Is Zoom Video Worth The Hype?

Zoom Video (NASDAQ:ZM) has seen its share price double from its April 2019 IPO price. By all accounts, Zoom Video has a best-in-class video conferencing product, and it has been able to produce strong growth figures with surprising profitability. However, at its current market cap of nearly $19 billion, the stock trades for more than 50 times its last 12 months' sales. Is this the case of an overhyped IPO, or does the company's trajectory warrant its stock price?

Best-in-class video conferencing software

Zoom Video is built around its video conferencing software. From there, the company provides a suite of communication tools to help organize meetings or communicate through voice and text. The video conferencing product is extremely easy to use and integrates with all of the standard software used in the workplace, including products made by salesforce.com, Microsoft, Google, Slack, Dropbox, and more. To video chat with someone, simply share a website link with a password; no software installation required.

The company attributes much of its success to its "video-first cloud architecture." Zoom Video was founded in 2011 and built its platform in a cloud computing environment from day one. Unlike many of its competitors, which have added video conferencing to an existing communications tool, Zoom has focused on video conferencing from the beginning, allowing it to deliver a differentiated video experience with quicker load times and more features.

The company doesn't just claim to have a superior product, it has the accolades to back up those claims. Gartner named Zoom Video a leader in its Magic Quadrant for Meeting Solutions and also recognized it as a 2018 Gartner Peer Insights Customers' Choice product for web conferencing.

Furthermore, Zoom Video boasts an extremely high Net Promoter Score of more than 70. Net Promoter Scores measure customer satisfaction by asking how likely customers are to recommend a product. A score of about 50 is considered positive; at 70, customers are extremely satisfied.

At first glance, who would have guessed that the world needed another video conferencing solution? However, Zoom Video has demonstrated that even in a niche with several strong competitors, there are ways to be innovative and carve out market share. Based on its customer satisfaction ratings, Zoom's video conferencing software should have staying power.

A "freemium" model has stoked rapid customer adoption

Video chatting tools are growing in prominence. There is an increasing trend for organizations to collaborate across geographies, and employees are increasingly distributed. It's not uncommon for employees to work remotely, and when they do, web conferencing is an essential tool.

Zoom Video's founder and CEO, Eric Yuan, recognized this trend while working at web conferencing giant Cisco Systems. Yuan also recognized that existing software was clunky to install, expensive to deploy, and often unreliable in practice. As a result of these observations, CEO Yuan crafted a product and business model designed to give customers the product they wanted in a flexible subscription package that won't break their bank.

The company offers its video conferencing product for free to those who just want to conduct one-on-one meetings. It upsells paid subscriptions to users who need more advanced features such as multiperson video conferences. Offering a product with limited functionality for free and upselling features is known as a "freemium" business model and is used by a growing number of tech companies.

The freemium model has no barriers for potential customers to try out the product. Once customers are hooked, many convert to a paid plan. Of Zoom Video's 344 largest customers, 55% of them started with a free version of its product. In other words, freemium is a great way to attract potential customers, even large ones.

Rapid revenue growth and unusual profitability

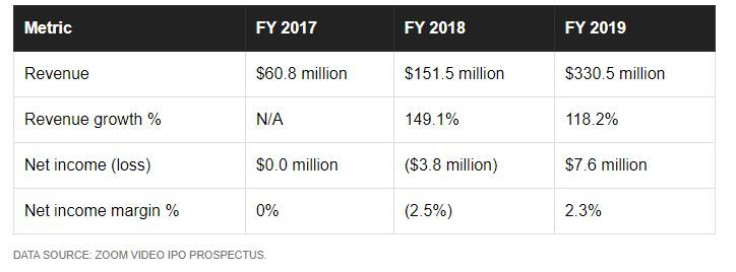

Zoom has been able to show impressive revenue growth figures, doubling its sales each year for the past two years. Even more surprising is that the company was profitable on a GAAP basis last fiscal year.

DATA SOURCE: ZOOM VIDEO IPO PROSPECTUS.

Virtually every other major tech IPO has shown income statement losses. Zoom's profitability at this stage in its growth trajectory suggests that the company is capable of running extremely high margins once it is fully scaled up.

Nosebleed valuation

On paper, everything about Zoom Video's business sounds great. However, the deal breaker is the stock's valuation, which is rich by any yardstick.

Dividing the company's nearly $19 billion market cap by its annual sales implies a price-to-sales ratio greater than 50. To put this figure in perspective, the tech-focused Nasdaq 100 index has a price-to-sales ratio of roughly 3.7. Therefore, ZM's stock is more than 10 times more expensive than the average tech stock.

There is almost no way to defend the company's valuation. The company would need to grow revenue tenfold without a commensurate increase in its share price to approach an average level of valuation. Investors appear to be pricing in not only a continuation of its current growth trend but also healthy profit margins coming sooner rather than later. This is asking for quite a lot from such a nascent company!

The company's growth path and early signs of profitability are very promising, but its valuation implies continued success for years to come. No one knows what the company's products or financials will look like in the distant or even near future, making the stock's valuation quite unpalatable.

Worth the hype?

Zoom Video is a polarizing stock. The company has a fabulous product with a clear path for strong earnings growth, but it is hard not to be concerned about the stock's extreme overvaluation. The company will be tested by many internal and external forces in the coming years, and it's likely that investors will have an opportunity to buy the stock at a more reasonable valuation. My advice is to wait until that opportunity presents itself and avoid overpaying for a white-hot recent IPO.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool's board of directors. Luis Sanchez has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Microsoft, and Salesforce.com. The Motley Fool recommends Gartner. The Motley Fool has a disclosure policy.

This article originally appeared in The Motley Fool.