Bitcoin IRA Account Makes It Easy To Add Crypto To Your Retirement Planning

A Bitcoin IRA gives you tax breaks when you earmark crypto as retirement savings.

Financial experts were skeptical about the long term viability of cryptocurrencies when they first came out. In fact, most thought that whole Bitcoin thing was just a fad. But today, it is pretty clear that while we may not know exactly where crypto is going, we do know it is not going away. Most coins have never been stronger than they are today, and 2021 is shaping up to be another huge year. That’s why more and more big time investors are adding crypto to their investment portfolios as a way to hedge against inflation and major downturns in the stock market. And now, thanks to forward-thinking companies like Bitcoin IRA, making crypto a part of your financial future is easier and more profitable than ever.

The Current State of Crypto

Why are some financial experts betting big on crypto this year? It all has to do with a trio of developments that are expected to push digital currencies into the mainstream.

First, back in February, the Chicago Mercantile Exchange began selling Ethereum futures. This has dramatically increased trade volume for the world’s second-most popular cryptocurrency and made it a household name.

Second, this month Coinbase, the world’s biggest cryptocurrency exchange, will become the first major cryptocurrency company to go public. On April 14 they are launching an initial public offering. After the exchange doubled in value in the first quarter of 2021, reporting revenues of $1.8 billion and profits of $730 million, experts predict the Coinbase IPO will be worth somewhere between $70 to $90 billion, and possibly as high as $100 billion.

Last but not least, the third major crypto development of 2021 involves online payment giant PayPal. After opening crypto as an option for their 300-million users at the end of 2020, they have announced that they will begin offering crypto trading on their popular Venmo app some time in the first half of 2021.

What does all this mean? It means cryptocurrencies aren’t just for speculative investing anymore. It means digital assets are going mainstream. It means even the most cautious investors should start thinking about dedicating a fraction of their holdings into this new asset class. And the best way to do that is with a Bitcoin IRA account.

What Is Bitcoin IRA?

An IRA, or individual retirement account, is a special kind of retirement savings account that gives you tax breaks on deposits, growth, and distributions, or withdrawals. There are different types of IRAs, and the specific rules governing each one depend on your employment status and income level. However, the basic idea is they help you grow wealth faster so you are ready for the future. And with IRAs, you are not limited to cash deposits like you are with a regular savings account. You can also buy all sorts of financial products, such as stocks, bonds, and mutual funds.

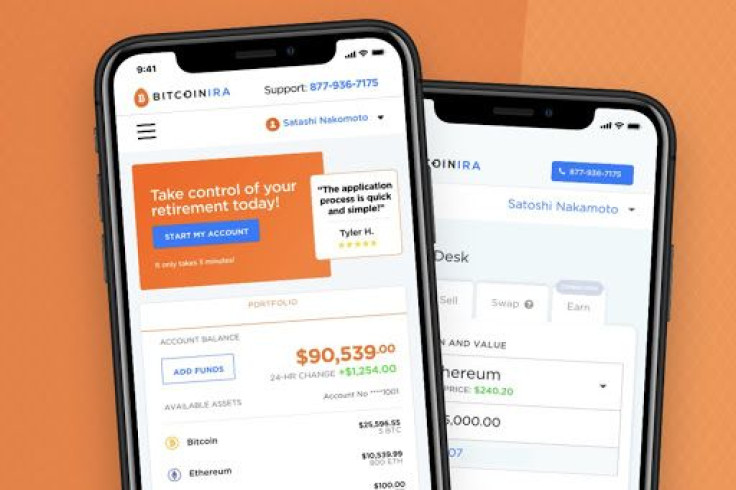

Now, thanks to companies like Bitcoin IRA, you can even fund your IRA with cryptocurrencies. And it’s so easy, you hardly need to know anything about crypto to get started.

A Bitcoin IRA account lets you earmark cryptocurrency holdings as retirement savings, thus realizing the same tax breaks you’d get with traditional investments. These crypto IRAs follow a lot of the same rules as regular IRAs. That means there are early withdrawal fees if you want to cash out before you turn 59½. It also means that only “earned income” is eligible for deposit into a crypto IRA, so you cannot transfer your existing crypto holdings into your Bitcoin IRA account. However, unlike traditional IRAs, which typically cap contributions at about $6,000 per year, with a Bitcoin IRA account there is no yearly investment cap. And just because you can’t transfer any existing crypto holdings, that doesn’t mean you have to start entirely from scratch. With a Bitcoin IRA account, you can transfer any existing retirement savings accounts into your crypto IRA without any penalties or fees.

With Bitcoin IRA You Get All The Expert Help You Need

Retirement planning is complicated. If you’re thinking about setting up a crypto IRA you probably have a lot of questions. Luckily, when you invest with Bitcoin IRA, you get access to all the help you need.

Bitcoin IRA is a full-service company that will walk you through every step of setting up your account. Once you complete the Bitcoin IRA application, they will help you fund your account. Whether that means transferring funds from an existing retirement savings account, or your regular old checking account, they’ll make the request for you and complete the transaction. Then they will help you perform your first trade. Bitcoin IRA currently offers Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), Stellar Lumens (XLM), Zcash (ZEC), Bitcoin Cash (BCH), Ethereum Classic (ETC), and Digital Gold (DG). And you can invest in one coin or a combination of multiple coins.

Once you’re all set up, you can perform your own trades, 24 hours a day, seven days a week, through Bitcoin IRA’s easy-to-use online platform. All of your digital assets are then stored in your BitGo Wallet. And with 256 bit SSL encryption, offline cold storage, and up to $100 million in insurance, BitGo might be the most secure digital currency wallet on the planet.

Don’t Miss The Next Crypto Wave

Digital currencies can be volatile assets. But if you invest in them wisely and remain patient, they can potentially make you a lot of money. When you invest with a Bitcoin IRA, you’re giving yourself a chance to hit it big on the next crypto boom without having to pay half of it back in taxes. If that sounds good to you, then click here to get started.