Revitalized Stimulus Hopes Send US Stocks Up

Progress on a US stimulus package sent Wall Street up at the close on Tuesday, though trading sentiment was not so positive elsewhere.

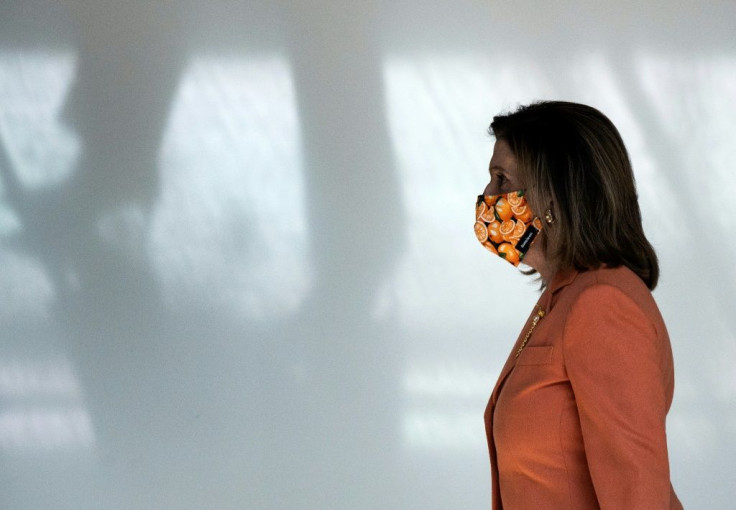

Investors have been waiting for months for Congress to pass new stimulus for the US economy, and good news came when House Speaker Nancy Pelosi said lawmakers were starting to write stimulus spending legislation.

She said she was hopeful it could be passed before the November 3 presidential election, though it must go through legislative steps, including approval by the House Appropriations Committee.

"I am optimistic," Pelosi said, but cautioned "Legislation is tough."

Senate Majority Leader Mitch McConnell, who has rejected the proposed price tag of $2.2 trillion, changed course and said he would bring the package to a vote if there is a bill President Donald Trump supports.

Peter Hanks, strategist at DailyFX, said the stimulus "seems to be the driving factor of the market."

But that will soon change, he said, since "Once the election comes, stimulus will be in the rearview and the election will take over."

Oil prices had fallen a day after OPEC and other major crude producers refrained from altering output despite virus-weakened demand and stubborn oversupply, but recovered as the stimulus prospects improved.

Economists say the coronavirus-ravaged US economy has held up well because of the massive injection of about $3 trillion in support for businesses and households, but needs more support to avert another downturn.

The talks between the White House and congressional Democrats have dragged on for months.

After Pelosi spoke with Treasury Secretary Steven Mnuchin on Tuesday, White House Chief of Staff Mark Meadows said the officials made "good progress," but "we still have a ways to go."

"Everybody is working real hard to try to make sure that we can get some kind of an agreement before the weekend at least," he said.

A top Pelosi aide said the two would speak again Wednesday.

In Europe, London finished the day slightly higher than it began, while stock indices in Paris and Frankfurt wallowed in negative territory.

Investors are also keeping tabs on post-Brexit trade negotiations, with Britain welcoming signs that the European Union was ready to intensify talks but saying the bloc's commitments did not yet go far enough to restart face-to-face dialogue.

Britain's chief negotiator David Frost said he had held a "constructive discussion" with EU counterpart Michel Barnier, but added on Twitter that the bloc "still needs to make a fundamental change in approach to the talks and make clear it has done so."

Barnier urged Britain to "make the most out of the little time left."

New York - Dow Jones: UP 0.4 percent at 28,308.79 (close)

New York - S&P 500: UP 0.5 percent at 3,443.12 (close)

New York - Nasdaq: UP 0.3 percent at 11,516.49 (close)

London - FTSE 100: UP 0.1 percent at 5,889.22 points (close)

Frankfurt - DAX 30: DOWN 0.9 percent at 12,736.95 (close)

Paris - CAC 40: DOWN 0.3 percent at 4,929.28 (close)

EURO STOXX 50: DOWN 0.3 percent at 3,227.87 (close)

Tokyo - Nikkei 225: DOWN 0.4 percent at 23,567.04 (close)

Hong Kong - Hang Seng: UP 0.1 percent at 24,569.54 (close)

Shanghai - Composite: UP 0.5 percent at 3,328.10 (close)

Euro/dollar: UP at $1.1824 from $1.1769 at 2100 GMT

Dollar/yen: UP at 105.45 yen from 105.43 yen

Pound/dollar: DOWN at $1.2946 from $1.2948

Euro/pound: UP at 91.33 pence from 90.90 pence

West Texas Intermediate: UP 1.7 percent at $41.51 per barrel

Brent North Sea crude: UP 0.4 percent at $42.79

© Copyright AFP 2024. All rights reserved.