US Fed Downplays Inflation Fears, Officials See Rate Hikes In 2023

Federal Reserve Chair Jerome Powell on Wednesday once again tried to assuage fears of rising US inflation, even while a majority of central bank officials now believe interest rates will increase in 2023.

While widespread vaccinations have allowed the United States to rebound faster than previously expected from the Covid-19 pandemic downturn, the Fed's policy-setting Federal Open Market Committee (FOMC) cautioned that "risks to the economic outlook remain" in a statement following its two-day meeting.

But amid the accelerating rebound, Fed officials appear to have grown more hawkish, with 11 of the 18 committee members now expecting at least two hikes of the benchmark lending rate in 2023, according to updated quarterly economic projections.

The March forecasts showed only seven officials expecting rate liftoff in 2023, but seven now expect one as soon as next year.

However, Powell stressed that those projections "do not represent a committee decision or plan."

Markets and analysts have been closely watching FOMC meetings in recent months as they weigh fears that the Fed's stance on rising prices is too passive, which could allow an upward price spiral that would force the central bank to aggressively raise rates -- and crush economic growth.

Powell again tried to ease those worries, stressing that officials stand ready to alter policy if they see signs inflation moved "materially and persistently beyond levels consistent with our goal."

However, the FOMC said it will not begin to withdraw the stimulus measures implemented at the start of the pandemic until progress is made on reducing unemployment and keeping inflation above their two percent goal.

And since inflation has lagged the bank's target for over a decade and unemployment remains at 5.8 percent, achieving "substantial further progress is still a ways off," Powell told reporters in his press conference following the meeting.

He warned that the "recovery is incomplete" and improvement has been "uneven," with employment in hard-hit sectors well below pre-pandemic levels.

But some economists remain skeptical the Fed can manage the policy dilemma smoothly, and US stock markets lost ground, with the Dow dropping 0.8 percent.

"Certainly, some of the rise in inflation is temporary, but as we have argued, risks are rising that underlying inflation pressures are mounting," said Mickey Levy of Berenberg Capital Markets.

The Fed officials' median forecast for annual inflation this year increased to 3.4 percent from the previous 2.4 percent in March, but they see the rate slowing to 2.1 percent in 2022, according to the projections.

Committee members also boosted their growth outlook to seven percent from 6.5 percent.

On inflation, Powell said, "What we are seeing in the near term is principally associated with reopening of the economy, and not with a tight labor market or tight resource constraints."

Those temporary effects should "stop, and in fact it would reverse over time," he said. However, "we are not sure" about the timeframe.

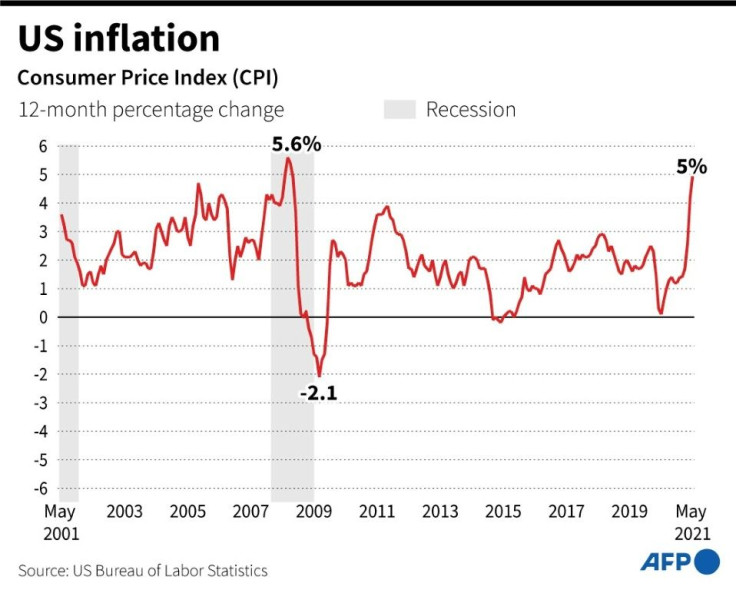

The consumer price index jumped to five percent for the 12 months ended in May, but Powell attributed that to "a perfect storm of strong demand and limited supply" for things like used cars.

The FOMC also said it will continue buying $120 billion a month in bonds, thereby providing a steady flow of liquidity to the economy.

Powell said the committee is not focused on raising lending rates but has started discussions on when to taper the pace of bond purchases as its first move towards ending the pandemic measures.

He said the Fed will give plenty of notice before making any major changes, and "do what we can to avoid a market reaction."

Even after the initial steps, the Fed measures "will continue to deliver powerful support to the economy until the recovery is complete," Powell said.

Ian Shepherdson of Pantheon Macroeconomics said that while "taper talk is underway" Powell "wants to see what happens in the labor market after the summer."

However, he warned that "for someone preaching uncertainty, Mr. Powell is very confident the Fed won't fall behind the curve."

© Copyright AFP 2024. All rights reserved.