U.S. Debt Deal Means Fiscal Stimulus Is Out, and Fed?s Q3 May Be In

Analysis

The U.S. debt deal will lead to a smaller federal government, which means less stimulus for an already low-growth U.S. economy, and that, as many Americans might sense, tosses the ball back in to the U.S. Federal Reserve's court, perhaps with a third phase of its quantitative easing program, QE3.

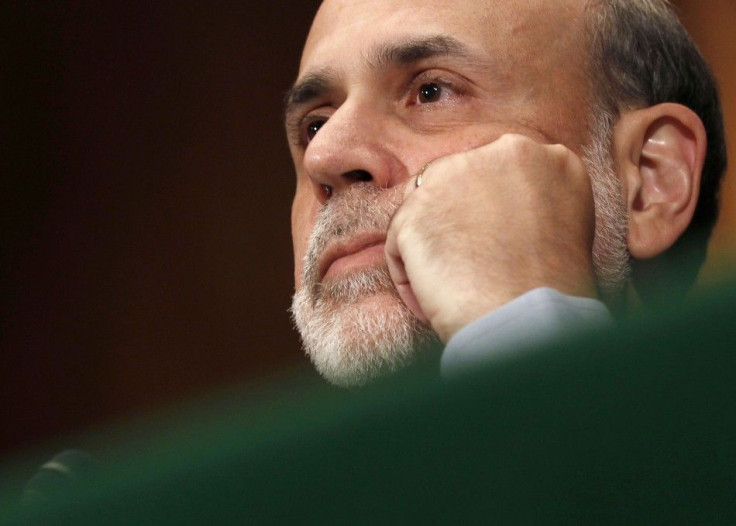

U.S. Federal Reserve Chairman Ben Bernanke, in testimony in July before Congress, underscored that additional, unconventional monetary action is possible, if economic conditions deteriorate further. However, as is the Fedspeak norm, given the importance of a Fed chair's words, Bernanke did not telegraph any clues as to a possible next move by the Fed.

The obvious question is, then: how likely is the Fed to implement QE3?

The three last directors of the Fed's powerful monetary affairs division -- Donald Kohn, Vincent Reinhart, and Brian Madigan -- put the risk of the U.S. economy tipping back into a recession at 20 percent to 40 percent, wsj.com reported Wednesday, wsj.com reported Wednesday.

The Fed ended its QE2 program, which involved buying $600 billion in bonds, in June. The Fed's balance sheet now stands at $2.8 trillion.

Kohn said the Fed should consider a third round of bond purchases only if U.S. inflation slows from recent elevated levels and if the economy continues to underperform.

Overall inflation has edged up but core inflation, which excludes the often-volatile food and energy component, has remained contained. The Personal Consumption Expenditure index -- closely monitored by the Fed -- has risen 2.6 percent in the past 12 months, but the core rate has risen only 1.3 percent -- or is still within the Fed's "comfort zone" for inflation.

Hence, with inflation still not creating havoc for the Fed, it would appear that Bernanke has room to deploy a QE3 quantitative easing program.

Some market participanst, most notable inflation hawks, and other investors, may not like it, but if the U.S. economy continues to slow, one can make a strong economic argument for Bernanke implementing QE3.

What would tip the scales in favor of QE3? Additional deterioration in the U.S. labor market. Unemployment has been at a dangerously elevated rate, currently 9.2 percent, for more than a year. If job growth, already anemic, does not pick up, rise to 150,000 to 200,000 new jobs created per month, Bernanke may feel QE3 is the prudent tack to take: in essence, the handwriting will be on the wall.

The reason: combine low GDP, a sluggish (at best) housing market, a pokey stock market, federal government spending cutbacks, to that aforementioned possible poor job growth and that's a tremendous amount of demand taken out of the system.

Monetary/Economic Analysis: The critics, U.S. Rep. Ron Paul, R-Texas, among them, will start howling about Q3, if it's deployed.

Many of these critics also opposed Bernanke's liquidity intervention that, in coordination with the world's other, major central banks, helped stabilize global financial markets during the 2007-2009 financial crisis, and there's considerable irony in that opposition stance: Bernanke's intervention helped maintain a system that provides the most rewards and benefits to Paul and his followers.

© Copyright IBTimes 2024. All rights reserved.