Apple’s iPad Market Share Suffers Significant Drop Worldwide In Q3 As Android-Powered Tablets Gain

Apple’s (NASDAQ:AAPL) share in the worldwide tablet market plunged to its lowest point in the third quarter of 2013, dropping 11 percent from the same period last year, while arch rival Samsung (KRX:005935) saw an 8 percent increase in its global footprint in the tablet market, thanks to its Android-powered devices, a new report from the International Data Corporation, or IDC, said on Wednesday.

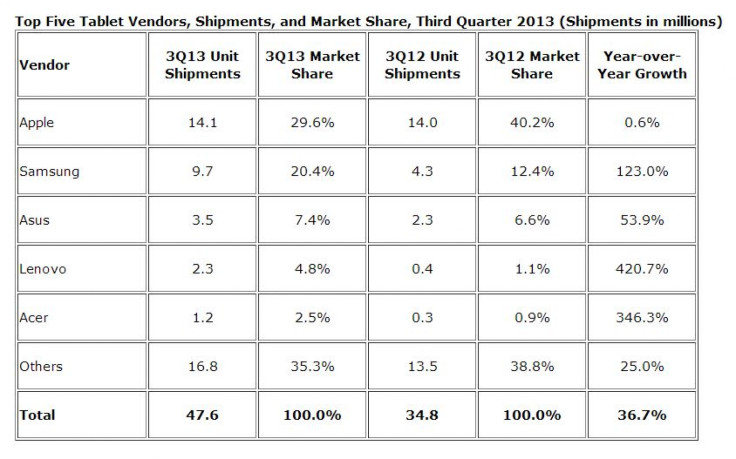

According to IDC, Apple’s sluggish growth can be attributed to a lack of new iPad product launches in the second and third quarters. The company’s worldwide market share in tablets dropped to 29.6 percent -- its lowest share to date -- in the third quarter from 40.2 percent during the same period last year, with shipments stagnating to grow at a mere 0.6 percent. In the second quarter of this year, Apple had experienced a decline in shipments to 14.1 million units from 14.6 million units in the second quarter of 2012.

However, IDC expects Apple to regain its foothold with “robust shipment growth during the fourth quarter,” riding on the back of its new iPad Air and the iPad mini with Retina Display. The full-sized iPad Air will be released on Friday, while the second-generation iPad mini will be rolled out later in November.

“With two 7.9-inch models starting at $299 and $399, and two 9.7-inch models starting at $399 and $499, Apple is taking steps to appeal to multiple segments,” Jitesh Ubrani, research analyst at IDC, said in a statement. “While some undoubtedly hoped for more aggressive pricing from Apple, the current prices clearly reflect Apple's ongoing strategy to maintain its premium status.”

Other than Apple, Google (NASDAQ:GOOG) and Amazon (NASDAQ:AMZN) too increased the price of their newest 7-inch tablets from $199 to $229 to cover the higher costs associated with high-resolution screens and better processors, Ubrani said.

As for Samsung, the company grabbed a 20.4 percent share of the global market -- up from 12.4 percent in the third quarter in 2012 -- with shipments of 9.7 million units, accounting for a huge annual gain of 123 percent.

ASUS (TPE:2357), which makes the Nexus 7 for Google, shipped about 3.5 million units during the quarter for a third-place finish and 7.4 percent market share. Lenovo (HKG:0992) moved into the number four spot with shipments of 2.3 million units and a 4.8 percent share, while Acer (TPE:2353) rounded out the top five with 1.2 million units shipped and a 2.5 percent share.

It’s worth noting here that tablet vendors from outside the top five were responsible for more than a third of all shipments in the September quarter. According to IDC, the "Others" section represents a combination of major companies, such as Amazon, Microsoft (NASDAQ:MSFT), HP (NYSE:HPQ) and Dell (NASDAQ:DELL), and lesser-known, “white box vendors,” which typically sell ultra-low cost Android devices.

"White box tablet shipments continue to constitute a fairly large percentage of the Android devices shipped into the market," Tom Mainelli, research director, tablets, at IDC, said in the statement. “These low cost Android-based products make tablets available to a wider market of consumers, which is good.”

Overall, worldwide tablet shipments grew to 47.6 million units in the third quarter of 2013, representing a 7 percent growth over the previous quarter and jumping 36.7 percent from the third quarter of 2012.

© Copyright IBTimes 2024. All rights reserved.