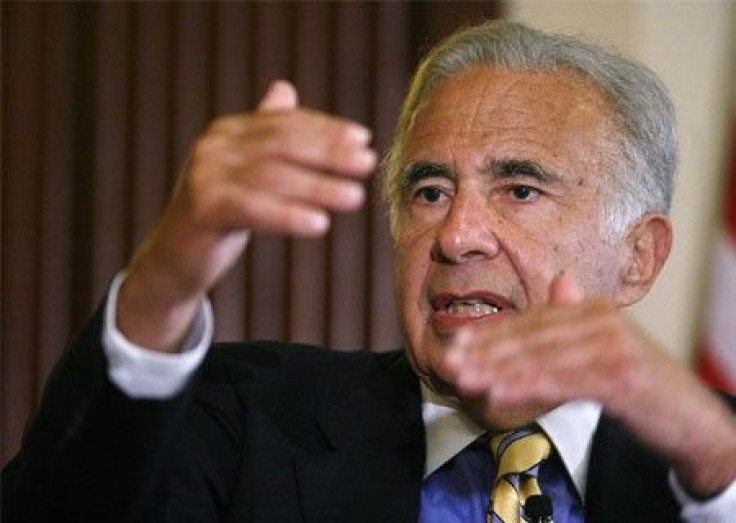

Chesapeake Energy jumps 7 pct as Carl Icahn increases stake

Chesapeake Energy (NYSE:CHK) jumped 6.95 percent at 12:09 p.m. on news that billionaire investor Carl Icahn increased his equity ownership of it from 2.5 percent to more than 5 percent.

When investors acquire over 5 percent of a company, they are required to file with the Securities and Exchange Commission (SEC) and disclose this fact.

This development is seen as positive for Chesapeake because it is a vote of confidence from Icahn. Moreover, by acquiring a large stake in the company (i.e. becoming an ‘activist shareholder’), Icahn will likely work with management to raise the stock price.

According to Icahn's SEC filing, he is acquiring Chesapeake shares because he believes they are undervalued. He also has had and intends to to seek to continue to have conversations with the Issuer's management to discuss the business and operations of the Issuer and the maximization of shareholder value.

© Copyright IBTimes 2024. All rights reserved.