Veteran Investor Predicts US Global Status Could Decline With BRICS' Success

KEY POINTS

- BRICS made headlines over the past week after several reports claimed it is planning to roll out a new currency

- Russia is currently considering issuing a commodities-backed stablecoin to serve as a multinational currency

- Wolfenbarger says the success of BRICS could have a sweeping impact on the US dollar

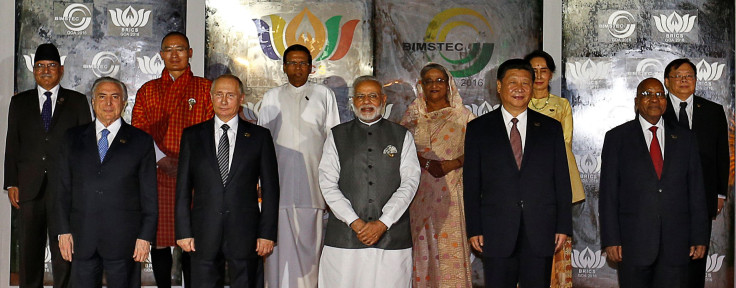

A veteran investor with decades of experience in the financial industry shared his grim prediction about the U.S., which includes the country going down in its global standing, the dollar losing its reserve currency status and the standard of living in the country eventually diminishing, if BRICS, the alliance of countries composed of Brazil, Russia, India, China, and South Africa, becomes successful.

The success of BRICS could have a sweeping impact on the U.S. dollar, as well as the living standard of Americans, according to the veteran investor and investment website Bull And Bear Profits founder and CEO Jon Wolfenbarger.

The former J.P. Morgan executive said that all empires have, at one point, fallen and the United States, despite its dominance on the world stage, is not an exception to this potential event.

Wolfenbarger noted that BRICS's success along with the stubbornness of the United States to change its policies, including avoiding war and choosing peace, could lead to the American fiat currency eventually losing its reserve currency status.

"If the BRICS are successful and the US does not change its policies to focus on a stronger dollar, less spending, and peace instead of war, it is possible the dollar will slowly lose its 'reserve currency' status," the veteran investor and former Merrill Lynch investment banker said in an article on Mises.

If this happens, Wolfenbarger said it "would hurt US living standards and lead to less power for the US government, similar to the weakening of the UK after World War II. All empires in history have failed, and the US will not likely be an exception – if the BRICS can create a successful hard currency to compete with the dollar."

However, he highlighted that like all other nascent alliances, BRICS nations have a long way to go and will have a lot of hurdles to jump if they are really seriously considering taking on the greenback.

Recently:

— Alf (@MacroAlf) May 7, 2023

1) Brazilian President Lula asked why should every country be tied to the US Dollar rather than just trade in its own currency?

2) BRICS countries finalized agreements to trade with each other in their own currencies

So, has the de-dollarization started?

Thread

1/

"The US has the largest and safest government bond market, no capital controls, and a reputation for enforcing the rule of law. By contrast, the BRICS countries are hardly known for respecting laws or having strong currencies," Wolfenberger noted.

Last week, Bank of America Securities said that the global dominance and privilege of the U.S. dollar are not, in any way, under threat since there are no alternatives available.

The "USD" is "not about to lose its exorbitant privilege" as "no single alternative has appeared," a note penned by BofA's foreign exchange strategist Athanasios Vamvakidi and other analysts read.

Russia, one of the countries under BRICS, is currently leading the initiative on issuing a multinational stablecoin backed by commodities with BRICS countries and Eurasian Economic Union.

© Copyright IBTimes 2024. All rights reserved.