Greensill Boss Takes Full Responsibility For Collapse

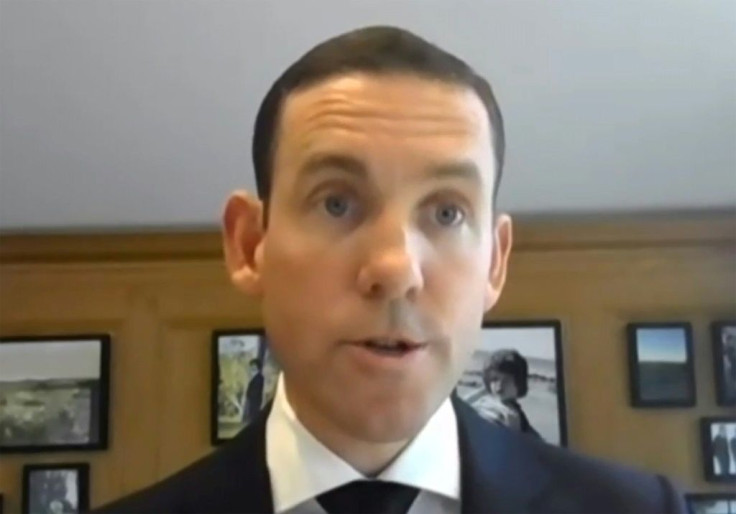

Australian financier Lex Greensill on Tuesday took full responsibility for the collapse of his finance group Greensill Capital, as he refused to be drawn over the company's links to UK government lobbying.

Greensill apologised for the fallout ahead of British lawmakers grilling him over his group's demise that has hit hard some of the world's biggest banks and risks thousands of steel-sector job losses, some in the UK.

His appearance before the cross-party Treasury Committee came ahead of UK former prime minister David Cameron facing the same panel Thursday for questions focused on claims of improper government lobbying involving the London-headquartered company.

"I bear complete responsibility for the collapse of Greensill Capital," Greensill said in a video statement.

He added that he was "desperately saddened that more than a thousand very hard working people" had lost jobs at Greensill and takes "full responsibility for any hardship" felt by its clients, their suppliers and investors.

"To all of those affected by this, I am truly sorry," Greensill finished by saying.

He however also laid blame at insurer Tokio Marine, which withdrew cover to loans issued to Greensill clients amid the coronavirus pandemic.

"It's deeply regrettable that we were let down by our leading insurer whose actions assured Greensill's collapse and indeed of some of our biggest customers," he said.

Ahead of Greensill's appearance over video-link, Britain's Treasury revealed the extent of Cameron's lobbying efforts for Greensill Capital.

Cameron and his office staff last year sent ministers and officials 45 emails, texts and WhatsApp messages relating to the now-collapsed firm, bypassing official channels.

It was revealed also that UK regulator, the Financial Conduct Authority, is formally investigating Greensill Capital after allegations that were "potentially criminal in nature".

Greensill Capital, which filed for insolvency in March after having operated for a decade, had clients including steel empire GFG Alliance which employs thousands of workers worldwide.

Headed by Indian-British magnate Sanjeev Gupta, GFG runs Liberty Steel, which could be forced to shut some of its dozen UK plants following the collapse of its main financial backer, according to Business Secretary Kwasi Kwarteng.

Greensill Capital's implosion threatens about 50,000 jobs overall at companies around the world that relied on its financing for their supply chains.

Lex Greensill, the 44-year-old son of sugar cane planters, obtained inside access to the Downing Street machine during Cameron's spell as prime minister in the previous decade.

This after offering to advise the government on financial technology.

Prime Minister Boris Johnson ordered a senior lawyer to investigate Cameron's lobbying for the firm in April.

Cameron, who was prime minister from 2010 until he resigned after Britain voted to leave the European Union in 2016, has admitted he acted in error but denies any impropriety.

Greensill Capital, which bypassed strict regulations forced upon traditional banks, specialised in short-term corporate loans via a complex and opaque business model that ultimately sparked its declaration of insolvency.

"Mr Greensill, are you a fraudster?" Siobhain McDonagh, an MP for the main opposition Labour party, asked Tuesday.

"No, Ms McDonagh, I'm not," the financier replied.

It was creditors including Credit Suisse and the Association of German Banks who last month placed the Australian parent of Greensill Capital into liquidation.

Switzerland's second-largest bank -- rocked also by the bankruptcy of US hedge fund Archegos -- has been forced to suspend four funds with an exposure to Greensill totalling $10 billion.

In Japan, Softbank is counting the cost after investing $1.5 billion in Greensill two years ago.

And the Association of German Banks counts losses of 2.0 billion euros after investing communities' money with the Bremen-based subsidiary of Greensill.

bcp/rl

© Copyright AFP 2024. All rights reserved.