The Yellen-Fischer Fed: Is The FOMC More Hawkish Or Dovish In 2014?

The U.S. Federal Reserve, arguably the most powerful and influential financial institution in the world, is getting a “Dream Team” this year in the top two positions.

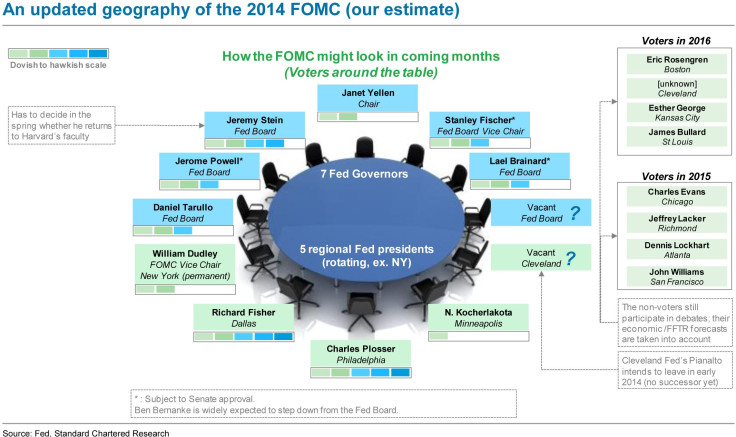

The U.S. Senate confirmed Janet Yellen as chair of the Fed on Jan. 6, with a final vote of 56 in favor and 26 against. Yellen, 67, will take the helm on Feb. 1, when Ben Bernanke steps down.

In addition, the nomination of former Bank of Israel head Stanley Fischer, 70, to be Yellen’s lieutenant puts one of the best-known figures in international economic policy in the central bank’s No.2 spot.

At the Massachusetts Institute of Technology, Fischer once advised an all-star crew of graduate students including Bernanke, European Central Bank President Mario Draghi and former chief White House economist Greg Mankiw.

Fischer is generally perceived as more hawkish on policy than Yellen, which has led to fears he might interfere with her overall dovish bias.

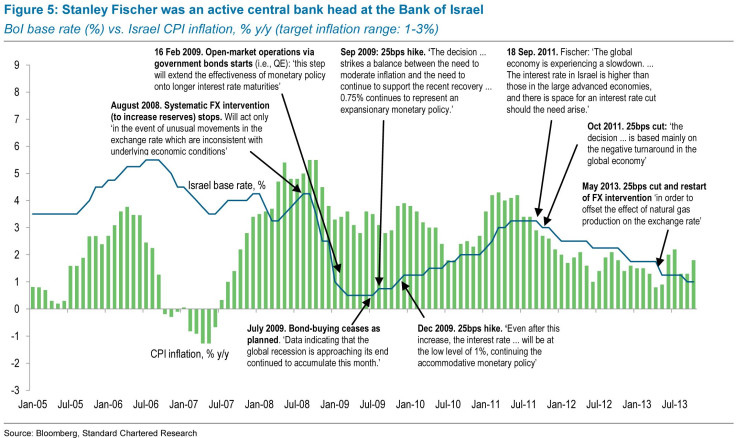

At the Bank of Israel, Fischer conducted quantitative easing only for a few months in 2009, and was among the first central bankers to hike interest rates in the summer of 2009. He has voiced concern about rising house prices and risks to financial stability.

Fischer also has recently expressed reservations about the Fed’s QE program and forward guidance policies.

Speaking at a conference in Hong Kong in September, he said: “You can’t expect the Fed to spell out what it’s going to do. Why? Because it doesn’t know.”

He added: “We don’t know what we’ll be doing a year from now. It’s a mistake to try and get too precise.”

But Standard Chartered Plc’s Thomas Costerg and Daniel Tenengauzer do not consider Fischer a hawk.

“Factors specific to Israel’s economy directed his policies at the BoI – in particular, the inflation picture is different, and Israel is a small but very open economy,” Costerg and Tenengauzer said in a note. In their view, Fischer is not intrinsically opposed to high policy accommodation.

“Continued low inflation and low wage growth may provide the justification for continuing a gradual pace of tapering in 2014, and keeping rates low until late 2015,” they added.

For now, they assign Fischer a 3/5 rating on their dovish-to-hawkish scale (versus 2/5 for Yellen). His Senate committee hearing should bring more insight into Fischer’s views.

The Yellen-Fischer duo arrives at a crucial time, the analysts said. Bernanke has already taken an important step toward exiting the Fed’s QE program by starting to reduce monthly bond purchases.

“The key now will be to manage the exit process and ensure that the Fed’s withdrawal of accommodation does not choke off the still-fragile U.S. economic recovery, while being cognizant of the global side effects of tapering and then rate hikes,” Costerg and Tenengauzer said. “We expect Fischer to help Yellen navigate these challenges.”

© Copyright IBTimes 2024. All rights reserved.