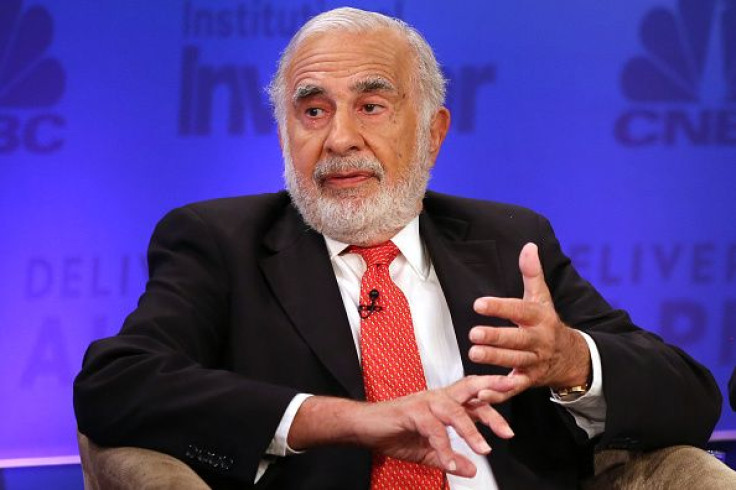

Xerox Announces Split, Which Will Give Activist Investor Carl Icahn 3 Board Seats

UPDATE: 7 a.m. EST — Xerox Corp. announced Friday it was splitting into two public companies. The separation is expected to be completed by the end of 2016, according to the announcement.

The split will create an $11 billion document technology company and a $7 billion business process outsourcing company.

Original story:

Xerox Corporation will split into two companies, one focused on hardware and the other on services. As part of the deal, Xerox will let activist investor Carl Icahn pick three members on the board of the services company, the Wall Street Journal reported Thursday, citing sources familiar with the matter.

The news comes just days after insurance giant AIG announced a deep restructuring following months of pressure from Icahn and fellow investor John Paulson, who pushed the company to split into three.

Xerox, like AIG, disappointed investors throughout 2015. In the third quarter the copier manufacturer reported a net loss of $34 million, compared to profits of $266 million the same quarter in 2014. The company's results had failed to meet expectations since its ambitious $6.4 billion acquisition of Affiliated Computer Services Inc., a data management and outsourcing company.

The split would essentially undo that merger, the Journal reported. The news is expected to be announced officially during the company's fourth-quarter earnings report Friday.

In November, a month after the company announced a strategic review of its structure, Icahn disclosed a 7 percent stake in Xerox, making him the second-largest investor in the 110-year-old company. He increased that stake to 8 percent in December.

Shares of Xerox were down 0.2 percent to $9.21 in after-hours trading an hour after the news broke.

© Copyright IBTimes 2024. All rights reserved.