US January Jobs Report, Auto Sales, FOMC Meeting, Q4 GDP: Economic Events For Jan 29- Feb 1

Market participants will have to contend with the busiest economic release calendar in recent memory this week.

The Federal Open Market Committee, the policy-making arm of the Federal Reserve, meets Tuesday and Wednesday, and will release its policy statement at 2:15 p.m. EST on Wednesday.

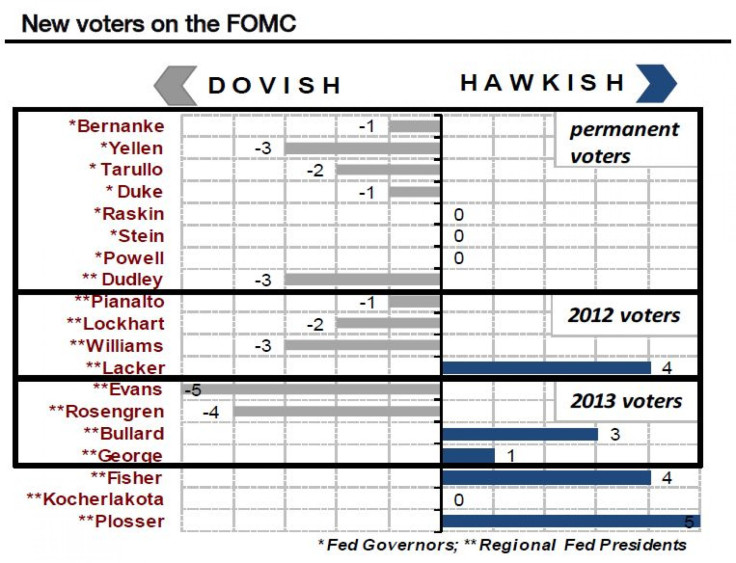

“The annual rotation of voting members will have little impact, although the group will be slightly more dovish this year,” Paul Ashworth, chief U.S. economist at Capital Economics, predicted in a note to clients.

The first FOMC meeting of the New Year is likely to be a non-event. Despite the resolution of the fiscal cliff and some marginal improvements in the data, the economy is still far from meeting the Fed’s condition for scaling back on its asset buying. In December, the U.S. central bank announced open-ended asset purchases of $85 billion a month until the jobless rate falls below 6.5 percent.

With this target in mind, market participants will be closely monitoring Friday’s January jobs report.

The Bureau of Labor Statistics is expected to report that job growth accelerated somewhat in January but a projected 160,000 gain will have little impact on the overall unemployment rate -- expected to remain at 7.8 percent. (Preview: Thousands Of New Jobs But Not Enough To Blunt US Unemployment)

Benchmark revisions to the establishment survey, along with updated population controls in the household canvass, could trigger additional market volatility in response to the BLS’ January report.

Gross domestic product likely weakened in the fourth-quarter of 2012 – economists expect an annualized rate of 1.1 percent, down from 3.1 percent in the third quarter. Nevertheless, the composition of growth was a lot more encouraging. Much of the Q3 growth was driven by a surge in government expenditure and strong positive contributions from inventories and net external trade. In contrast, private investment barely increased at all. In Q4, however, the growth rate of both consumption and investment apparently accelerated, while inventories and net external trade probably made negative contributions.

Meanwhile, U.S. auto sales in January are expected to come in at an annualized rate of 15.2 million vehicles, according to analysts polled by Thomson Reuters.

Economic data out of Europe are likely to bring mixed news, with the European Commission consumer and business survey probably recording another improvement and inflation likely to fall, while unemployment posts another rise and the money supply figures underline the continued weakness of credit growth in the euro zone, according to Jonathan Loynes, chief European economist at Capital Economics.

Elsewhere, there are scheduled policy rate meetings this week in India, New Zealand and Malaysia. Interest rates are likely to be cut in India, but left on hold in New Zealand and Malaysia.

Below are entries on the economic calendar Jan. 29 – Feb. 1. All listed times are EST.

Tuesday

TBA: FOMC first day of 2-day meetings.

9 a.m. – Economists expect the S&P Case-Shiller home price index to rise 0.6 percent month-on-month in November. The 20-city index has posted increases for nine straight months and economists look for this momentum to continue. This will leave home prices up 5.5 percent year-on-year in November. This will bring Case-Shiller more in line with CoreLogic and FHFA, which show a gain of 7.5 percent and 5.7 percent year-on-year gains, respectively.

10 a.m. – The Conference Board’s index of consumer confidence likely slipped in January, leaving it at a level consistent with only modest consumption growth. Economists have penciled in a fall in confidence to around 64, from 65.1 in December.

Non-U.S.:

India – RBI repot rate and reverse repo rate.

Hungary – Deposit rate.

E17 -- European Central Bank Executive Board member Peter Praet speaks at the annual Danish Top Executive Summit in Copenhagen.

E17 -- European Central Bank Executive Board member Joerg Asmussen speaks at start to the year event in Glücksburg, Germany.

Wednesday

7 a.m. -- The Mortgage Bankers Association's, or MBA's, mortgage-applications indexes for the week ending Jan. 25.

8:15 a.m. – The ADP private payrolls likely increased by 165,000 in January, slight below the 3-month average of 174,000. In December, ADP payrolls were especially strong and overshot BLS estimates by 47,000.

8:30 a.m. – The advance release of Q4 GDP is expected to show that growth weakened at the end of 2012. Economists forecast Q4 GDP growth of 1.1 percent, down from the 3.1 percent pace registered in Q3. Nevertheless, the composition of growth was a lot more encouraging. Much of the Q3 growth was driven by a surge in government expenditure and strong positive contributions from inventories and net external trade. In contrast, private investment barely increased at all. In Q4, however, the growth rate of both consumption and investment apparently accelerated, while inventories and net external trade probably made negative contributions.

2:15 p.m. – At the January FOMC meeting, economists don’t expect any change in the Fed’s policy stance and foresee few changes to the statement. Unlike past January meetings, there will be no update to the Summary of Economic Projections this time -- those will next be revised for the March 19-20 FOMC meeting. As a result, there also will not be a press conference following this meeting.

Non-U.S.:

Italy -- Prime Minister Mario Monti speaks on "Democracy in Europe" in Brussels.

New Zealand – RBNZ official cash rate.

Spain – Preliminary Q4 GDP.

E17 – “Final” consumer confidence index for January.

Japan – December industrial production.

Thursday

7:30 a.m. – The Challenger Job-Cut Report for January.

8:30 a.m. – Initial jobless claims likely bounced back to 351,000 for the week ending Jan. 26, a partial reversal from two prior weeks of strong jobless claims data.

8:30 a.m. – Economists forecast a strong 0.8 percent pop in personal income buy only a 0.3 percent gain in personal spending in December, leaving the saving rate to increase. The former should partly reflect a solid rise in wage and salary income, consistent with increases in average hourly earnings and aggregate hours in the employment report. A one-time jump in dividend income could have also helped push up the personal income figure, given that many firms brought forward special dividend payments before tax rates rose in January. The PCE price index likely remained flat on the month.

9:45 a.m. – After the annual seasonal adjustments were incorporated, the December print of the Chicago PMI was revised down to 48.9 from 51.6 originally. This put the index more in line with trends seen in other regional activity indicators, and economists look for the index to rise modestly to 50.8 in January.

Non-U.S.:

E17: -- European Central Bank Vice President Vitor Constancio and Executive Board member Peter Praet speak at European Financial Services Conference in Brussels.

Egypt – Deposit rate.

Malaysia – Overnight rate.

Germany – Preliminary HICP and CPI for January.

Germany – Unemployment change for January.

Friday

All Day – After a strong end to 2021, vehicle sales should decrease modestly to 15.2 million SAAR in January, from 15.3 million in December.

8:30 a.m. – Economists look for headline nonfarm payrolls to increase 160,000 and for private payrolls to rise by 165,000 in the January employment report. A 160,000 gain in payrolls would probably not be enough to prompt a fall in the unemployment rate from 7.8 percent. Also in this report, the BLS will incorporate the annual adjustments to the population estimates used in the household survey as well as the annual benchmark revision to the payroll data. The former means that there will be a discontinuity between December and January in the household measure of employment and the labor force. Hence, these data should be interpreted with care. After two months of gains, economists expect a softening in wages with average hourly earnings only increasing 0.2 percent, following a 0.3 percent gain in December. The average workweek is expected to hold at 34.5.

8:30 a.m. -- Federal Reserve Bank of New York President William Dudley (FOMC voter) speaks before the New York Bankers Association 2013 Annual Meeting and Economic Forum.

8:58 a.m. – U.S. January Markit manufacturing PMI.

9:55 a.m. – The University of Michigan’s index of consumer sentiment likely rose slightly to 71.5 in the final January report after a preliminary reading of 71.3.

10 a.m. – Economists expect the ISM manufacturing index to fall slightly to 50.5 in January from 50.7 in December. The index has been basically flat and stuck near the breakeven level since June. The manufacturing sector stalled in 2012 and is expected to continue to tread water in the first quarter of this year.

10 a.m. – Construction spending is likely to increase 0.6 percent in December as homebuilding continues to improve, as suggested by the pop in housing starts at year-end. This will follow a gain of 0.7 percent in October but a decline of 0.3 percent in November.

Non-U.S.:

Russia – Overnight deposit rate and overnight repo rate.

China – NBS manufacturing PMI index for January.

China – Final HSBC manufacturing PMI index for January.

E17 – “Flash” HICP for January.

E17 – Unemployment rate for December.

E17 – Final manufacturing PMI index for January.

U.K. – Manufacturing PMI index for January.

Japan – Auto sales for January.

Sources: Central banks, European Commission, Reuters, Market News, Capital Economics, Barclays, Bank of America Merrill Lynch, Societe Generale.

© Copyright IBTimes 2024. All rights reserved.