The Rise of MemeCoins: Will They Survive 2022?

When it comes to the nuts and bolts of any culture, it's all about memes. From fashion styles to fiat currency, memes manifest as commonly shareable beliefs and behaviors. For memes to spread, they have to tap into some kind of instinct or idea that has value and be worthy of spreading.

This is the story of Dogecoin (DOGE), the first memecoin that set the trend for others to follow. Having launched on the back of a Shiba Inu dog photo in 2013 when it went viral, the image became a brand for the coin. It represents a flexible template for an assortment of memes, including self-referential meta memes.

It is safe to say that 2021 was marked by the rise of NFTs and memecoins, both sharing memetic imagery, to gain traction and explode trading volumes. But have memecoins exhausted their memetic potential to thrive in 2022?

The current state of memecoins

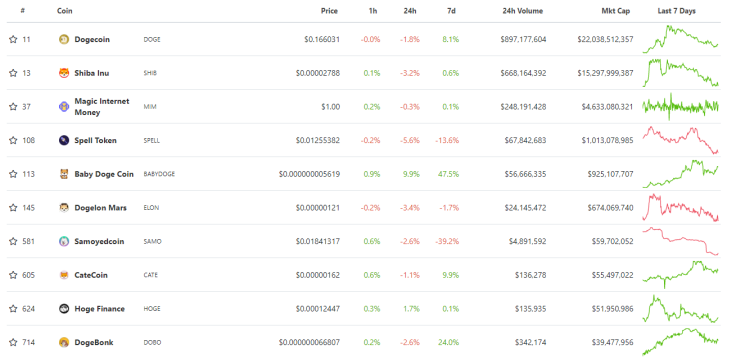

The total market cap of all memecoins is at $45 billion, with Dogecoin taking a firm lead with nearly half the market. Interestingly, of the top 10 memecoins, only two are not related to any animals. Dog coins continue to reign supreme, while cats are represented with only one cat coin among the top 10 — CateCoin (CATE).

Magic Internet Money (MIM) diverges from the rest as a softly USD-pegged stablecoin. For the peg to remain tethered to USD, MIM relies on the Abracadabra protocol ecosystem. This DeFi protocol employs interest-yielding tokens to collateralize MIM. Meaning, if MIM trades under $1, an arbitrage mechanism kicks in and drops the MIM price, so traders are incentivized to buy it.

Likewise, if MIM trades above $1, there is an incentive to borrow MIM and sell it high. Spell Token (SPELL) also hails from the Abracadabra system, as a governance token for the protocol that can be staked for rewards.

In a nutshell, SPELL and MIM offer a decentralized banking service of borrowing and lending via liquidity providers (LPs), as MIM coins can be swapped for regular stablecoins such as USDT or USDC.

As far as memecoins go, it's not bad to fuse memetics with propositional value in one ecosystem. However, can that be said of the dog family of coins as well?

What drives memecoin value?

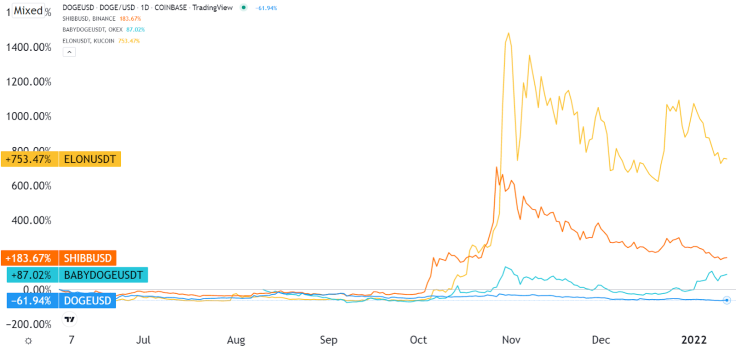

To understand if memecoins have a future, we first need to figure out what has driven them so far. Interestingly, of four top dog coins, the alpha dog with the largest market cap, DOGE, performed the worst. While, Dogelon Mars (ELON) had a stellar performance in the last six months with a 753% rise.

After its initial success, it seems that DOGE has become stale but still serves as the reserve currency of memecoins. More importantly, given that ELON is the top performer, they all rely on Elon Musk, one of the wealthiest men alive, who has three cutting-edge companies in his pocket: Tesla, SpaceX and Neuralink. Coupled with Musk's massive Twitter following of nearly 70 million people, we have all the ingredients necessary for memecoins:

- People tend to gravitate toward power and wealth, and Elon Musk is a meme himself, akin to the real-life version of Tony Stark, aka Iron Man.

- Elon Musk is no stranger to memeing, which is how DOGE got its day in the crypto sun in the first place.

- On the back of Musk's social media shenanigans, DOGE spawned SHIB, an Ethereum token mirror. Unlike DOGE that has its own blockchain, SHIB and other dog coins are tokens rather than cryptocurrencies.

With that cleared, why would anyone trade in memecoins? What value do they bring compared to the thousands of other altcoins? Case in point, Chainlink (LINK) solves a specific problem of bringing off-chain data to on-chain smart contracts. Likewise, VeChain (VET) is used to streamline supply chain management.

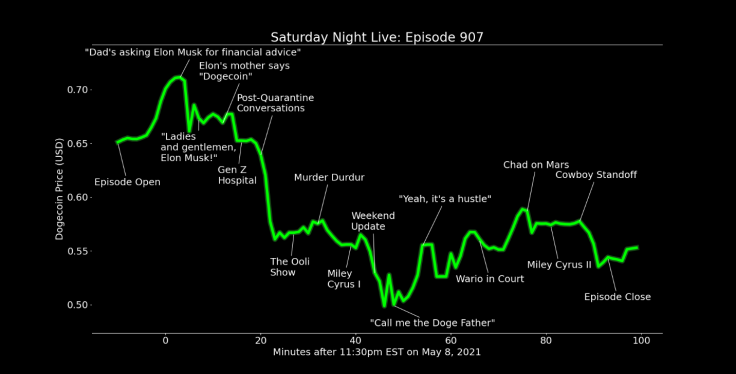

In contrast, with few exceptions, memecoins rely on speculation for their price to be boosted. This is why they are so centered on Elon Musk's Twitter platform. To illustrate, when Musk was hosting the Saturday Night Live show, the ups and downs of the episode could easily be tracked with the ups and downs of DOGE's price moves.

In other words, memecoin traders are engaging in a kind of gambling. They count on other traders to commit to entering or exiting the market based on external social media stimulation. Then, if they are lucky, they make a killing if their buy positions were lower than their sell positions.

Outside of such speculation, the tokenomics of top memecoins are atrocious. While DOGE has an infinite supply, aka inflation, SHIB is highly centralized and depends on the team to burn its massive supply of tokens.

In the past 24 hours, there have been a total of 19,156,573 $SHIB tokens burned and 8 transactions. So far, a total of 410,301,254,039,570 #SHIB tokens (41.03013%) have been burned from the initial supply of 1 quadrillion. #shibarmy

— Shibburn (@shibburn) January 19, 2022

With hundreds of other tokens, such as Bitcoin (BTC), Bitcoin Cash (BCH), Litecoin (LTC), Monero (XMR), providing sound money and utility, where does that leave memecoins if all things are equal? After all, the listed coins have memes themselves. For instance, BTC is viewed as digital gold, while XMR is viewed as a privacy guardian.

Speculation may still give life to memecoins

In the end, memecoins are spurred by renewed adoption and speculation. If a notable crypto exchange happens to list a memecoin, it gives it a second wind. Likewise, for social media mentions by celebrities. Most importantly, traders who don't care about fundamentals, the so-called degens, see memecoins as a quick way to make a buck in the crypto market.

They rely on the lack of knowledge of others to hurl into the memecoin market and temporarily boost it for their selloff gains. However, mathematician Charles Hoskinson, the founder of Cardano (ADA) as a more robust Ethereum alternative, doesn't see the memecoin trend lasting:

“…it is unrealistic if there’s a 100x or something to expect that to happen every single year. It just can’t. Math doesn’t work that way.”

Sooner or later, the supply of memecoin newcomers will run out. In the meantime, there are plenty of blockchain projects with tangible long-term gains. Alongside those already listed, there is Polkadot (DOT), Terra (LUNA), Avalanche (AVAX), Celo (cGLD), Radix (DLT), to just name a few, and to not even mention metaverse coins for Web3 gaming.

While they have their own volatility issues, they propose tangible value and real solutions to real issues. The same cannot be said of memecoins. In conclusion, those who love memecoin fun would do better to read up on infrastructural/metaverse/gaming coins and make them into memecoins by their own merit.

Rahul owns less than 1 BTC and 40 LRC.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2024. All rights reserved.