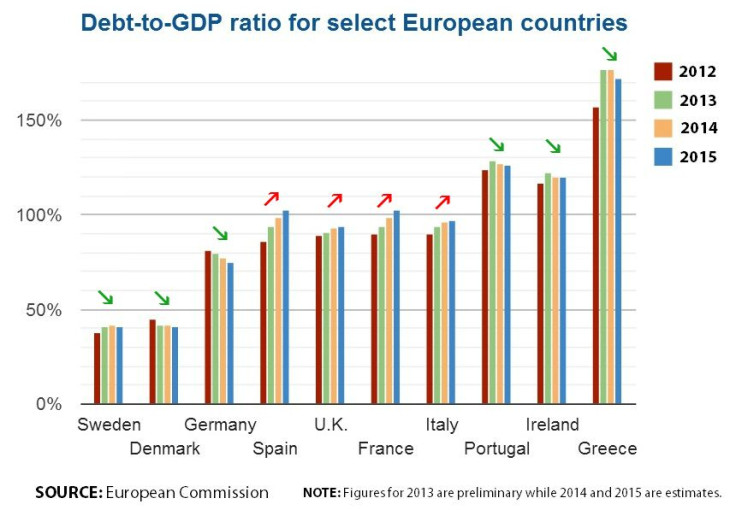

Europe’s Growth Forecast Upgraded, But Ratio Of Debt to GDP Will Continue To Worsen In France, Spain And UK While Germany Continues To Improve

The European Commission released Tuesday its latest regional economic GDPO forecast, lauding continued economic recovery for the region. The executive body of the European Union sees GDP growth at 1.5 percent for the 28 members of the EU and 1.2 percent for the 18 members of the euro currency bloc. Growth is expected to accelerate from these modest figures, to 2 percent for the EU and 1.8 percent for the euro zone, on expected growth in domestic consumer demand and a rebound in export growth.

“The worst of the crisis may now be behind us,” said Olli Rehn, commission vice president for economic and monetary affairs and the Euro, in a statement announcing the projected forecasts, which have increased slightly from the autumn 2013 estimates, suggesting that the situation has improved in recent months in the view of the commission.

Europe’s largest economies, Germany, the U.K., France, Italy and Spain are all expected to grow this year, albeit nowhere near pre-crash levels. Germany and the U.K. could top 2 percent growth by the end of next year.

But the ratio of debt to GDP will continue to rise for major European economies, which means that highly unpopular austerity measures to reduce spending will continue for the foreseeable future as many of Europe’s major economic powers are still increasing how much they’re borrowing compared to how much revenue they generate from productivity to pay back these public loans. Spain and France could see the ratio toping 100 percent by the end of next year while economic austerity in Portugal, Ireland and Greece, which have the highest debt-to-GDP ratios, will begin to see declines.

The higher the debt-to-GDP ratio, the harder it is for countries to pay back loans or to acquire further lines of credit – and the higher the ratio the more costly it is to borrow. The larger a country’s economy, the more debt it can handle and the cheaper it is to borrow money. When economies are huge and stable, they can handle higher debt loads than less stable and less productive economies. That’s why, for example, Japan can have the world’s highest debt ratio among developed economies, at over 200 percent, while Sudan, an underdeveloped economy that has a lower debt ratio than Japan, is in a more economically precarious position despite a debt ratio of under 100 percent. When it comes to debt, the size of the economy matters. However, there is debate about how high the debt ratio of an economy can go before it caps growth.

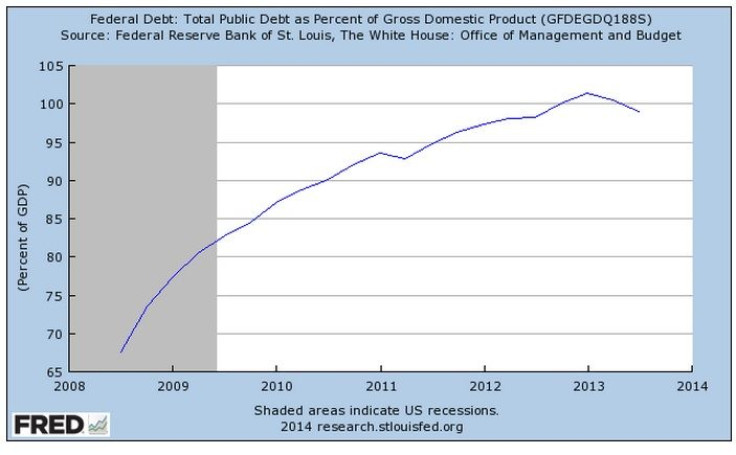

The United States debt-to-GDP ratio stood at 99 percent as of the third quarter of 2013 (it topped 100 percent early last year), according to the latest figures from the St. Louis Fed. In 2008 that ratio was 67 percent, showing just how much the national debt has risen in recent years.

© Copyright IBTimes 2024. All rights reserved.