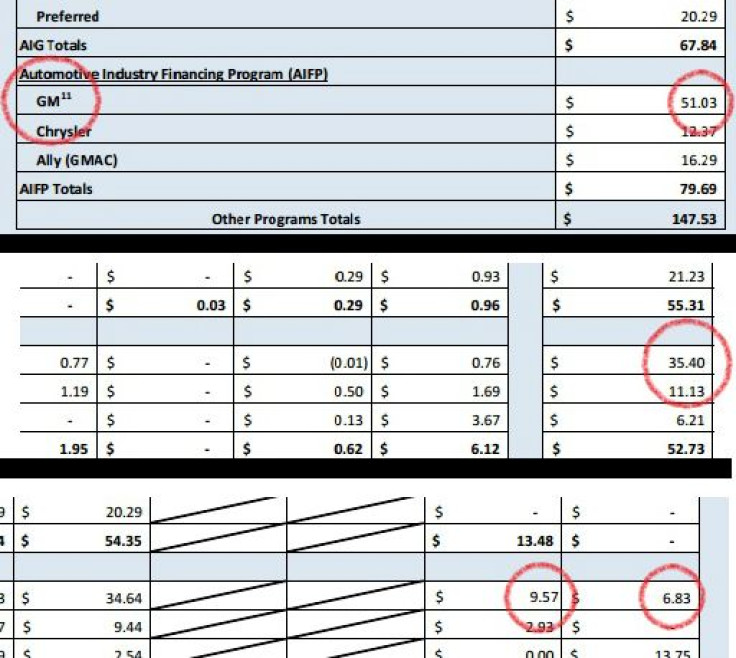

US Govt Expects An Approximately $9.57B Loss For Bailing Out General Motors (GM), Which Still Owes US Taxpayers $15.6B

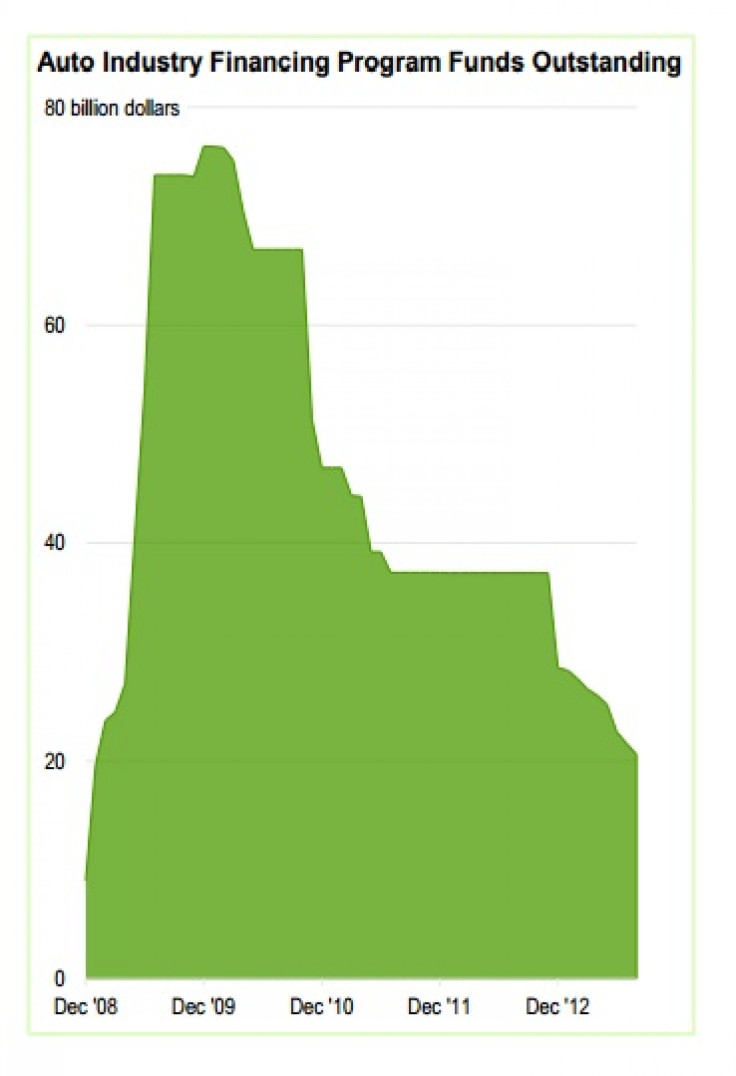

The U.S. Treasury Department may be winding down its ownership of General Motors Company (NYSE:GM), but if it sold all the shares it owns today, it would make back less than one-quarter of the $15.6 billion GM still owes the U.S. taxpayer from the 2009 Troubled Asset Relief Program.

Even if the Treasury continues to sell its remaining 101 million GM shares on price rises, the best the U.S. government can hope for is to recover a little more than the approximately $3.7 billion it would get at Wednesday’s price. The cost basis of the shares the government holds is $43.52. GM was trading at around $37 on Wednesday, near its 52-week high of $37.71.

Since GM went public three years ago, the stock has traded at between $19 and $39 a share. This means the agreed-upon cost basis when the loans were converted into stock was always too high. With more than 80 percent of the government's stock sold off since 2010, GM's stock price has never touched $40 a share and actually plummeted last summer to less than half of that.

The government has cut its ownership of GM from 13.8 percent in June to 7.3 percent as of the latest figure. The U.S. Treasury announced earlier this year that it would fully divest from GM by the first quarter of 2014.

The U.S. taxpayer was paid back for rescuing GM in 2009 by converting loans into common and preferred stock as the company returned to the New York Stock Exchange in 2010. This is why people often say that GM paid back its loans. But it didn’t pay cash; it paid back America with the rough equivalent of stock options.

As far as actual cash is concerned, taxpayers gave GM $51 billion to rescue it in the wake of the subprime mortgage meltdown that sent the auto industry reeling. Since then, American taxpayers have recovered $35.4 billion, a number that reflects the Treasury selling $811 million worth of stock in August.

According to Tuesday's Daily TARP Update (shown above), the U.S. considers $9.57 billion to be a loss and it expects to recover $6.83 billion in the coming months.

Could GM pay that back instead of the government writing off a loss, like it did with Chrysler Group LLC, which ended up costing the taxpayer $1.3 billion?

Not anytime soon.

As of June, GM had about $26 billion in cash and $60 billion in short-term liabilities. It could top $8 billion in profit this year, but that still means the company’s financials aren’t great. The best the U.S. taxpayer can hope for is for GM to figure out a way to pay the difference.

Or GM could just become a company that the U.S. considers too big to fail and deserving of a massive multibillion-dollar subsidy.

© Copyright IBTimes 2024. All rights reserved.