Real Estate Forecast 2012 and Beyond: Warren Buffett Says Buy, Baby, Buy!

Warren Buffett's real estate forecast for 2012 and beyond is extremely rosy, with the so-called Oracle of Omaha even recommending buying them over investing in a diversified group of leading companies.

In an interview with CNBC on Monday, Buffett said single-family homes, along with stocks, are cheap and attractive investments. By contrast, investments in Treasury bills, gold or simply keeping money in cash are not as attractive.

Buffett said if he had a way to buy a couple hundred thousand single-family homes and easily manage them, he would load up on them and take mortgages out at very, very low rates.

However, he said that managing a couple hundred thousand single-family homes is an impossibly Herculean logistical task.

This line of reasoning likely holds true for many brilliant investment minds who choose not to bother with buying single-family homes -- even though they are undervalued -- when buying and owning stocks is as easy as a few keystrokes and mouse clicks on a computer.

Because of the absence of many of these big institutional investors in the U.S. residential real estate market, it is less competitive than the stock market, Buffett said. When institutional investors of size do enter the residential real estate market, they usually go for apartment buildings, which leaves the single-family homes segment even less competitive than the general residential real estate market.

When asked if a young individual investor should buy stocks or his first single-family home, Buffett recommended buying a single-family home with a 30-year mortgage.

It's a terrific deal, he said. It's a leveraged way of owning a very cheap asset now and I think that's probably as an attractive an investment as you can make now.

In fact, if the young individual investor is a handy type, he could buy a couple of them at distressed prices and find renters, said Buffett.

Buffett is famous for only investing in assets he believes are undervalued. He must, therefore, believe that the U.S. residential real estate market is undervalued.

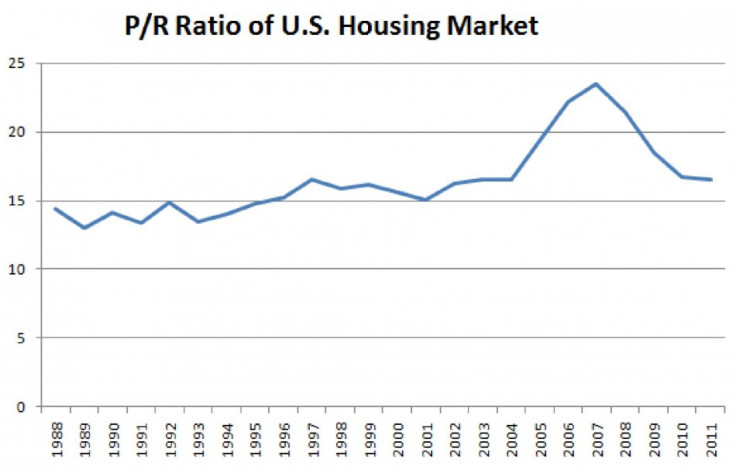

One valuation metric for residential properties is the price-to-rent (P/R) ratio, which roughly corresponds to the price-to-earnings (P/E) ratio for stocks.

As seen on the chart below, the rent-to-earnings ratio has fallen to 2004 levels.

Data from U.S. Census Bureau, chart made using Microsoft Excel

Moreover, as the economy recovers, both rent and housing prices should rise as well.

A perhaps even better argument that the real estate market is historically cheap, however, is that mortgage rates are at or near the historic low.

Mortgage rates are a huge driving factor of the ultimate cost of purchasing a home.

For example, the total interest expense of a $200,000, 30-year fixed-rate mortgage at a 4 percent mortgage rate, which is the current rate, is $144,000. At 10 percent, which was the prevalent rate in 1990, interest expense comes to $432,000.

READ ALSO: Housing Market Forecast Beyond 2012 From Warren Buffett

© Copyright IBTimes 2025. All rights reserved.