Hydraulic Fracking In Regions Experiencing Low Water Supply Poses Risks For Investors, According To Ceres

Energy providers chasing the shale boom are getting thirsty for water as some of the most popular areas to drill and hydraulically fracture are increasingly the driest, according to a recent report by Ceres, a nonprofit that advises businesses and investors on sustainability challenges and is raising a red flag about hydraulic fracturing. But other experts say concerns about hydraulic fracturing's use of groundwater are vastly overblown.

Hydraulic fracturing, or fracking, entails pumping water, sand and chemicals down a vertical well and into porous shale rock to push gases, oil or water into horizontal veins and up into storage tanks. Companies using fracking technology on average consume about 2 million gallons of water per well each year, the equivalent of use by 13 families of four.

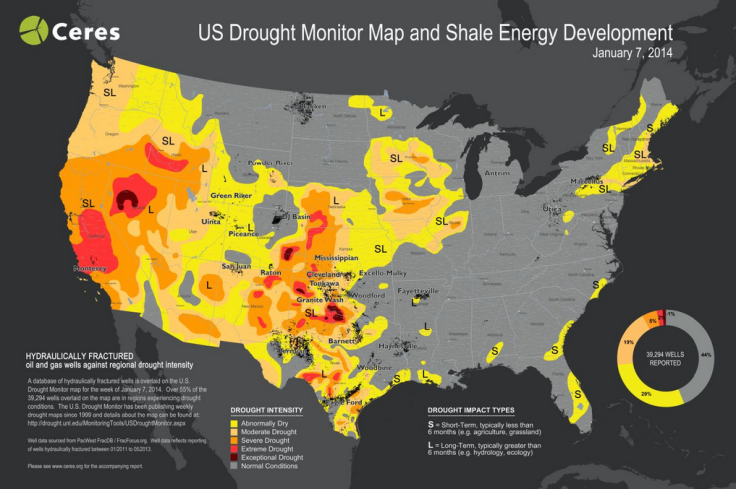

Nearly half of oil and gas wells hydraulically fractured in the U.S. since 2011 are using water in regions with high water stress, according to Ceres.

"We worry that groundwater is not stewarded well," Monika Freyman, the report's author and analyst, wrote. "We think it's a material risk from an investor point of view."

That's not a worry that is shared by the Independent Petroleum Association of America, an industry trade group whose Energy in Depth program criticized the Ceres study on Friday.

"Ceres uses data from the World Resources Institute to make its claims, but when you actually dig into that data, it shows that virtually every major industry has higher overall water risk across the country than oil and gas development," said Katie Brown of Energy in Depth, which issued a statement about the Ceres study.

"In Colorado oil and gas development accounts for one-tenth of 1 percent of the state's total water demand, while in Texas it's less than 1 percent. In fact, a report from the University of Texas found that since hydraulic fracturing is moving the state away from more water-intensive energy sources, it is actually helping to shield the state from water shortages."

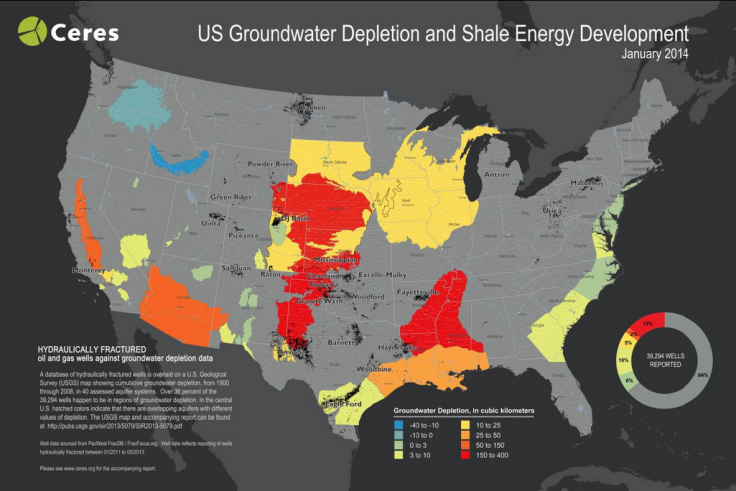

Ceres sees things differently. Using data from FracFocus.org and water stress indicator maps from the World Resources Institute, Ceres says more than 55 percent of all fractured oil and gas wells in the U.S. are operated in areas experiencing short- to long-term drought as of Jan. 7, 2014. Thirty-six percent of the wells are in areas experiencing groundwater depletion. Since only 10 states require their water data be disclosed to FracFocus, the study may be understating the water issue nationally, Ceres said.

However, a study released in December by the University of Texas found that fracking saves water if it substitutes natural gas for coal for electricity generation. The researchers estimate that water saved by shifting a power plant from coal to natural gas is 25 to 50 times as great as the amount of water used in hydraulic fracturing to extract the natural gas.

Ceres found that Halliburton, Schlumberger and Baker Hughes, the top three shale energy service providers, combined use about half of the water fracking accounts for nationally. Fracking accounts for 1 percent of the nation's water usage, far below the more than 30 percent agriculture uses and the 13 percent households use. But locally, fracking accounts for higher percentages of water use in many places.

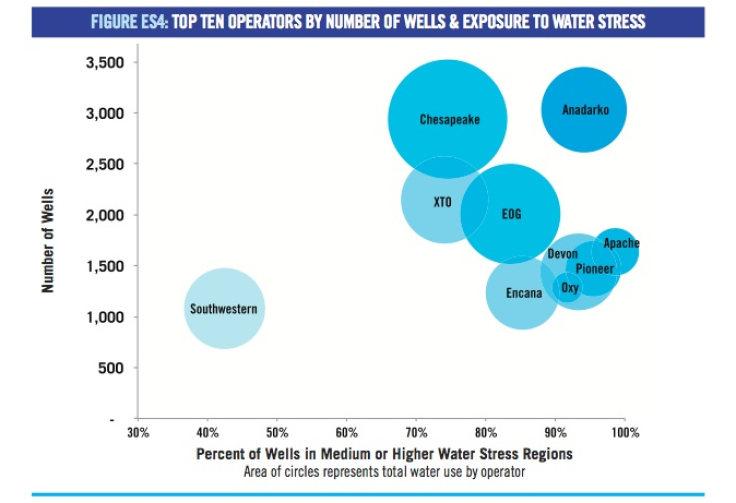

Among eight leading shale energy producers, Anadarko Petroleum has the highest water risk exposure. More than 70 percent of its wells operate in high or extremely high water risk regions, mainly in Texas and Colorado. Most of Apache, Encana and Pioneer’s wells are also fracked in high or extremely high water stress regions. Apache recycles all of its water into the west Texas Permian Basin.

Freyman estimates that companies can save 10 to 40 percent on their costs by recycling water.

In the East, Chesapeake Energy in the Marcellus region recycles nearly all of its water used for fracking and also uses the most water for fracking, 12 billion gallons in the 29 months that Ceres studied. Most of its wells are located in medium water stress regions. The Marcellus Shale region as a whole in Pennsylvania and West Virginia used 13.5 billion gallons in the period Ceres studied, the second-highest amount by region after the Eagle Ford in Texas. Regulators in the Marcellus region track water demand and sometimes halt fracking until aquifers and rivers fill up again.

But groundwater regulation in Texas is less commanding, and the Eagle Ford in South Texas is facing the toughest water challenges among shale energy producers. Fracking water use is the highest in the country at 19.2 billion gallons over 29 months, and the region meets about 90 percent of water demand with groundwater, which is being depleted.

"Groundwater levels are depleting rapidly" in areas of heavy fracking, Amanda Brock, CEO of the Houston-based water treatment firm Water Standard, told Inside Climate News. "There's no denying that it has had a significant impact."

Nearly all fracking in California and the Denver-Julesburg Basin in Colorado occurs in high or extremely high water stress areas. And more than 70 percent of the wells in the Permian Basin in New Mexico and west Texas are in areas of extreme water stress, partly overlapping the depleted Ogallala aquifer. Fracking water use is expected to double in the Permian Basin by 2020.

Ceres recommends that shale energy operators disclose to investors and regulators the amount of water they are using and the amount returning to the surface after fracking, as well as options for water sources and plans for reducing water use.

"We think it's good business practice," Freyman wrote.

© Copyright IBTimes 2024. All rights reserved.