US Foreclosure Rate Is Declining But Still More Than Double What It Was Before The Financial Crisis [Map]

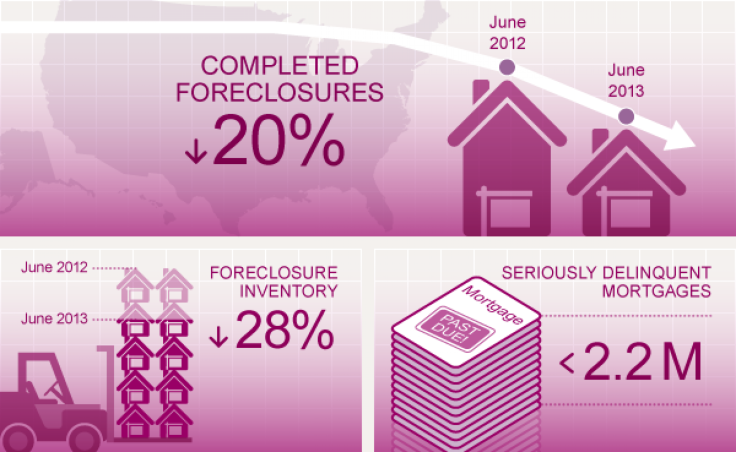

A total of 55,000 foreclosures were completed in June, a 20 percent decline from a year earlier, according to a just-released report from CoreLogic, a financial services and analytics firm.

The number of distressed homes have fallen for 19 consecutive months, as have the number of homes that are seriously delinquent, indicating that the U.S. housing market is well on the road to recovery.

But that 55,000 number is still more than double the national average in 2007 -- just 21,000 foreclosures per month. It might be several years until this particular housing down-cycle ends, Anand Nallathambi, CEO of CoreLogic, said.

However, some states still have a high percentage of homes that are about to be foreclosed on. With 8.6 percent of all homes headed for foreclosure, Florida has the highest percentage of foreclosure inventory in the U.S., followed by New Jersey, New York and Connecticut.

Many Midwestern states are faring much better, with foreclosure inventories below 1 percent.

Check out this map of the foreclosure inventory of each U.S. state. Click on any state for more information:

© Copyright IBTimes 2024. All rights reserved.