US Debt Ceiling 2014: Key Dates On The Debt Limit Battle

It is debt-ceiling time again. On Saturday, suspension on the U.S. borrowing limit will be lifted and the Department of the Treasury will have to begin to employ extraordinary measures to stay under the cap.

Fiscal tensions were defused, but not extinguished, when the U.S. Congress surprised many observers by reaching a modest budget accord in late 2013, preventing another government shutdown. But it did not address the debt limit.

If Congress does not increase the limit in time, borrowed funds will be unavailable to pay bills and the U.S. may be forced to default on its debt obligations, which would be unprecedented and cause panic in the global financial markets.

Here’s what you need to know about the looming debt ceiling battle.

Important Upcoming Dates

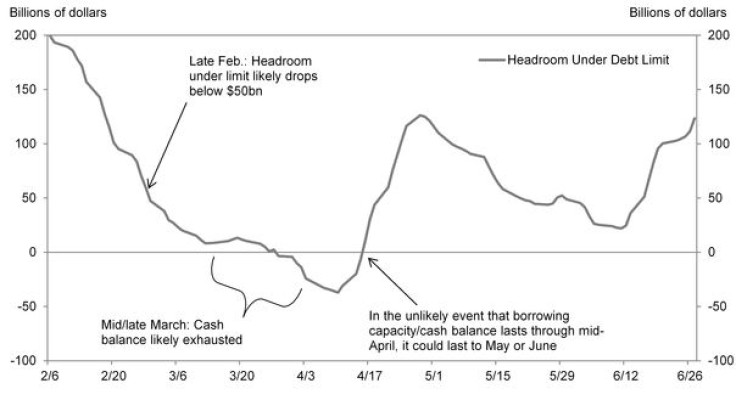

While there is no single key date apart from the deadline itself, there are a number of milestones along the way to the deadline, according to Goldman's Alec Phillips.

Feb. 8: The debt limit is reinstated. In October 2013, as part of the deal that ended the government shutdown, Congress suspended the borrowing limit until Feb. 7, after which it is reinstated at a higher level. In other words, the debt limit will be set to equal to the prior limit ($16.7 trillion) plus the amount of debt incurred during the period the limit was suspended on Feb. 8. According to Phillips’ calculation, this will likely raise the limit to slightly less than $17.3 trillion.

At that point, the Treasury will immediately be forced to rely on bookkeeping strategies known as “extraordinary measures” that it traditionally uses to extend borrowing capacity. This involves swapping Treasury securities held in government employee retirement funds that count toward the debt limit with IOUs that do not (the transactions are reversed, with accrued interest, once the debt limit is raised). Roughly $200 billion in additional headroom can be created this way once the debt limit is reinstated, according to Phillips.

Feb. 13-24: Congressional recess. It would not be unprecedented for Congress to cancel recess in order to deal with such a fiscal deadline. “That said, in the past, seemingly intractable political disputes have often been resolved when they threaten to delay the start of a congressional recess,” Phillips said.

“Late February”: The Treasury's projected debt limit deadline. This is when the Treasury expects that it will no longer be able to operate normally, though it will still have cash on hand plus incoming revenue to make payments. However, the Treasury is bumping up against the debt ceiling in tax-filing season, which means tax refunds will be going out the door faster than tax payments will be coming in, leaving the government with less cash on hand than usual.

Treasury Secretary Jack Lew has informed Congress that it must raise the debt limit by “late February,” if not sooner. “The bottom line is time is short,” Lew said, speaking at the Bipartisan Policy Center on Monday morning.

“We estimate that the Treasury will exhaust extraordinary maneuvers on Feb. 28, the settlement date of the end-of-month coupon auctions,” said Priya Misra, head of U.S. rates strategy at Bank of America Merrill Lynch.

Feb. 28-March. 25: Treasury becomes unable to make scheduled payments. In its latest analysis, the Bipartisan Policy Center projects that the government will reach the point where it can no longer meet all of its obligations sometime between these dates.

Bank of America’s estimate for the exhaustion of the federal government’s cash balance is on the next business date, March 3, and thus the Treasury will not be able to pay the full amount of Social Security and tax refund payments on that date. The first Treasury debt that will be vulnerable to default is the March 6 bills.

Goldman Sachs estimates that without an increase of the debt limit, the Treasury could default as soon as the second week of March, though it might not occur until later in the month.

Are We In For Another Messy Debt Ceiling Debate?

“While we do not expect uncertainty from the debt limit debate to have as negative an effect on public and market sentiment as the debate in October 2013 had, an increase only shortly before the deadline would not be surprising,” Phillips said.

As in the last skirmish, congressional Republicans would want "something" in return for their support for the debt limit increase. The White House and congressional Democrats prefer a "clean" increase with no other policy changes attached and they do not expect to negotiate on potential additions to a debt limit package.

Several House members told The Washington Post on Monday that Republican leaders have narrowed their list of possible debt-limit strategies to two options: trading a one-year extension for approval of the Keystone XL pipeline, or trading a one-year extension for repeal of a provision of the Affordable Care Act. A clean debt-limit extension is not yet on the GOP’s radar, though House Speaker John Boehner, R-Ohio, has said he would avoid default.

Following a meeting of rank-and-file House Republicans Tuesday morning, Boehner told reporters they are aiming for deficit-reduction steps as part of any deal to raise the nation's debt limit but have not decided on a strategy yet.

“Nobody wants to default on our debt. While we are doing this, we ought to do something about jobs and the economy, about the drivers of our debt. We are talking to our members. When we have a decision, we'll let you know,” Boehner said.

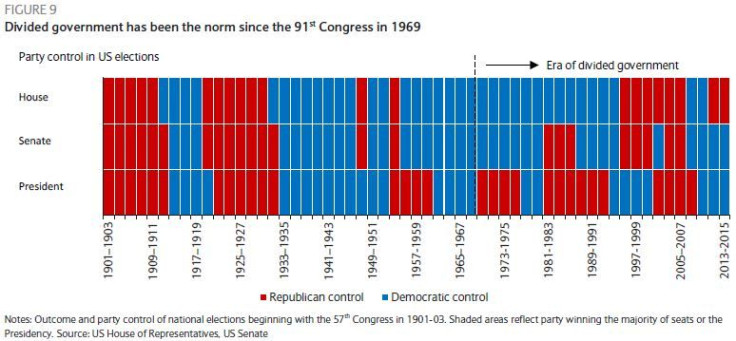

While a divided government would force the parties to negotiate in order to get anything done -- pulling policy toward the center and encouraging reasonableness – it is difficult to be happy with how that played out during last year’s 16-day government shutdown.

“Ironically, it is looking like the government shutdown in October was the best thing to happen in Washington in the last several years. After years of threats, the 16-day disruption in October forced voters and politicians to reveal how they really felt about using the shutdown as a negotiating tactic,” Ethan Harris, chief economist at Bank of America-Merrill Lynch, said.

A CBS News poll during the shutdown found that 72 percent of Americans opposed the shutdown as a negotiating tactic. At the same time, a Gallop poll showed a sharp drop in the favorability ratings of the two parties: the Democratic Party fell from 47 percent to 43 percent, while the Republican Party fell from 38 percent to 28 percent, marking a record low.

With the fall election looming, the message to stop fighting and start getting things done seems to be coming through loud and clear.

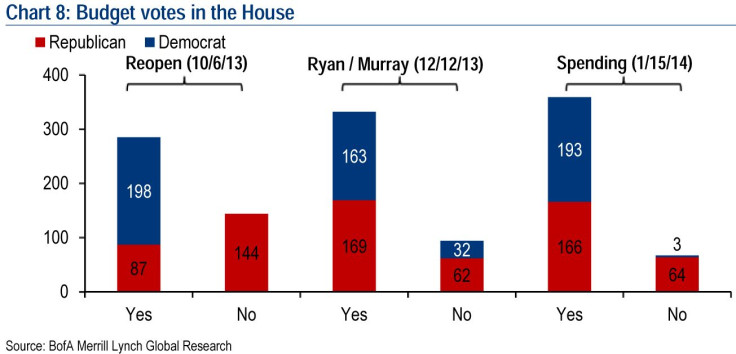

There have been three budget bills in the last several months and each has garnered increasing bipartisan support in the deeply divided House. Senate votes show a similar pattern.

“This is the first time since 2009 that discretionary spending is based on a budget agreement between both chambers,” Harris said. “All of this makes us optimistic about the upcoming debt ceiling battle.”

--

(Note: U.S. Capitol winter scene photo by Shutterstock.com.)

© Copyright IBTimes 2024. All rights reserved.