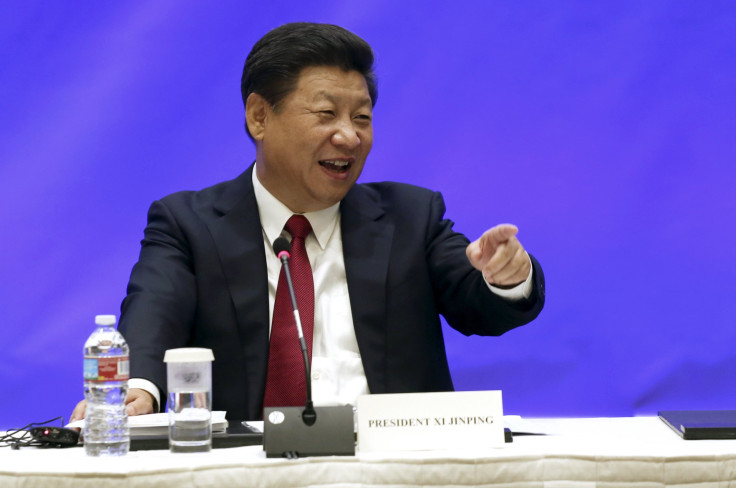

Xi Jinping Visit: What Do US Businesses Want From China?

Chinese President Xi Jinping’s visit to the United States has brought out corporate leaders hopeful for eased trade relations between the countries.

On Wednesday, President Xi will command an audience of some of the world’s wealthiest and most powerful business leaders in Seattle as he tours the U.S. for the first time during his presidency. Warren Buffett and Apple CEO Tim Cook will join executives from Microsoft, Starbucks and a host of other American and Chinese corporate giants for the meeting with Xi, who is hoping to demonstrate the importance of China to the American economy.

The trip comes as China and the U.S. navigate a particularly rocky time in international relations, with tensions over hacking and China’s military maneuvering attracting global attention. China's economy, meanwhile, has hit the skids, spooking international investors.

But an equally contentious set of challenges faces the business community as American corporate leaders angle for a greater slice of the world’s second-largest economy. China currently represents a nearly $600 billion market for U.S. firms.

Among the issues almost certain to come up at the Seattle meeting are high-profile business hacks suspected of having at least tacit approval from Beijing and China’s internet censorship regime, one of the most advanced in the world.

Yet for American business, conflicts between U.S. corporate ambitions and Xi’s controversial government reforms present even greater challenges, from new Chinese laws business leaders say stifle competition to surveillance policies that expose American firms' innermost secrets to the Communist Party.

Regulatory Friction

When former National Security Agency contractor Edward Snowden released his explosive spy leaks in 2013, China-U.S. relations were not spared. "The NSA does all kinds of things like hack Chinese cell phone companies to steal all of your SMS data," Snowden told a Hong Kong newspaper.

That allegation provided ammunition for new policies in Beijing that have created one of the most difficult binds American business has faced in China. Under new policies, U.S. corporations would be expected to submit to a raft of new oversight provisions, including agreements to hand the Chinese government access to their data systems through so-called backdoors into company source code and communications.

The new rules are just some of the laws that American companies say unfairly target and intimidate foreign firms. Chinese authorities have wielded anti-monopoly laws, for example, to impose steep fines on companies like Qualcomm and Mercedes-Benz. U.S. firms fear that billions more in such penalties may loom in the future.

“There has been some friction in the past year or two from the Chinese government levying fines on non-Chinese businesses,” says Greg Stoller, a senior lecturer at the Boston University Questrom School of Business. Still, he says it’s “too early to tell” how much these fines have to do with benefiting Chinese firms.

Michael Froman, U.S. Trade Rep., is far less uncertain about China’s application of business regulations. “The rules aren’t about security -- they are about protectionism and favoring Chinese companies,” Froman said of China’s new cybersecurity laws this year. “The administration is aggressively working to have China walk back from these troubling regulations.”

Xi, for his part, denies any targeting of foreign firms. “We give equal and fair treatment to all market players -- including foreign-invested companies in China -- and welcome all forms of cooperation between transnational corporations and their Chinese counterparts,” Xi said in a Wall Street Journal interview.

Despite the impediments, investors are still eager to see American tech companies expand their presence in China, which boasts the world’s largest online population. But with tech giants Facebook and Google still sidelined from the country due to censorship concerns, it’s clear that finding a balance won’t be easy.

Intellectual Property

Earlier this year, IBM raised eyebrows by agreeing to share some of its most profitable proprietary technology with Teamsun, a Chinese IT provider, for a joint project that will allow the company to build a full supply chain on the foundation of IBM know-how.

The move, approved by U.S. trade authorities, stirred long-standing concerns around China’s use of intellectual property. For years, American companies have reported heavy losses in connection with intellectual property rights violations.

The U.S. government has also put the pressure on China. Though he commended China for recent reforms, the U.S. trade representative in 2015 kept China on a priority watch list for countries that have failed to protect trade secrets. Investors are hoping that further reforms are forthcoming.

And the situation for American businesses is improving in some ways, says Minyuan Zhao, an associate professor of management at the Wharton School and an expert in intellectual property rights.

“The infrastructure for intellectual property protection has improved significantly, especially in the legal system,” Zhao wrote in an email, citing the establishment of specialized new courts to address the issue.

“On the other hand, however, the push for indigenous innovation has blurred the boundary between copying and learning,” Zhao wrote. China’s ambitions to increase its technological output has meant more gray areas and partnerships like the one IBM recently forged.

Though Zhao said the environment is still “not great,” the size of China’s economy remains irresistible to U.S. firms. “If knowledge leakage is inevitable, the company might as well take the initiative and work closely with local partners.”

A BIT Closer?

If there’s a single initiative toward China that most unites the American business community, it’s the establishment of a bilateral investment treaty (BIT) between the two superpowers. Observers have posited that Xi’s visit could be an opportune time for the announcement of progress on the treaty.

The agreement would provide rules of the road for the respective governments, setting limits on regulation and preferential treatment of domestic business.

“We urge the two governments to reinforce the economic and commercial relationship, including by concluding a high-standard, comprehensive BIT as soon as possible,” said U.S. Chamber of Commerce President Thomas Donohue in a statement.

Xi also spoke in favor of trade accords. “[We] stand ready to properly settle economic and trade disputes with relevant countries through consultation and promote a balanced multilateral economic and trade system that focuses on development and seeks win-win results,” he told the WSJ.

The U.S. currently has BITs with more than 40 countries. But despite a yearslong attempt to hammer out trade accords, China is still not one of them.

A treaty could go far in resolving some of the most pressing issues U.S. businesses face in China, from ensuring that state-owned businesses don’t crowd out foreign competitors to increasing transparency in national judicial processes. More than 90 U.S. CEOs have signed onto a letter calling for "significant" progress on the talks.

But the road to a full treaty is rocky. On Tuesday, Trade Rep. Froman told an audience at an event, “We are a substantial distance from the kind of high-standard agreement necessary to achieve our mutual objectives.”

Reuters reported that negotiators remain at loggerheads over the number of industries that China wants to keep out of the deal. A so-called negative list of proposed exceptions currently keeps American companies out of more than 100 sectors.

Though China’s most recent proposal reportedly contained more than 35 exceptions, U.S. negotiators are aiming for a BIT that substantially reduces that number. Given Froman’s comments, an agreement during Xi’s visit may be farther out of reach. But corporate leaders are still hopeful that the meetings this week may provide some blue skies for American business.

© Copyright IBTimes 2024. All rights reserved.