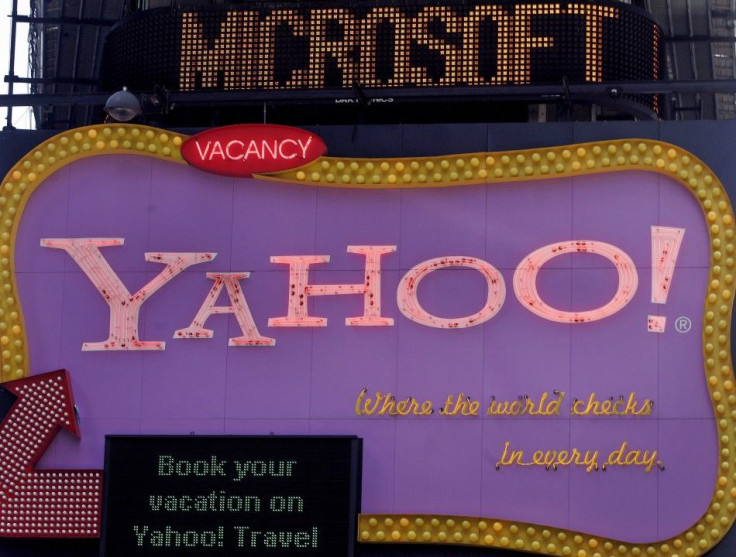

Yahoo Could Attract China’s Alibaba, Russia’s Digital Sky

Uncertainty over Yahoo may have attracted takeover interest from Russia's Digital Sky Technologies as well as from China's Alibaba Group and Silver Lake Partners.

If they become serious, a takeover of the Sunnyvale, Calif.-based media and search company could raise eyebrows in Washington, where foreign takeovers by Chinese interests have been barred.

Previously, investment sources have said Yahoo might be targeted by private equity giants like Silver Lake and Providence Equity Partners, as well as media companies like News Corp. and Walt Disney, which Monday announced a media alliance with Yahoo News for its ABC News division.

Microsoft, which handles search functions for Yahoo through a partnership executed by ousted CEO Carol Bartz, is another prospective bidder.

Digital Sky's interest, first reported by Bloomberg, would not be totally unfounded. Last month, the Russian media company and Silver Lake announced they would tender for Alibaba shares, valuing the Chinese company around $32 billion.

That would value Yahoo's 40 percent share around $12.8 billion, more than six times their earlier estimated value.

Digital Sky, run by Russian tycoon Yuli Milner, is no stranger to U.S. companies. It's a major investor in Zynga, Facebook, Groupon and others. As well, it has close ties to Goldman Sachs.

Last week, Alibaba CEO Jack Ma told a Stanford University forum he would be interested in a Yahoo buyout. Under terms of a 2005 deal, if Yahoo wishes to dispose of its investment in either Alibaba or Yahoo Japan, it must provide each company 15 days to buy its shares. Yahoo Japan is controlled by SoftBank, which was an original Yahoo investor.

Since Bartz's firing on Labor Day, Yahoo has hired Allen & Co. for strategic advice. It also attracted a 5.1 percent investment from activist investor Daniel Loeb's Third Point, which announced plans to buy more.

Yahoo's market capitalization is $17 billion; its enterprise value is $14.6 billion.

© Copyright IBTimes 2024. All rights reserved.