Volkswagen Scandal: Company Looks To Raise Funds To Cushion Financial Blow, Says Report

German automaker Volkswagen AG is in talks with lenders to put together a short-term financing plan to ensure it has adequate liquidity to cover fines and other expenses from the emissions scandal, people close to the matter told Bloomberg.

Volkswagen is set to approach a dozen banks Monday to go over the proposed funding. However, the company does not need the money currently, and is seeking extra funds to create a financial cushion, the report said, citing sources.

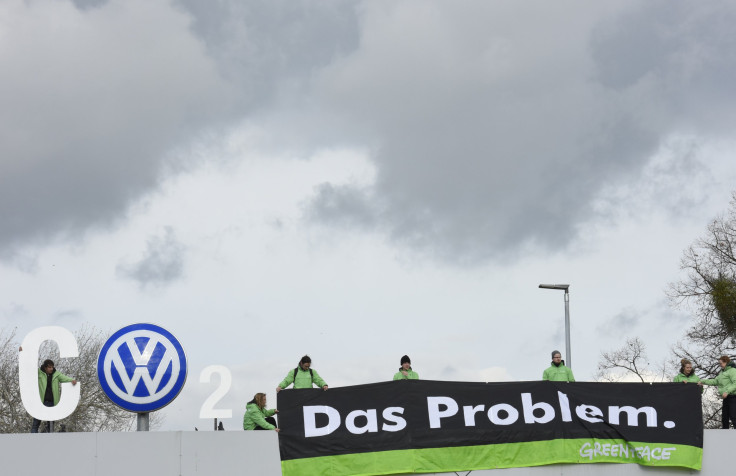

Volkswagen’s worries have compounded since it first admitted to cheating on emission tests which may affect about 11 million cars worldwide. The car maker later admitted that additional 800,000 cars in Europe had higher carbon dioxide output than allowed by emission norms.

The scandal led to the resignation of Martin Winterkorn, the company's chief executive, who was replaced with the top manager of its Porsche subsidiary Matthias Mueller.

The direct cash cost of the cheating scandal will probably be about 25 billion euros ($26.9 billion) through 2017, Kristina Church, a London-based analyst for Barclays Plc. said Friday, according to reports.

Sascha Gommel, a Frankfurt-based analyst for Commerzbank AG told Bloomberg that Volkswagen’s move makes perfect sense as the added liquidity would protect their credit ratings.

"If the ratings agencies think you won’t have cash and they downgrade you, then your funding gets more expensive,” Gommel added.

"A well-diversified portfolio of funding tools gives us the necessary flexibility to offer appropriate and competitive financing options for our customers as well as our industrial investment needs,” Volkswagen said in an e-mailed statement to Bloomberg, declining to give further details.

© Copyright IBTimes 2024. All rights reserved.