New York Subsidy To Lure Aetna Benefits A Cuomo Donor

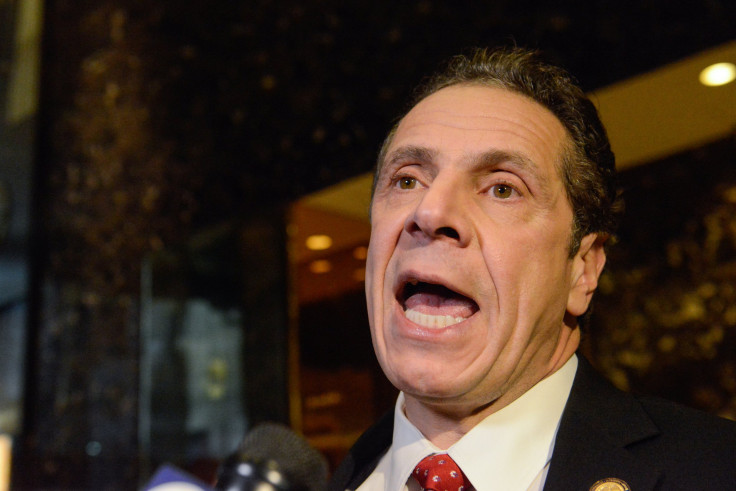

As New York Gov. Andrew Cuomo positions himself for a 2020 presidential bid, he has strongly condemned Republicans’ health care bill as a giveaway to the insurance industry. New York Mayor Bill de Blasio has echoed that criticism. At the same time, though, the two high-profile Democrats have teamed up to deliver a big taxpayer gift to a major health insurer — one that has given big money to Democratic political groups. The gift also includes side benefits for another major Cuomo donor.

In June, New York state and city agencies announced $34 million in tax credits for Aetna — the health insurance giant that threatened to pull out of Obamacare exchanges as it tried to persuade federal regulators to approve a controversial merger. Aetna secured the tax credits after giving $500,000 in the last three years to the Democratic Governors Association, which has supported Cuomo’s gubernatorial campaigns and which appointed Cuomo policy chair in 2016.

Under the terms of the deal, Aetna will move into a New York City building owned by Vornado, which is run by Cuomo megadonor Steve Roth. He and his wife have given the governor over $344,000 since 2007, with most of that money coming in since Cuomo was elected governor in 2011. The state tax incentives from Cuomo’s administration will effectively subsidize the rent paid to Roth’s firm and the improvements to Roth’s property mandated by the terms of the tax credits. (Roth was recently appointed by Cuomo to a task force to redevelop Penn Station and he is also an adviser on President Donald Trump’s infrastructure privatization plans.)

Economic development in New York state has a recent history of favoring those politically connected to the governor. A 2016 indictment in a corruption probe pursued by former U.S. Attorney Preet Bharara alleged, among other charges, that a construction deal worth $750 million was steered to Louis Ciminelli, a major Cuomo donor. The case is ongoing. Separately, a 2013 New York Times investigation found that Empire State Development, the state agency responsible for economic development, hired — and in several cases created new jobs for — relatives of major Cuomo donors.

Governor Cuomo’s office did not respond to multiple requests for comment from International Business Times. In the weeks since the Aetna deal was announced via press release, the Cuomo and De Blasio administrations have declined to release documents detailing the taxpayer subsidies.

Aetna is receiving the subsidies only seven years after New York state regulators fined it $1.6 million for failing to provide consumers’ rights information and explanations of benefits to its subscribers. The company was fined another $500,000 in 2014 for violating consumer protection law. Cuomo himself heralded the 2014 action as a victory for consumers over insurers. “Our administration will continue our work to ensure that consumers are fully informed of their rights and insurance companies meet their obligations,” he said. Aetna also paid a $1 million federal fine in 2015 for giving inaccurate information about pharmacy benefits to its customers.

The multimillion-dollar taxpayer subsidies will more than offset the fines that New York has collected from the insurance giant.

The taxpayer subsidy for Aetna spotlights how, while state and municipal budget constraints have forced cuts to social services and layoffs of public workers, lucrative corporate incentives continue to flow out of public coffers to politically connected companies. In all, states and cities are giving away roughly $50 billion a year in subsidies, mostly for jobs already in the United States. The subsidies flow even to companies that are immensely profitable — and that already receive other forms of taxpayers largesse. Aetna posted a profit of $2.9 billion in 2016, while Chairman and CEO Mark Bertolini earned $17.3 million in salary, bonuses and stocks. If you calculate the gains in value on restricted stock between 2013 and 2015, as the Hartford Courant did, his total compensation was $41 million for the year.

Proponents of the insurance industry incentives in New York say that the taxpayer subsidy makes sense. Cuomo’s Empire State Development Agency touted the Aetna deal, saying that it would create 250 high-income jobs in the city.

“Aetna’s decision to headquarter in New York is further proof that our economic development strategies are working, actively and effectively attracting companies to New York to grow and diversify,” said Amy Varghese, Empire State Development’s press secretary, in an email to IBT. “This is a Fortune 50 company adding 250 well-paying jobs to our economy and extending two of our premier industries — tech and life sciences. The Empire State is open for business and we have the workforce, the infrastructure and the global access to prove it.”

However, critics argue that such subsidies are an inefficient use of taxpayer money, do not generate revenue for public coffers and do not actually motivate relocation decisions. For each job created through its relocation, Aetna is receiving $134,200 in city and state tax breaks.

“At that price, it’s very doubtful that New York taxpayers will ever break even,” said Greg Leroy, executive director of the nonprofit watchdog Good Jobs First, which tracks corporate subsidies in economic development. “The calculation you have to do here is, how many years would it take for the average new Aetna employee to pay $134,000 more in state and local taxes than they and their families will consume in public services. And that’s a long time if ever, frankly, because the average state government isn’t running a surplus and making a profit off of taxes.”

According to data compiled by Good Jobs First, the top 10 companies in the health care sector have gotten $5.8 billion in taxpayer subsidies since 1992. Six health insurers have received a total of $259 million in state and local subsidies in those years. That includes $106.9 million for Cigna, $56.9 million for Anthem, and $37.4 for UnitedHealth — which just reported a single-quarter 30 percent jump in profits after leaving the Affordable Care Act’s exchange. Aetna has previously received $16 million in tax incentives.

“Proponents of tax incentive programs often say there is no cost to these programs because these are incentives going to companies that wouldn’t relocate otherwise,” Nate Jensen, a professor of government at the University of Texas, who has extensively studied state tax incentives around the country, told IBT. “But my research shows that the vast majority of these companies were coming anyway.

“Cities and states use these incentive programs despite their inefficiency because offering incentives allows politicians to take credit for investments into their district, even if the incentive wasn’t the deciding factor,” Jensen said.

In recent years, states have waged an escalating border war to try to lure companies from one another, creating a situation in which taxpayers are paying to move existing American jobs from one part of the country to another. While there have been some federal initiatives to discourage some subsidies, and some attempts at regional truces to reduce interstate arms races, there has been no comprehensive federal restriction on such incentives. The result: an explosion in such spending.

“Connecticut’s loss is not New York’s gain,” wrote Bill Lipton and Lindsay Farrell, directors of the Working Families Party in New York and Connecticut, in an editorial for the Albany Times Union. “In states across America, legislators have been pressured into a toxic game of cross-border business poaching that drives millions of dollars in tax breaks and subsidies to wealthy executives — draining funds we need to invest in infrastructure, schools, parks, and other public goods that is the bedrock of economic health.”

The controversial Aetna deal comes only five years after a similar fight over Connecticut’s deal for Cigna, which continues to generate political outrage.

Under Aetna’s relocation agreement, New York State is giving Aetna $24 million in tax credits over 10 years. Empire State Development gave incentives in three categories: $18 million tied to the creation of 250 new jobs, $1.5 million for capital investments, and an additional $4.5 million at ESD’s discretion for “targeted industries.”

The $1.5 million “Excelsior Investment Tax Credit” is given for up to the value of 2 percent of a company’s investments. With that credit, Aetna is obligated to make a capital investment of $75 million. The company has pledged $84 million to upgrade and equip Vorando’s space at 61 Ninth Avenue, thereby increasing the value of Roth’s property. In effect, city and state taxpayers are subsidizing upgrades and rent to a Cuomo donor’s company.

In addition, Crain’s reports that the asking rent for Vornado’s 145,000 square foot office building was $150 per square foot, more than double the average office rent in Manhattan. If Aetna were to pay that price, the company would pay rent of $21.75 million per year to Roth’s firm. The actual lease terms are unknown, as neither Empire State Development nor Aetna would release them.

Separately from the state, New York City is giving Aetna a $5 million sales tax credit over 18 months and another $4.55 million in tax breaks over 10 years.

Critics argue that tax incentives play very little role in a major company’s decision to relocate. “Most research suggests that economic development incentives are largely redundant,” Jensen told IBT. “Incentives are often given to firms that were already going to move to or expand at a given location.” And indeed, while Mayor Rahm Emanuel of Chicago was interested in bringing Aetna to his city, the insurer made its decision about New York before Chicago and Illinois could even put together an incentive package.

Leroy argues that Aetna moved to New York City for the simple fact that it’s New York City. The metropolis is teeming with highly qualified businesspeople and is the financial capital of the country, with unparalleled access to the global marketplace.

“To pay a company to move to a city with a rich executive talent pool that they were probably going to move to anyway?” said Leroy. “It’s a windfall. New York’s taxpayers are paying companies to do exactly what they would do otherwise.”

© Copyright IBTimes 2024. All rights reserved.