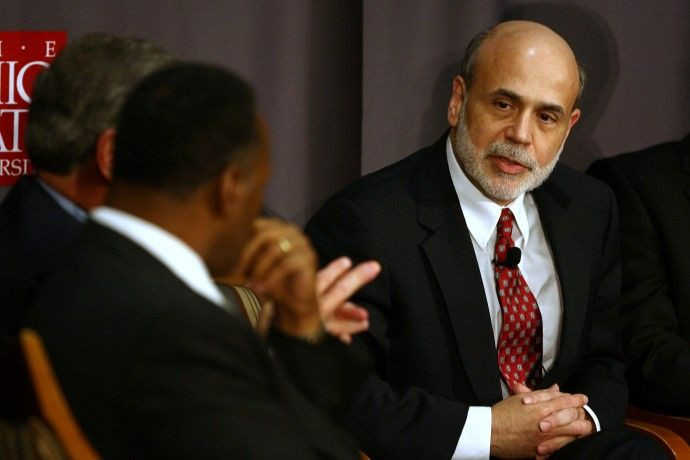

Bernanke takes shots at foreign critics of QE2

In a rare interview aired on CBS's 60 Minutes show, Federal Reserve Chairman Ben Bernanke used the platform to address mostly domestic hot-button issues like the high unemployment rate, ballooning public debt, and Wall Street compensation.

However, Bernanke also took shots at foreign (often government) critics that openly bashed the Federal Reserve's second round of quantitative easing (QE2), alleging that it stokes inflation in emerging market economies and was launched for the purpose of competitively devaluing the dollar.

First, Bernanke stressed that the Fed is non-partisan and independent from the influence of U.S. politicians, implying that QE2's purpose was not to orchestrate a currency devaluation with the Obama administration as a part of the President's plan to double exports over five years.

As he did in a Washington Post op-ed in early November, Bernanke suggested that QE2 is a domestically-driven policy whose primary purpose is lowering longer-term U.S. interest rates.

Second, Bernanke said that China (and other emerging market countries, by extension) is forced to adopt or import the Federal Reserve's loose monetary policy only because it keeps its currency artificially low relative to the dollar.

He said the United States needs and has a relatively supportive monetary policy. If China is concerned and wants a more appropriate monetary policy for itself, it should allow [its] currency to appreciate to something more appropriate in terms of its market value.

Third, he raised issues about the timing of QE2 criticisms from foreign officials, saying after two months of essentially broadcasting to the world that we were going to do [QE2], that only after we've made the announcements, suddenly there was concern raised.

QE2 was officially announced on November 3, subsequently, the G20 meetings, in which the global currency war was the main topic, commenced a few days later on November 11.

Much of the international criticisms of QE2 occurred in the days leading up to November 11 (even though the program had been telegraphed since August, in Bernanke's words).

Moreover, Germany and China, who are accused of artificially boosting exports through either undervalued currencies or low wages -- and who feared their alleged abuses would be the center of the G20 Summit -- were the loudest critics of the United States' QE2 program.

The timing and identity of foreign QE2 critics, therefore, suggests the attacks were politically motivated and hurled to influence the G20 Summit.

Email Hao Li at hao.li@ibtimes.com

© Copyright IBTimes 2025. All rights reserved.