” date, according to Axel. Once the ceiling is raised the likely implications for the ratings are:

Moody’s (Aaa, stable): Moody’s remains at Aaa and maintains their stable outlook. Moody’s puts much less emphasis on political brinkmanship and focuses instead on the fiscal consolidation results that have been achieved.

S&P (AA+, stable): S&P maintains its current outlook and rating. While S&P is much more concerned about the stability and predictability of a sovereign’s government, the agency has already downgraded the U.S. to reflect this.

Fitch (AAA, negative): Another last-minute scenario like 2011 could prompt Fitch to cut the U.S. credit rating by one notch. Fitch explicitly points to the expiration of federal appropriations authority and the debt ceiling as stress points that will help determine a decision on how to resolve a negative outlook by the end of 2013. Fitch warned in June that “failure to raise the federal debt ceiling in a timely manner (i.e. several days prior to when the Treasury will have exhausted extraordinary measures and cash reserves) will prompt a formal review of the U.S. sovereign ratings and likely lead to a downgrade.”

In the unlikely event that the debt ceiling is not raised by the “X” date, the Treasury may be forced to miss a debt payment. According to Axel, the debt payment most at risk may not be until Oct. 31, when the Treasury has to make $6 billion in coupon interest payments.

“Rating agencies do not consider missed payments on non-debt obligations as a default, but missing a debt-related payment is a default,” Axel said, adding that the rating agency actions depend on how many defaults occur and over what time frame.

© Copyright IBTimes 2024. All rights reserved.