Wild Weekend For BATS Capped By Mea Culpa

In the wake of the uncommon cancellation of the initial public offering by Bats Global Markets Inc. on Friday, the company's chairman, CEO, and president apologized to customers and members of the trading community in a letter posted on its website on Sunday.

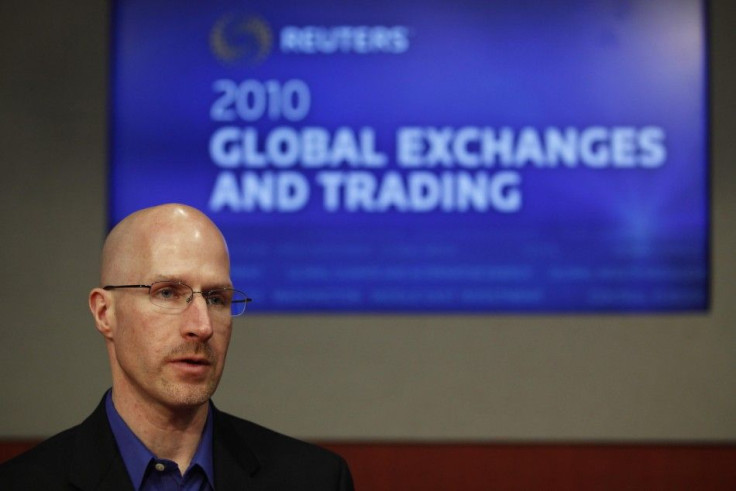

"BATS experienced a serious technical failure Friday morning, and I want to apologize for not measuring up to the level of excellence that you have come to expect from us," Joe Ratterman said.

The technical failure caused a halt in the trading of shares in Apple Inc., the most highly valued company on U.S. equity exchanges. The erroneous trades also caused BATS' own shares to be quoted at less than one cent on Friday morning after its IPO had been priced at $16 on Thursday afternoon.

"[W]e experienced a system problem in our attempt to open the BATS ticker symbol for the first time on Friday morning," Ratterman said. "We failed to roll into continuous trading with our new BATS ticker immediately following the opening auction. In effect, our newly issued stock did not begin trading as it should and was halted before it ever started trading.

"[W]e were under the brightest spotlight imaginable -- opening our own stock on our own exchange for the first time ever. It doesn't get much more public than that," he added.

However, almost as public as that are the opinions of Dave Cummings, BATS director and founder, who emailed an open letter about the debacle to industry insiders on Sunday, according to Reuters.

Cummings called for the company, based in Lenexa, Kansas, to develop a "credible IPO plan" and go through with it in the second quarter, Reuters reported, while noting that Ratterman said in an interview the company has no plans to do so in the foreseeable future.

Cummings also advocated suspending bonus plans for executives. "In this business, mistakes cost money," he said in a note to market participants, according to the Wall Street Journal.

BATS, or Better Alternative Trading System, operates two electronic exchanges in the United States, the BZX Exchange and the BYX Exchange, which account for 11 percent to 12 percent of all U.S. equity trading on a daily basis, according to the company.

© Copyright IBTimes 2024. All rights reserved.