Will Taxes Go Down In 2017? Treasury Secretary Steven Mnuchin Says Reform Could Come By August

In his first television interview since the Senate confirmed him Feb. 13, Treasury Secretary Steven Mnuchin promised the new administration’s tax overhaul would arrive before Congress planned to kick off its summer break for the month of August.

“We want to get this done by the August recess,” Mnuchin said on CNBC’s “Squawk Box” early Thursday morning, adding that the proposed tax cuts would mainly target middle-income workers and would streamline the corporate tax code. “We’ve been working closely with the leadership in the House and Senate and we’re looking at a combined plan.”

When pressed as to whether the administration of President Donald Trump, whose previous tax plans would largely benefit wealthier earners to the detriment of some of the lowest-income Americans, would cut taxes for members of the top income brackets, the former Goldman Sachs Group partner and hedge fund manager offered an unclear answer.

"Look, as I've said before, we're primarily focused on a middle income tax cut and simplification for business. And what we are focused is that on the high end, if there are tax cuts, that they are offset with reduction of deductions and other things," he said, after promising to close loopholes that benefit the wealthy. "So it's something we're going to carefully look at. And when we come out with the plan, we'll come obviously out with the distribution and how it impacts people and that's something we're very focused on."

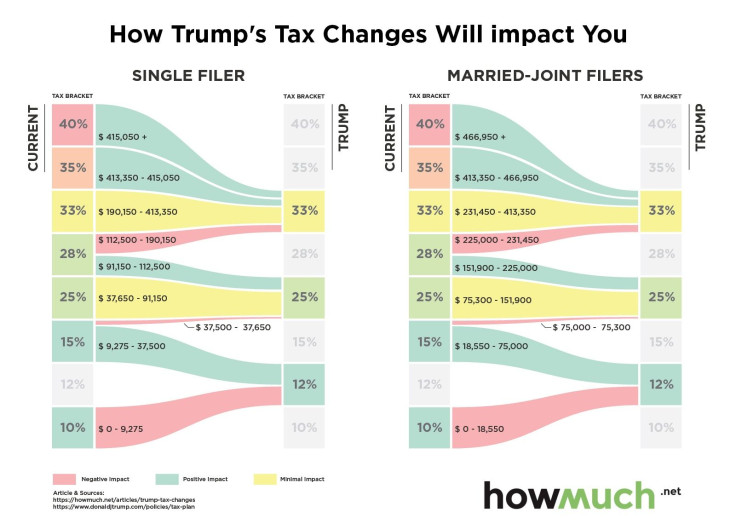

On the campaign trail, Trump planned to draw down the number of income tax brackets from seven to three, predominantly benefitting the ultra-wealthy, as a graphic created by the cost information site HowMuch showed. He also planned to slash corporate taxes to 15 percent from 35 percent.

Mnuchin also fielded questions related to a proposed 20 percent tax on imports intended to cover the estimated $12 billion to $15 billion required for a wall along the border with Mexico mandated by one of Trump’s executive orders.

Acknowledging anxiety among U.S. companies heavily reliant on imports, Mnuchin admitted that “there are some concerns,” but that “we’re looking at” a border-adjustment tax.

The CNBC discussion marked his second-ever interview as Treasury Secretary, following a Wednesday talk with Wall Street Journal reporters that mainly touched on his expectations for economic growth, which stood far above projections from the Federal Reserve and Congressional Budget Office.

© Copyright IBTimes 2024. All rights reserved.