National 401(k) Day 2021: How To Roll Over Your 401K?

Every employee's dream is to have a well-planned retirement to not have to worry about their finances when they're already in their golden years. While current challenges might make that dream difficult to achieve, the National 401(k) Day was created to remind people of its importance and that it's not impossible.

National 401(k) Day is celebrated every Friday after Labor Day. In 1996, the Plan Sponsor Council of America -- formerly known as the Profit Sharing/401(k) Council of America (PSCA), created the special day in 1996 so employees will be able to celebrate the week with Labor Day on a Monday and end the week with retirement in mind on a Friday.

Plan for your retirement as early as now, here are important tips on how to roll over your 401(k) so it’s safe and sound. But first, let’s discuss the basics of 401(k).

What is a 401(k)?

Normally, employers offer a plan for your retirement or an investment in the form of a 401(k). With each paycheck, a portion is withdrawn by employers as contributions. The employee chooses from a list where to invest these funds. There is a limit to how much you can contribute on a yearly basis. As of 2021, the annual contribution limit is currently $19,500 and $26,000 for those who are 50 years old and above.

What are the types of 401(k) plans?

There are numerous kinds of 401(k) plans but the main ones are the regular or traditional 401(k) and the Roth 401(k).

Traditional 401(k)

A traditional 401(k) plan lets you keep your contributions whole before the IRS touches it. Technically, you get a tax break on your savings in the form of pretax contributions. In the traditional 401(k) plan, the contributions are deducted from your paycheck first and placed into retirement or investment funds. The rest of your salary becomes deductible for income tax based on your current income bracket, thus lowering your income tax. However, these are all tax-deferred and may not be touched by the IRS while they’re in your account, but will be taxed once you start making withdrawals in the future.

Roth 401(k)

This type of plan only lets you make contributions after your taxes have been deducted from the bulk of your present salary. Your savings are still safe from the IRS in your account even as it grows and you start withdrawing, taxes can no longer be deducted. This is because the IRS can only collect income tax once and you’ve already paid your contributions after the income tax was deducted.

How to roll over your 401(k)?

As your 401(k) is dependent on your employer, you might be wondering what happens when you switch jobs or if you decide to quit and start your own business? If you want to know how to move your 401(k) from one company to another or place it in an Independent Retirement Account (IRA), you’ll need some help as the process can get confusing.

Here's why you should check out Capitalize for your 401(k) rollover.

What is Capitalize?

Capitalize helps you save for your retirement by working on your 401(k) the smarter way. After years or even decades of being employed and making contributions, what happens to your 401(k)? How can you maximize it to your advantage?

One big mistake is cashing it out all at once which results in hefty penalties and even taxes. Some might even leave their 401(k) where it is but that may incur higher fees and mismatched investments. Others may even let it go completely out of frustration or may have simply forgotten about it. That’s why you need a rollover to move your money into your own account. This way, you can track your investments and assets more closely.

How Can Capitalize Help?

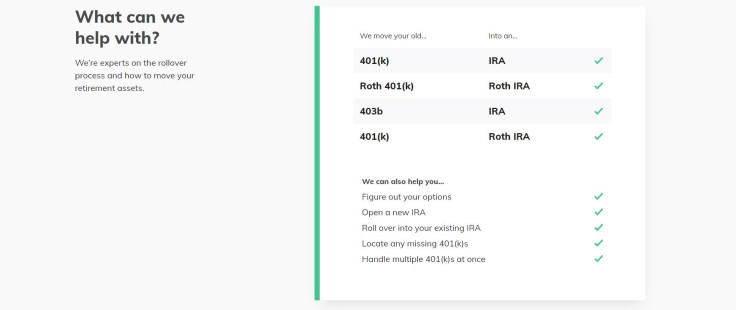

Capitalize has a team of experts in the rollover process. They’ll help you every step of the way to ensure you move your 401(k) assets into an IRA from a leading provider. But if an IRA isn’t for you, Capitalize also helps move all types of retirement assets including 401(k), Roth 401(k), or 403b into either an IRA or a Roth IRA whichever fits best.

How does Capitalize work?

Capitalize can help you in three simple steps.

1. Locate your 401(k)

You don’t have to look for it, they’ll do it for you. All you need to do is tell them which institution manages your 401(k) and your previous employer so they can locate it.

2. Choose your rollover IRA

Answer a few questions to help give them a better understanding of what you’re looking for and they’ll present a roster of IRA providers. Then compare fees, investments and other options. Once you’ve picked one, Capitalize will help you open an account.

3. Sit back and wait

Capitalize will do everything, from contacting your old 401(k) provider to transferring your money to a new IRA account. They'll keep you updated every step of the way.

How much is Capitalize?

Capitalize is absolutely free to use. But don’t worry, just because it’s free doesn’t mean you won’t get the best options and the best opinions. Capitalize is free to its users because once you do choose an IRA provider, they can be compensated by the provider for their services to you.

Is Capitalize legit?

According to Capitalize 401(k) users reviews on Trustpilot, it is indeed legit. It has also been featured in credible publications and websites like Yahoo! Finance, New York Business Journal, Crunchbase, TechCrunch, Fortune and Bloomberg so you can be assured that Capitalize has a good reputation to back it up as well as the trust from the media.